Step by step please

Step by step please

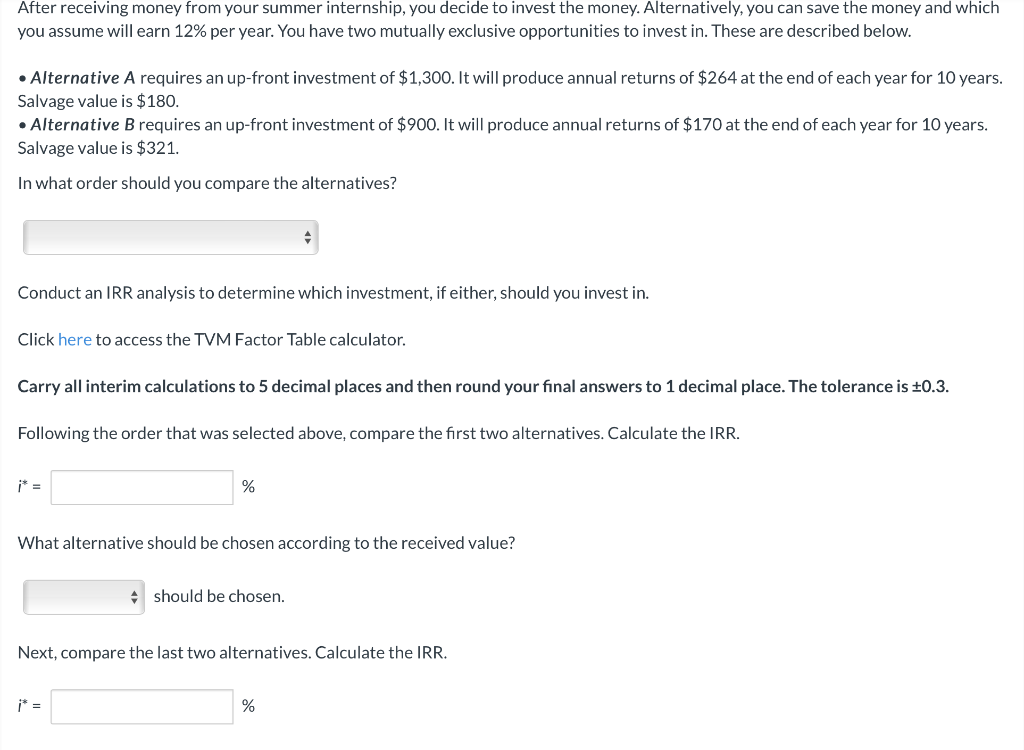

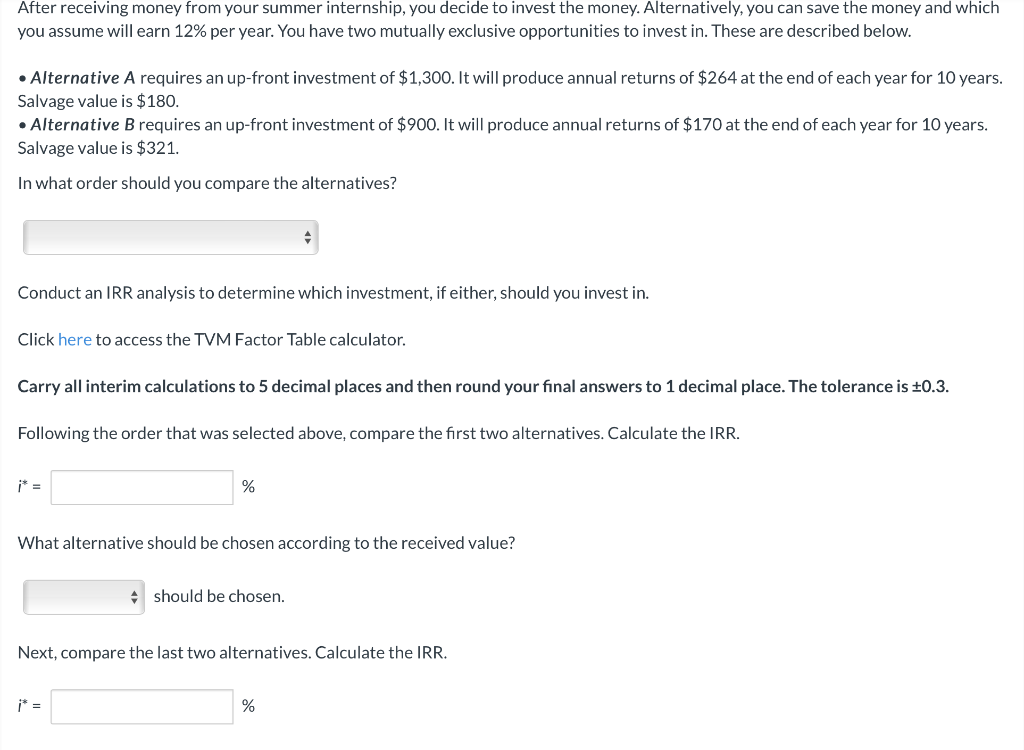

After receiving money from your summer internship, you decide to invest the money. Alternatively, you can save the money and which you assume will earn 12% per year. You have two mutually exclusive opportunities to invest in. These are described below. - Alternative A requires an up-front investment of $1,300. It will produce annual returns of $264 at the end of each year for 10 years. Salvage value is $180. - Alternative B requires an up-front investment of $900. It will produce annual returns of $170 at the end of each year for 10 years. Salvage value is $321. In what order should you compare the alternatives? Conduct an IRR analysis to determine which investment, if either, should you invest in. Click here to access the TVM Factor Table calculator. Carry all interim calculations to 5 decimal places and then round your final answers to 1 decimal place. The tolerance is 0.3. Following the order that was selected above, compare the first two alternatives. Calculate the IRR. i=% What alternative should be chosen according to the received value? should be chosen. Next, compare the last two alternatives. Calculate the IRR. i= After receiving money from your summer internship, you decide to invest the money. Alternatively, you can save the money and which you assume will earn 12% per year. You have two mutually exclusive opportunities to invest in. These are described below. - Alternative A requires an up-front investment of $1,300. It will produce annual returns of $264 at the end of each year for 10 years. Salvage value is $180. - Alternative B requires an up-front investment of $900. It will produce annual returns of $170 at the end of each year for 10 years. Salvage value is $321. In what order should you compare the alternatives? Conduct an IRR analysis to determine which investment, if either, should you invest in. Click here to access the TVM Factor Table calculator. Carry all interim calculations to 5 decimal places and then round your final answers to 1 decimal place. The tolerance is 0.3. Following the order that was selected above, compare the first two alternatives. Calculate the IRR. i=% What alternative should be chosen according to the received value? should be chosen. Next, compare the last two alternatives. Calculate the IRR. i=

Step by step please

Step by step please