Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Stephanie Limited is considering a $20 million ($20,000,000) investment project to support the launch of a new product. Total project economic life is estimated

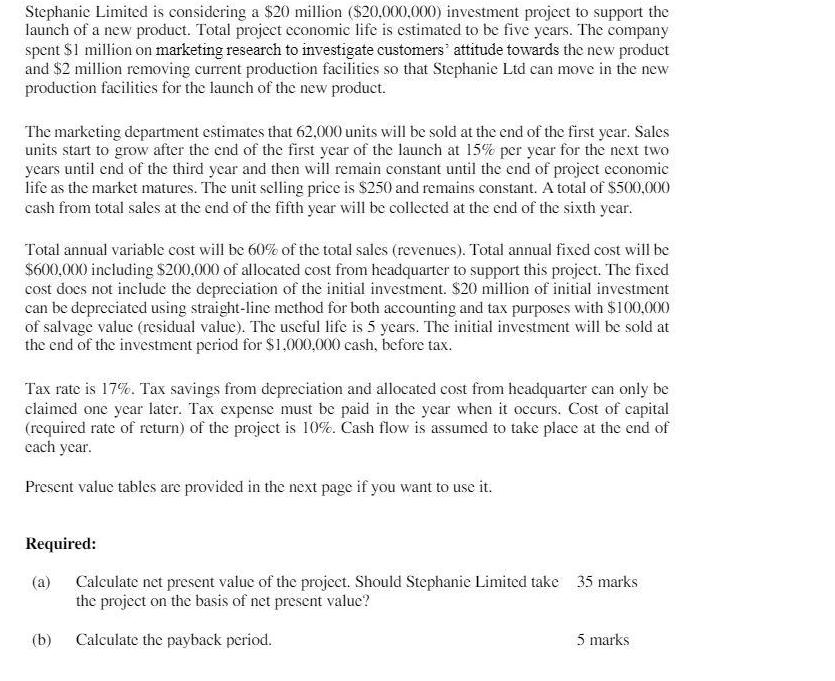

Stephanie Limited is considering a $20 million ($20,000,000) investment project to support the launch of a new product. Total project economic life is estimated to be five years. The company spent $1 million on marketing research to investigate customers' attitude towards the new product and $2 million removing current production facilities so that Stephanie Ltd can move in the new production facilities for the launch of the new product. The marketing department estimates that 62,000 units will be sold at the end of the first year. Sales units start to grow after the end of the first year of the launch at 15% per year for the next two years until end of the third year and then will remain constant until the end of project economic life as the market matures. The unit selling price is $250 and remains constant. A total of $500,000 cash from total sales at the end of the fifth year will be collected at the end of the sixth year. Total annual variable cost will be 60% of the total sales (revenues). Total annual fixed cost will be $600,000 including $200,000 of allocated cost from headquarter to support this project. The fixed cost does not include the depreciation of the initial investment. $20 million of initial investment can be depreciated using straight-line method for both accounting and tax purposes with $100,000 of salvage value (residual value). The useful life is 5 years. The initial investment will be sold at the end of the investment period for $1,000,000 cash, before tax. Tax rate is 17%. Tax savings from depreciation and allocated cost from headquarter can only be claimed one year later. Tax expense must be paid in the year when it occurs. Cost of capital (required rate of return) of the project is 10%. Cash flow is assumed to take place at the end of each year. Present value tables are provided in the next page if you want to use it. Required: (a) (b) Calculate net present value of the project. Should Stephanie Limited take 35 marks the project on the basis of net present value? Calculate the payback period. 5 marks

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the net present value NPV of the project and determine whether Stephanie Limited should proceed with it we need to calculate the cash flows for each year and discount them to their pres...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started