Answered step by step

Verified Expert Solution

Question

1 Approved Answer

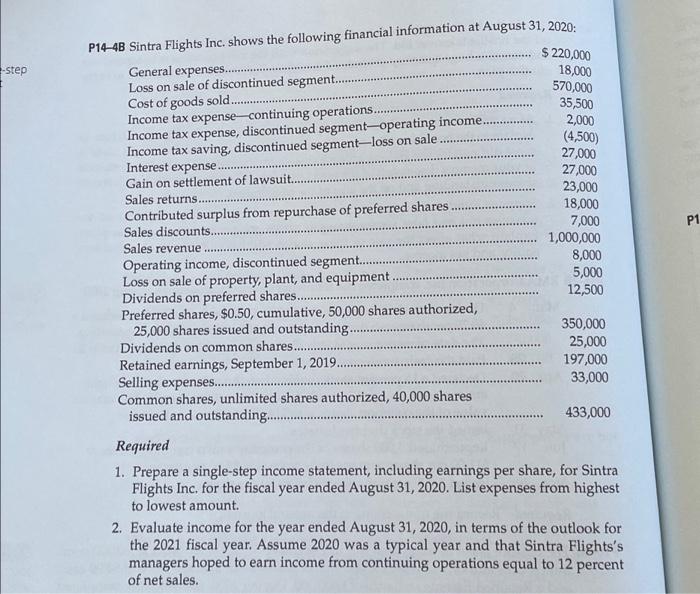

-step P14-4B Sintra Flights Inc. shows the following financial information at August 31, 2020: General expenses......... Loss on sale of discontinued segment....... Cost of goods

-step P14-4B Sintra Flights Inc. shows the following financial information at August 31, 2020: General expenses......... Loss on sale of discontinued segment....... Cost of goods sold.................. Income tax expense-continuing operations........... Income tax expense, discontinued segment-operating income............... Income tax saving, discontinued segment-loss on sale Interest expense............. Gain on settlement of lawsuit.......... Sales returns................... Contributed surplus from repurchase of preferred shares Sales discounts.......... Sales revenue .......... Operating income, discontinued segment..... Loss on sale of property, plant, and equipment Dividends on preferred shares. Preferred shares, $0.50, cumulative, 50,000 shares authorized, 25,000 shares issued and outstanding............ Dividends on common shares.......... Retained earnings, September 1, 2019.......... Selling expenses.............. Common shares, unlimited shares authorized, 40,000 shares issued and outstanding.... $220,000 18,000 570,000 35,500 2,000 (4,500) 27,000 27,000 23,000 18,000 7,000 ...... 1,000,000 8,000 5,000 12,500 350,000 25,000 197,000 33,000 433,000 Required 1. Prepare a single-step income statement, including earnings per share, for Sintra Flights Inc. for the fiscal year ended August 31, 2020. List expenses from highest to lowest amount. 2. Evaluate income for the year ended August 31, 2020, in terms of the outlook for the 2021 fiscal year. Assume 2020 was a typical year and that Sintra Flights's managers hoped to earn income from continuing operations equal to 12 percent of net sales. P1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started