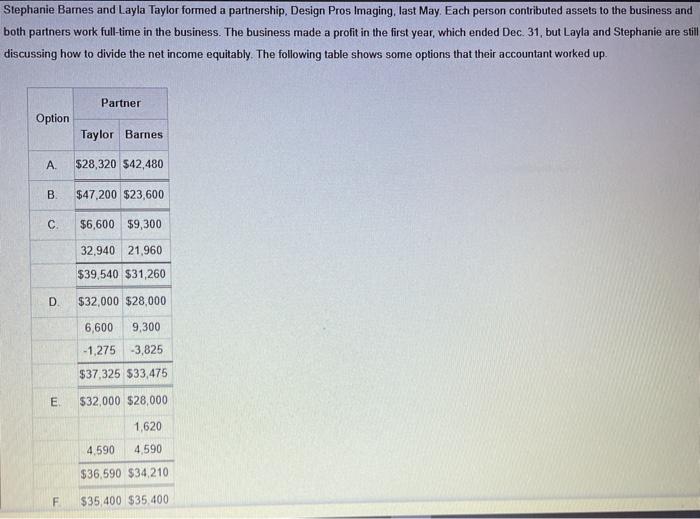

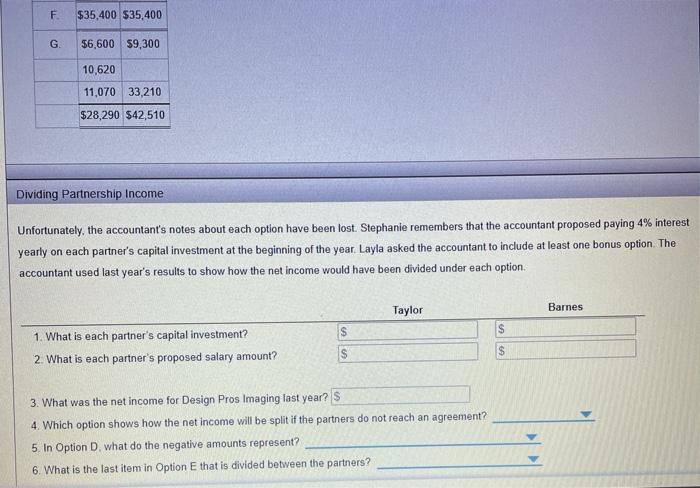

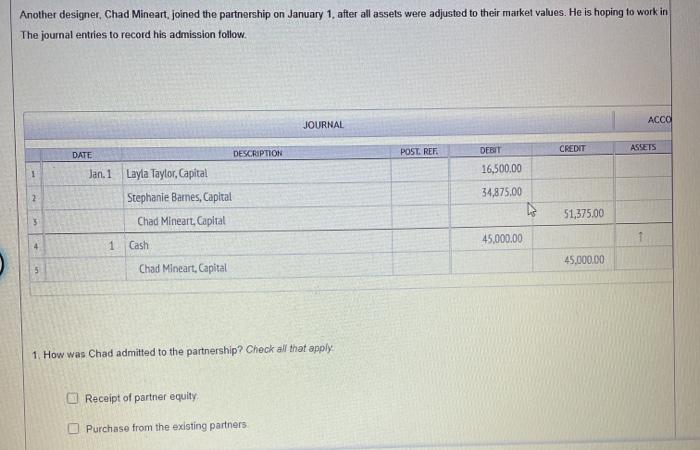

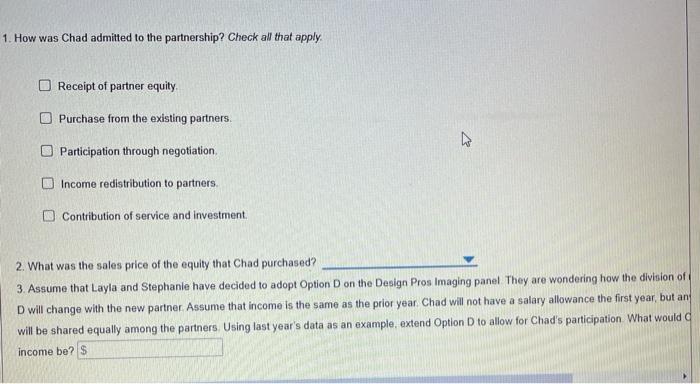

Stephanie Barnes and Layla Taylor formed a partnership, Design Pros Imaging, last May. Each person contributed assets to the business and both partners work full-time in the business. The business made a profit in the first year, which ended Dec. 31, but Layla and Stephanie are stil discussing how to divide the net income equitably. The following table shows some options that their accountant worked up Partner Option Taylor Barnes A $28,320 $42,480 . $47,200 $23,600 C $6,600 $9,300 32,940 21,960 $39,540 $31,260 D $32,000 $28,000 6,600 9,300 -1,275 -3,825 $37,325 $33,475 E $32,000 $28,000 1,620 4.590 4.590 $36,590 $34,210 F $35,400 $35.400 F $35,400 $35,400 G $6,600 $9,300 10,620 11,070 33,210 $28,290 $42,510 Dividing Partnership Income Unfortunately, the accountant's notes about each option have been lost. Stephanie remembers that the accountant proposed paying 4% interest yearly on each partner's capital investment at the beginning of the year. Layla asked the accountant to include at least one bonus option. The accountant used last year's results to show how the net income would have been divided under each option Taylor Barnes S 1. What is each partner's capital investment? 2. What is each partner's proposed salary amount? S $ $ 3. What was the net income for Design Pros Imaging last year? S 4. Which option shows how the net income will be split if the partners do not reach an agreement? 5. In Option D, what do the negative amounts represent? 6. What is the last item in Option E that is divided between the partners? Another designer, Chad Mineart, joined the partnership on January 1, after all assets were adjusted to their market values. He is hoping to work in The journal entries to record his admission follow. JOURNAL ACCO POST REF DEBIT CREDIT ASSETS 16,500.00 DATE DESCRIPTION Jan. 1 Layla Taylor, Capital Stephanie Barnes, Capital Chad Mineart, Capital 34,875.00 2 51,375.00 5 1 Cash 45,000.00 45,000.00 5 Chad Mineart, Capital 1. How was Chad admitted to the partnership? Check all that apply Receipt of partner equity Purchase from the existing partners 1. How was Chad admitted to the partnership? Check all that apply Receipt of partner equity Purchase from the existing partners Participation through negotiation Income redistribution to partners Contribution of service and investment 2. What was the sales price of the equity that Chad purchased? 3. Assume that Layla and Stephanie have decided to adopt Option D on the Design Pros Imaging panel They are wondering how the division of D will change with the new partner. Assume that income is the same as the prior year Chad will not have a salary allowance the first year, but an will be shared equally among the partners. Using last year's data as an example, extend option to allow for Chad's participation What would income be? $