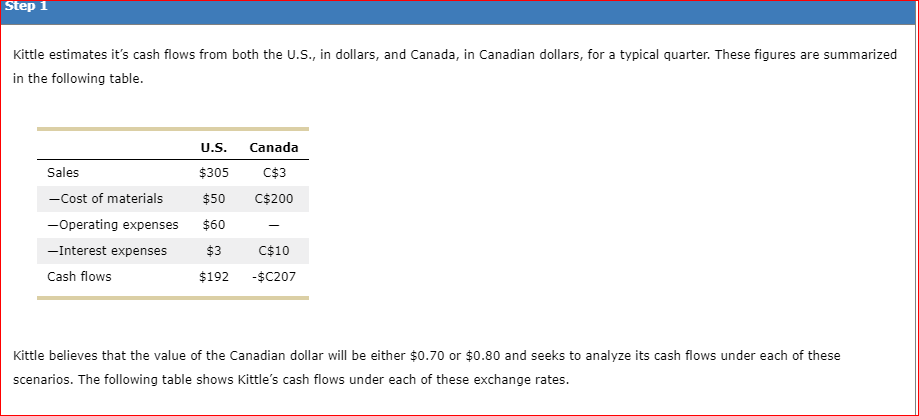

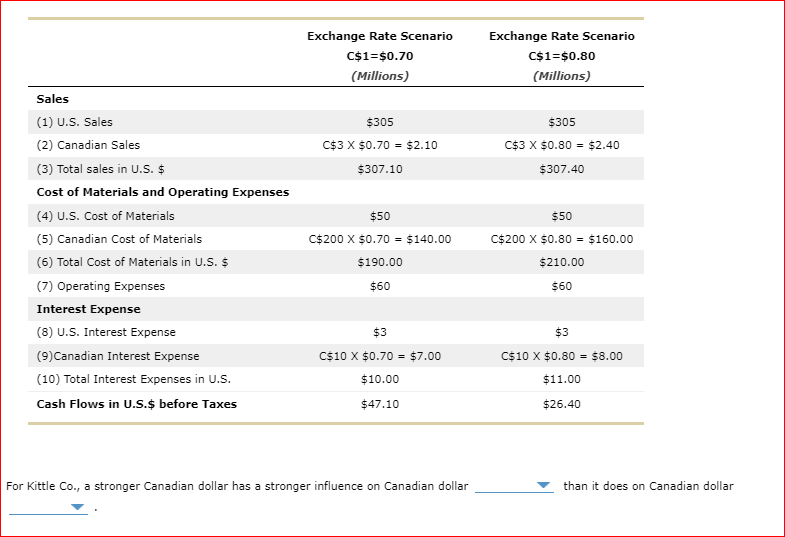

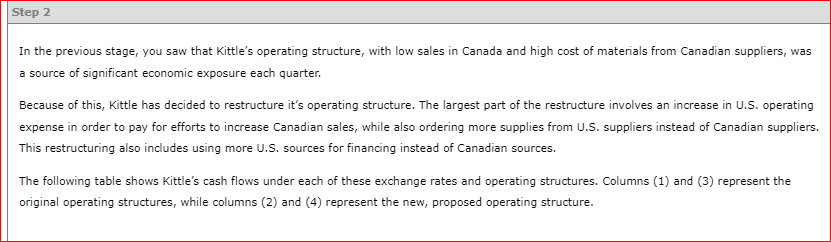

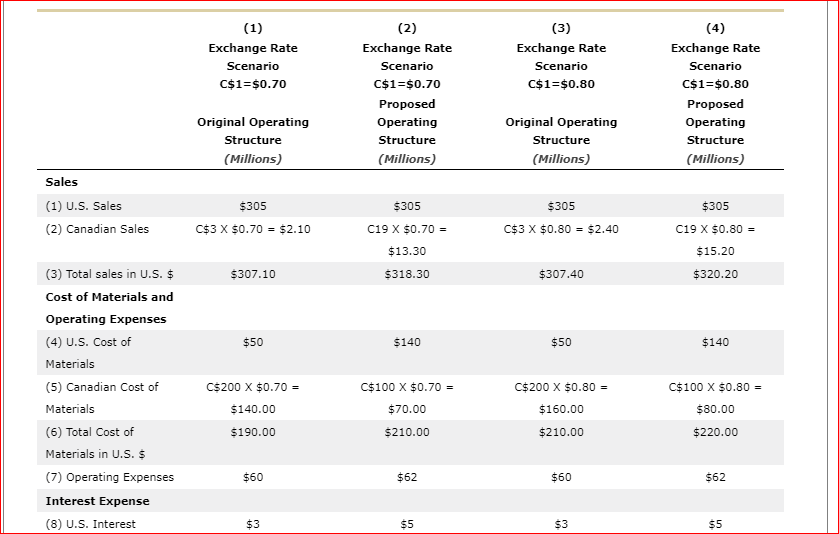

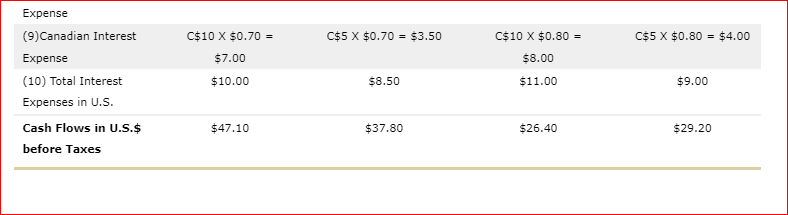

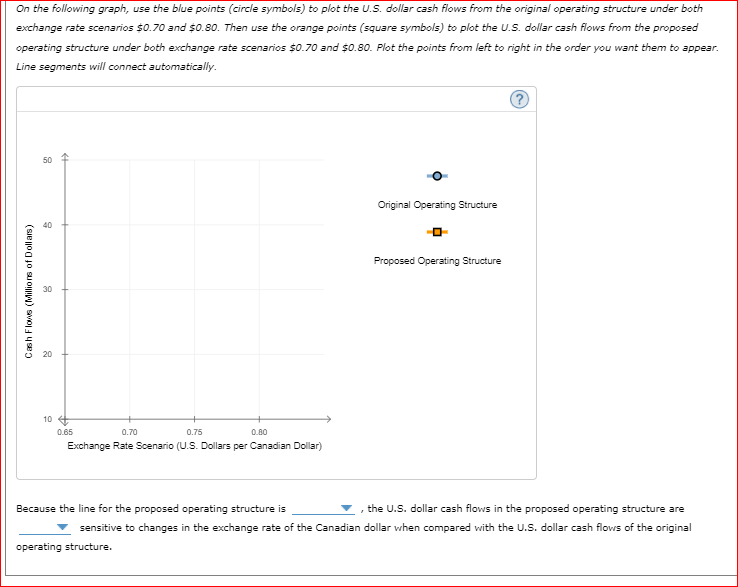

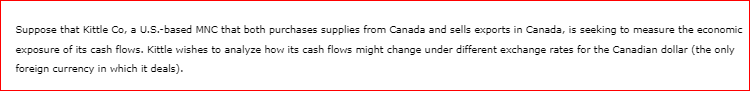

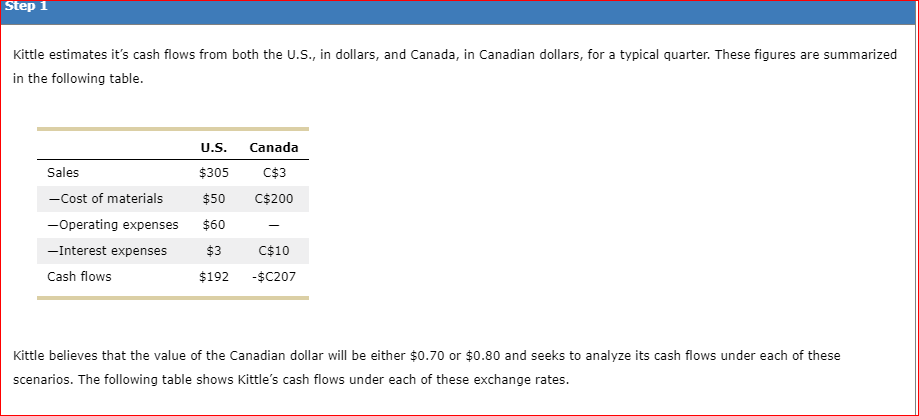

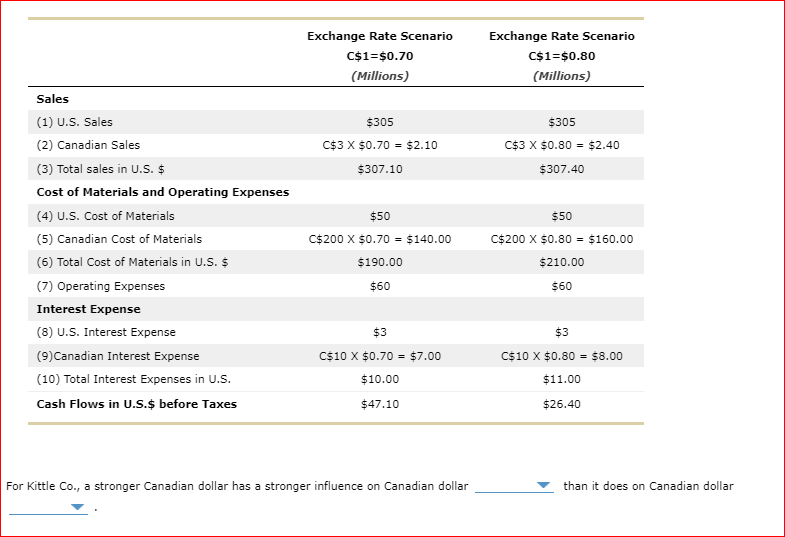

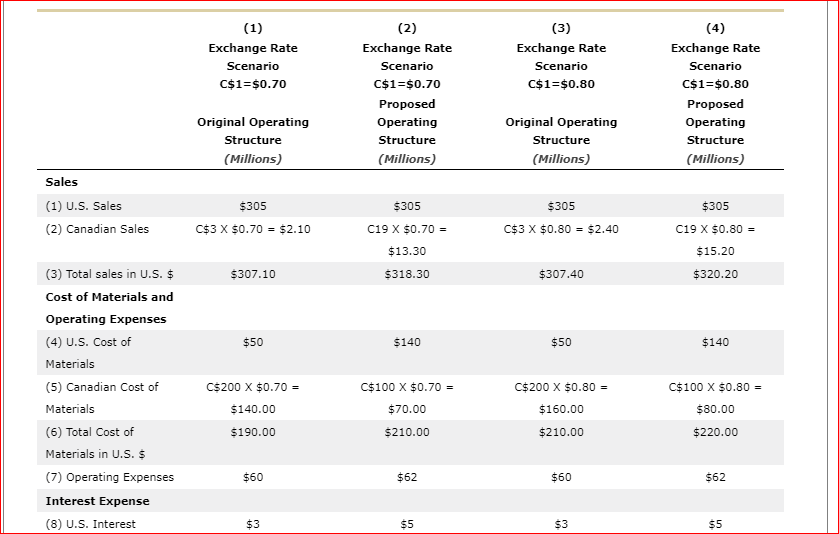

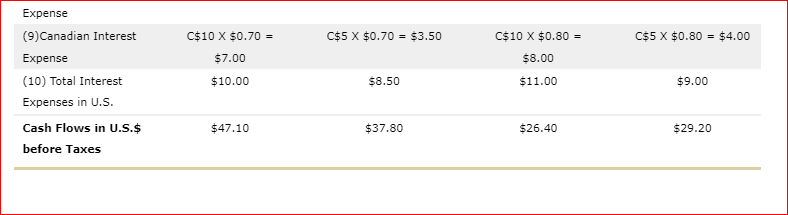

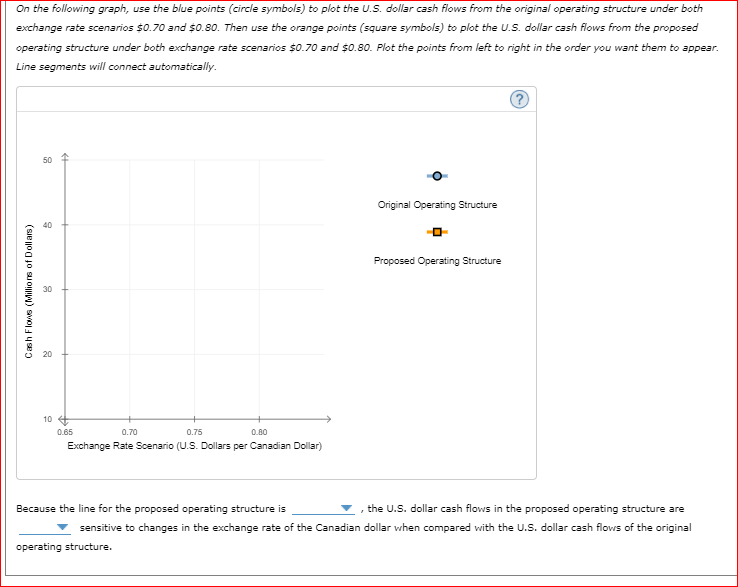

Step 1 Kittle estimates it's cash flows from both the U.S., in dollars, and Canada, in Canadian dollars, for a typical quarter. These figures are summarized in the following table. U.S. $305 Canada C$3 $50 C$200 Sales -Cost of materials -Operating expenses - Interest expenses Cash flows $60 $3 C$10 -$C207 $192 Kittle believes that the value of the Canadian dollar will be either $0.70 or $0.80 and seeks to analyze its cash flows under each of these scenarios. The following table shows Kittle's cash flows under each of these exchange rates. Exchange Rate Scenario C$1=$0.70 (Millions) Exchange Rate Scenario C$1=$0.80 (Millions) $305 C$3 X $0.70 = $2.10 $305 C$3 X $0.80 = $2.40 $307.10 $307.40 $50 $50 Sales (1) U.S. Sales (2) Canadian Sales (3) Total sales in U.S. $ Cost of Materials and Operating Expenses (4) U.S. Cost of Materials (5) Canadian Cost of Materials (6) Total Cost of Materials in U.S. $ (7) Operating Expenses Interest Expense (8) U.S. Interest Expense (9) Canadian Interest Expense (10) Total Interest Expenses in U.S. Cash Flows in U.S.$ before Taxes C$200 X $0.70 = $140.00 $190.00 C$200 X $0.80 = $160.00 $210.00 $60 $60 $3 $3 C$10 X $0.70 = $7.00 $10.00 C$10 X $0.80 = $8.00 $11.00 $47.10 $26.40 For Kittle Co., a stronger Canadian dollar has a stronger influence on Canadian dollar than it does on Canadian dollar Step 2 In the previous stage, you saw that Kittle's operating structure, with low sales in Canada and high cost of materials from Canadian suppliers, was a source of significant economic exposure each quarter. Because of this, Kittle has decided to restructure it's operating structure. The largest part of the restructure involves an increase in U.S. operating expense in order to pay for efforts to increase Canadian sales, while also ordering more supplies from U.S. suppliers instead of Canadian suppliers. This restructuring also includes using more U.S. sources for financing instead of Canadian sources. The following table shows Kittle's cash flows under each of these exchange rates and operating structures. Columns (1) and (3) represent the original operating structures, while columns (2) and (4) represent the new, proposed operating structure. (1) Exchange Rate Scenario C$1=$0.70 (3) Exchange Rate Scenario C$1=$0.80 (2) Exchange Rate Scenario C$1=$0.70 Proposed Operating Structure (Millions) (4) Exchange Rate Scenario C$1=$0.80 Proposed Operating Structure (Millions) Original Operating Structure (Millions) Original Operating Structure (Millions) Sales (1) U.S. Sales (2) Canadian Sales $305 $305 C$3 X $0.70 = $2.10 C$3 X $0.80 = $2.40 $305 C19 X $0.70 = $13.30 $318.30 $305 C19 X $0.80 = $15.20 $320.20 $307.10 $307.40 $50 $140 $50 $140 C$200 X $0.70 = (3) Total sales in U.S. $ Cost of Materials and Operating Expenses (4) U.S. Cost of Materials (5) Canadian Cost of Materials (6) Total Cost of Materials in U.S. $ (7) Operating Expenses Interest Expense (8) U.S. Interest C$100 X $0.70 $70.00 C$200 X $0.80 = $160.00 C$100 X $0.80 = $80.00 $140.00 $190.00 $210.00 $210.00 $220.00 $60 $62 $60 $62 $3 $5 $3 $5 C$5 X $0.70 = $3.50 C$5 X $0.80 = $4.00 Expense (9) Canadian Interest Expense (10) Total Interest Expenses in U.S. Cash Flows in U.S.$ before Taxes C$10 X $0.70 = $7.00 $10.00 C$10 X $0.80 = $ $8.00 $11.00 $8.50 $9.00 $47.10 $37.80 $26.40 $29.20 On the following graph, use the blue points (circle symbols) to plot the U.S. dollar cash flows from the original operating structure under both exchange rate scenarios $0.70 and $0.30. Then use the orange points (square symbols) to plot the U.S. dollar cash flows from the proposed operating structure under both exchange rate scenarios $0.70 and $0.80. Plot the points from left to right in the order you want them to appear. Line segments will connect automatically. 50 1 Original Operating Structure Proposed Operating Structure Cash Flows (Millions of Dollars) 20 10 + 0.65 0.70 0.75 0.80 Exchange Rate Scenario (U.S. Dollars per Canadian Dollar) Because the line for the proposed operating structure is the U.S. dollar cash flows in the proposed operating structure are sensitive to changes in the exchange rate of the Canadian dollar when compared with the U.S. dollar cash flows of the original operating structure. Suppose that Kittle Co, a U.S.-based MNC that both purchases supplies from Canada and sells exports in Canada, is seeking to measure the economic exposure of its cash flows. Kittle wishes to analyze how its cash flows might change under different exchange rates for the Canadian dollar (the only foreign currency in which it deals). Step 1 Kittle estimates it's cash flows from both the U.S., in dollars, and Canada, in Canadian dollars, for a typical quarter. These figures are summarized in the following table. U.S. $305 Canada C$3 $50 C$200 Sales -Cost of materials -Operating expenses - Interest expenses Cash flows $60 $3 C$10 -$C207 $192 Kittle believes that the value of the Canadian dollar will be either $0.70 or $0.80 and seeks to analyze its cash flows under each of these scenarios. The following table shows Kittle's cash flows under each of these exchange rates. Exchange Rate Scenario C$1=$0.70 (Millions) Exchange Rate Scenario C$1=$0.80 (Millions) $305 C$3 X $0.70 = $2.10 $305 C$3 X $0.80 = $2.40 $307.10 $307.40 $50 $50 Sales (1) U.S. Sales (2) Canadian Sales (3) Total sales in U.S. $ Cost of Materials and Operating Expenses (4) U.S. Cost of Materials (5) Canadian Cost of Materials (6) Total Cost of Materials in U.S. $ (7) Operating Expenses Interest Expense (8) U.S. Interest Expense (9) Canadian Interest Expense (10) Total Interest Expenses in U.S. Cash Flows in U.S.$ before Taxes C$200 X $0.70 = $140.00 $190.00 C$200 X $0.80 = $160.00 $210.00 $60 $60 $3 $3 C$10 X $0.70 = $7.00 $10.00 C$10 X $0.80 = $8.00 $11.00 $47.10 $26.40 For Kittle Co., a stronger Canadian dollar has a stronger influence on Canadian dollar than it does on Canadian dollar Step 2 In the previous stage, you saw that Kittle's operating structure, with low sales in Canada and high cost of materials from Canadian suppliers, was a source of significant economic exposure each quarter. Because of this, Kittle has decided to restructure it's operating structure. The largest part of the restructure involves an increase in U.S. operating expense in order to pay for efforts to increase Canadian sales, while also ordering more supplies from U.S. suppliers instead of Canadian suppliers. This restructuring also includes using more U.S. sources for financing instead of Canadian sources. The following table shows Kittle's cash flows under each of these exchange rates and operating structures. Columns (1) and (3) represent the original operating structures, while columns (2) and (4) represent the new, proposed operating structure. (1) Exchange Rate Scenario C$1=$0.70 (3) Exchange Rate Scenario C$1=$0.80 (2) Exchange Rate Scenario C$1=$0.70 Proposed Operating Structure (Millions) (4) Exchange Rate Scenario C$1=$0.80 Proposed Operating Structure (Millions) Original Operating Structure (Millions) Original Operating Structure (Millions) Sales (1) U.S. Sales (2) Canadian Sales $305 $305 C$3 X $0.70 = $2.10 C$3 X $0.80 = $2.40 $305 C19 X $0.70 = $13.30 $318.30 $305 C19 X $0.80 = $15.20 $320.20 $307.10 $307.40 $50 $140 $50 $140 C$200 X $0.70 = (3) Total sales in U.S. $ Cost of Materials and Operating Expenses (4) U.S. Cost of Materials (5) Canadian Cost of Materials (6) Total Cost of Materials in U.S. $ (7) Operating Expenses Interest Expense (8) U.S. Interest C$100 X $0.70 $70.00 C$200 X $0.80 = $160.00 C$100 X $0.80 = $80.00 $140.00 $190.00 $210.00 $210.00 $220.00 $60 $62 $60 $62 $3 $5 $3 $5 C$5 X $0.70 = $3.50 C$5 X $0.80 = $4.00 Expense (9) Canadian Interest Expense (10) Total Interest Expenses in U.S. Cash Flows in U.S.$ before Taxes C$10 X $0.70 = $7.00 $10.00 C$10 X $0.80 = $ $8.00 $11.00 $8.50 $9.00 $47.10 $37.80 $26.40 $29.20 On the following graph, use the blue points (circle symbols) to plot the U.S. dollar cash flows from the original operating structure under both exchange rate scenarios $0.70 and $0.30. Then use the orange points (square symbols) to plot the U.S. dollar cash flows from the proposed operating structure under both exchange rate scenarios $0.70 and $0.80. Plot the points from left to right in the order you want them to appear. Line segments will connect automatically. 50 1 Original Operating Structure Proposed Operating Structure Cash Flows (Millions of Dollars) 20 10 + 0.65 0.70 0.75 0.80 Exchange Rate Scenario (U.S. Dollars per Canadian Dollar) Because the line for the proposed operating structure is the U.S. dollar cash flows in the proposed operating structure are sensitive to changes in the exchange rate of the Canadian dollar when compared with the U.S. dollar cash flows of the original operating structure. Suppose that Kittle Co, a U.S.-based MNC that both purchases supplies from Canada and sells exports in Canada, is seeking to measure the economic exposure of its cash flows. Kittle wishes to analyze how its cash flows might change under different exchange rates for the Canadian dollar (the only foreign currency in which it deals)