Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Step 4 - Calculate the Stock's Potential Rate of Return The potential rate of return for an investment over a period of years can be

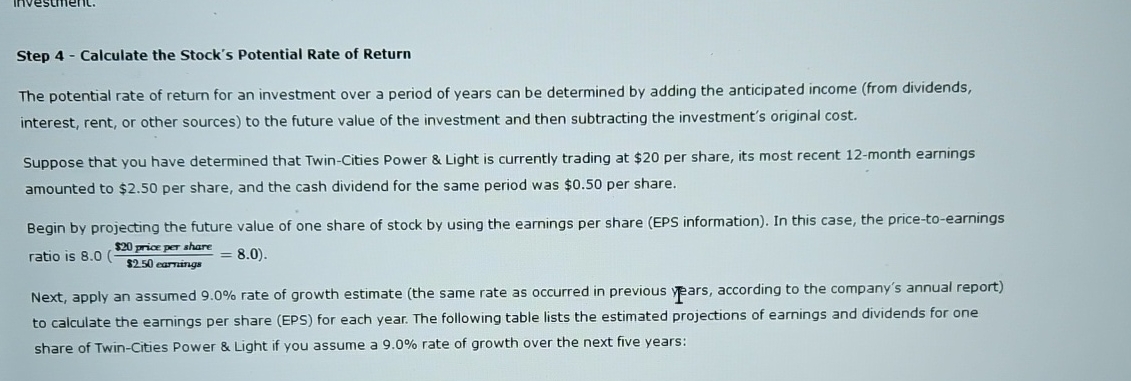

Step Calculate the Stock's Potential Rate of Return

The potential rate of return for an investment over a period of years can be determined by adding the anticipated income from dividends, interest, rent, or other sources to the future value of the investment and then subtracting the investment's original cost.

Suppose that you have determined that TwinCities Power & Light is currently trading at $ per share, its most recent month earnings amounted to $ per share, and the cash dividend for the same period was $ per share.

Begin by projecting the future value of one share of stock by using the earnings per share EPS information In this case, the pricetoearnings ratio is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started