Answered step by step

Verified Expert Solution

Question

1 Approved Answer

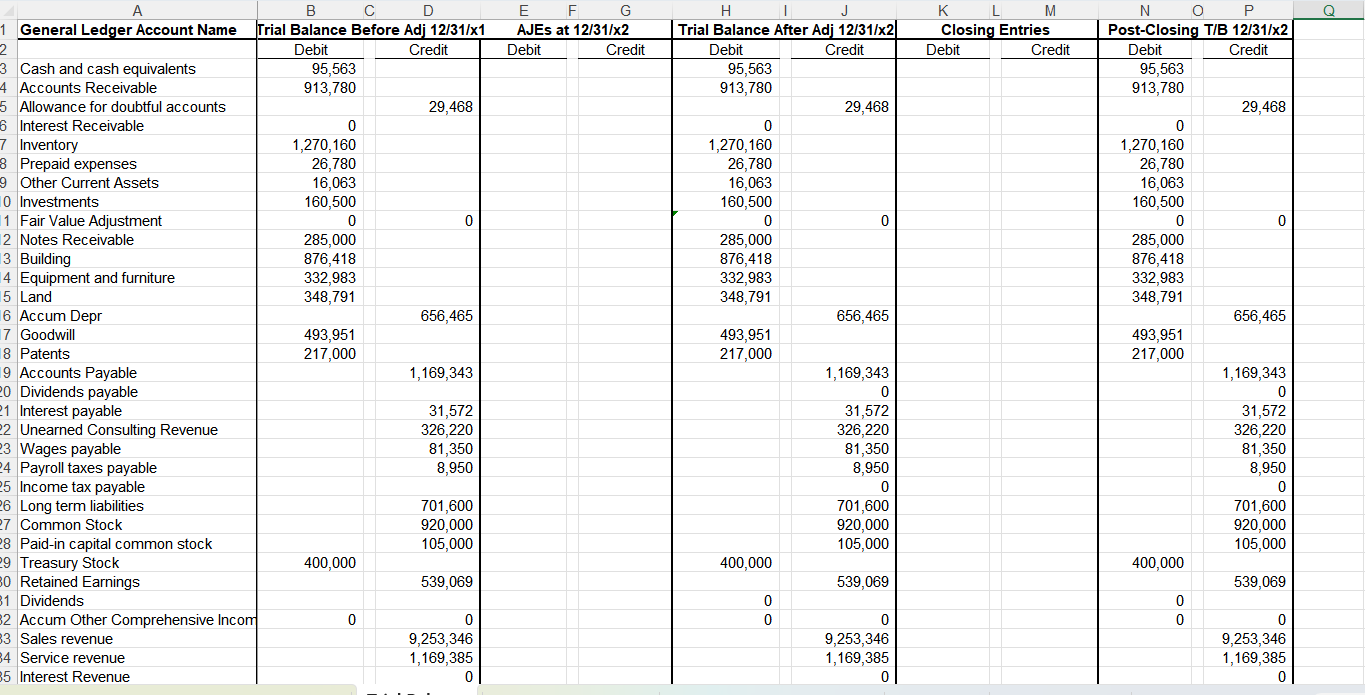

Step 2 : Record the 1 1 adjusting journal entries based on the information below. Record all AJE's on the Excel spreadsheet using the tab

Step : Record the adjusting journal entries based on the information below. Record all AJE's on the Excel spreadsheet using the tab labeled "AJEs and Closing Entries." Post to the Trial Balance second tab at the bottom of the spreadsheet in the two columns labeled AJE's Columns E & G SC uses a perpetual inventory system, which means that when they record the sale of a product at the selling price they also update COGS and Inventory at cost Recommendation: use cell referencing when posting to the Trial Balance to eliminate potential typos and followthrough errors.

Step : Once all AJE's have been recorded & posted to the Trial Balance, check your work with the "CHECK FIGURES FOR Accounting Cycle Project." If your spreadsheet agrees with the Check Figures, you can move to Step

Step : Record the Closing entries on the tab labeled "AJE's & Closing." Post to the Trial Balance in columns K & M

Step : Complete the Income Statement, Comprehensive Income Statement, Statement of Retained Earnings, and Balance Sheet in good form.

Additional information to use in recording the necessary Adjusting Journal Entries AJEs:

As of December wages of $ should be accrued; associated payroll taxes on these wages are $Record in two separate adjusting entries. The payroll taxes are an expense to the company for unemployment benefits and are recorded as payroll taxes payable to the state & federal taxing authority.

The Unearned Consulting Revenue account has a balance before adjustment of $ as of December x Of this balance, of the work was completed by yearend.

You discover that a sale of a product was made on the account and SC recorded the sale in December for $ However, the product has not yet been shipped, therefore it is not considered to be delivered to the customer. The cost of the product was of its selling price. SC uses the perpetual inventory method. Simply reverse the original journal entry!

At yearend, the CFO asks you to review the Accounts Receivables to determine if any customer accounts should be written off as uncollectible. Based on your review, you determine that the Account Receivable from Shift, Co has been past due for over months, and Shift recently declared bankruptcy. The CFO instructs you to write off the account balance of $ Directly following this action, you can now record bad debt expense, estimated to be of ending Accounts Receivable. Round to the nearest whole dollar.

SC prepays for its property & casualty insurance. As of December x of the prepayments have now been consumed. Round to the nearest whole dollar.

SC records depreciation and amortization expenses annually. They do not use an accumulated amortization account. ie Amortization Expense is recorded with a debit to Amort. Exp and a credit to the Patent. Annual depreciation rates are for BuildingsEquipmentFurniture with no salvage. Round to the nearest whole dollar. Annual Amortization rates are of the original cost, straightline method, no salvage. SC owns two patents: Patent #FJ has an original cost of $ and Patent #CQ was acquired for $ The last time depreciation & amortization were recorded was December x

The longterm liabilities were outstanding for all of x and accrue interest at APR. SC records accrued interest quarterly interest was last updated on September The company is required to pay the interest annually each January

SC often allows customers to finance the purchase of their products through longterm lending agreements and therefore reports Longterm Notes Receivable on their Balance Sheet. These notes are interestbearing and earn SC interest revenue at APR and were outstanding for all x Interest is payable to SC each January

On December SC declared a dividend of $ to be paid on January x The dividend declaration had not yet been recorded. Please record the debit to Dividends.

On December the LongTerm Investments Availableforsale securities or "AFS" had a fair value of $ The AFS Investment was initially purchased on June x for $ SC uses a "Fair Value Adjustment" account an adjunctcontra account to the Investments to marktomarket the investment portfolio at yearend. eg If the fair value of the Investment has increased at yearend, debit the Fair Value Adjustment account to increase the Carrying Value of the asset to equal its fair value on the balance sheet on December This is an "unrealized" holding gain, which would require a credit to record it

SCs Income tax rate for x was determined to be Hint: The income statement must be prepared to determine income tax expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started