Answered step by step

Verified Expert Solution

Question

1 Approved Answer

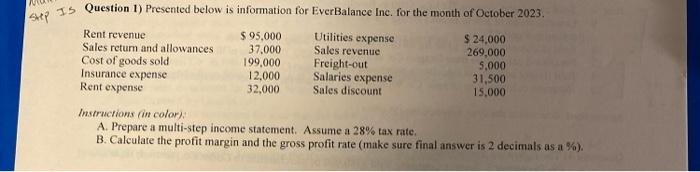

/ Step Is Question 1) Presented below is information for EverBalance Inc. for the month of October 2023. Utilities expense Sales revenue Rent revenue Sales

/ Step Is Question 1) Presented below is information for EverBalance Inc. for the month of October 2023. Utilities expense Sales revenue Rent revenue Sales return and allowances Cost of goods sold Insurance expense Rent expense $ 95,000 37,000 199,000 12,000 32,000 Freight-out Salaries expense Sales discount $ 24,000 269,000 5,000 31,500 15,000 Instructions (in color): A. Prepare a multi-step income statement. Assume a 28% tax rate. B. Calculate the profit margin and the gross profit rate (make sure final answer is 2 decimals as a %).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started