Answered step by step

Verified Expert Solution

Question

1 Approved Answer

STEP BY STEP SOLUTION FOR NUMBER 12 Growth Rates. The stock price of return of 10.5 percent on similar stocks. If the company plans to

STEP BY STEP SOLUTION FOR NUMBER 12

STEP BY STEP SOLUTION FOR NUMBER 12

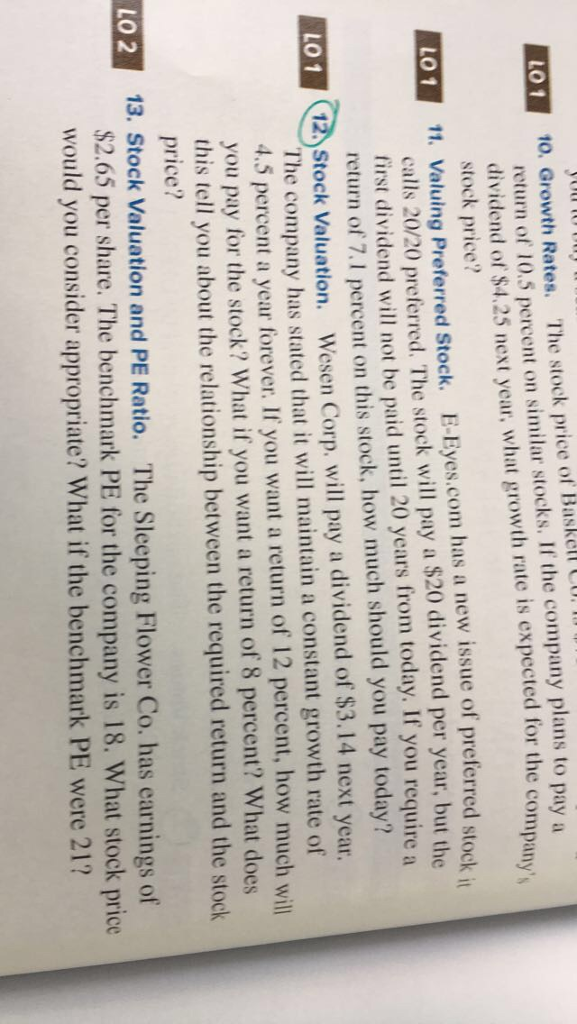

Growth Rates. The stock price of return of 10.5 percent on similar stocks. If the company plans to pay a dividend of $4.25 next year, what growth rate is expected for the company's stock price? Valuing Preferred Stock. E-Eyes.com has a new issue of preferred stock it calls 20/20 preferred. The stock will pay a $20 dividend per year, but the first dividend will not be paid until 20 years from today. If you require a return of 7.1 percent on this stock, how much should you pay today? Stock Valuation. Wesen Corp. will pay a dividend of $3.14 next year. The company has stated that it will maintain a constant growth rate of 4.5 percent a year forever. If you want a return of 12 percent, how much will you pay for the stock? What if you want a return of 8 percent? What does this tell you about the relationship between the required return and the stock price? Stock Valuation and PE Ratio. The Sleeping Flower Co. has earnings of $2.65 per share. The benchmark PE for the company is 18. What stock price would you consider appropriate? What if the benchmark PE were 21

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started