Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Step One: Select a company and obtain its income statements and balance sheets for at least 10 accounting periods (quarterly or annual data). Step

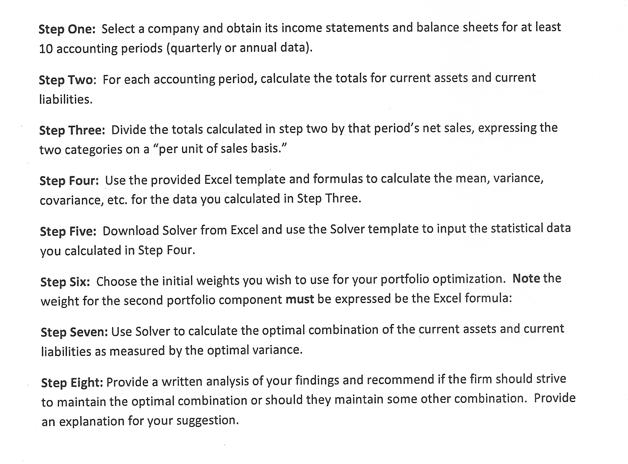

Step One: Select a company and obtain its income statements and balance sheets for at least 10 accounting periods (quarterly or annual data). Step Two: For each accounting period, calculate the totals for current assets and current liabilities. Step Three: Divide the totals calculated in step two by that period's net sales, expressing the two categories on a "per unit of sales basis." Step Four: Use the provided Excel template and formulas to calculate the mean, variance, covariance, etc. for the data you calculated in Step Three. Step Five: Download Solver from Excel and use the Solver template to input the statistical data. you calculated in Step Four. Step Six: Choose the initial weights you wish to use for your portfolio optimization. Note the weight for the second portfolio component must be expressed be the Excel formula: Step Seven: Use Solver to calculate the optimal combination of the current assets and current liabilities as measured by the optimal variance. Step Eight: Provide a written analysis of your findings and recommend if the firm should strive to maintain the optimal combination or should they maintain some other combination. Provide an explanation for your suggestion.

Step by Step Solution

★★★★★

3.58 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The company I have selected is Walmart Below are Walmarts income statements and balance sheets for t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started