Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Stephen and Madeline wish to take a trip to the United States to visit friends and attend a wedding in a couple of months' time.

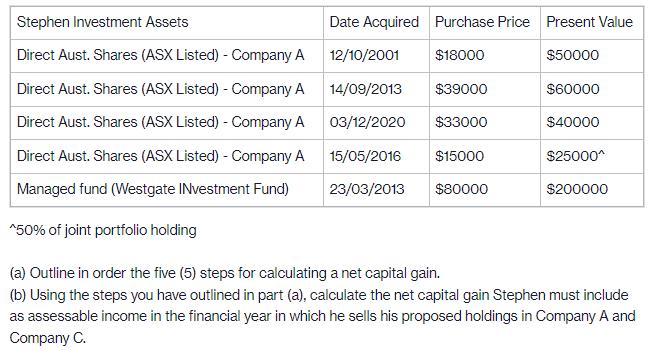

Stephen and Madeline wish to take a trip to the United States to visit friends and attend a wedding in a couple of months' time. To help fund this trip, Stephen has told you he intends on selling $25,000 worth of the shares from his holding in Company A, and a further $10,000 worth of shares from his holding in Company C. Additionally, Stephen also has a carry-forward capital loss from a previous financial year of $5,000.

Stephen Investment Assets Direct Aust. Shares (ASX Listed) - Company A Direct Aust. Shares (ASX Listed) - Company A Direct Aust. Shares (ASX Listed) - Company A Direct Aust. Shares (ASX Listed) - Company A Managed fund (Westgate Investment Fund) ^50% of joint portfolio holding Date Acquired Purchase Price Present Value 12/10/2001 $18000 $50000 14/09/2013 $39000 03/12/2020 $33000 15/05/2016 23/03/2013 $15000 $80000 $60000 $40000 $25000 $200000 (a) Outline in order the five (5) steps for calculating a net capital gain. (b) Using the steps you have outlined in part (a), calculate the net capital gain Stephen must include as assessable income in the financial year in which he sells his proposed holdings in Company A and Company C.

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a The five steps for calculating a net capital gain are Calculate the total proceeds of the sale This is the total amount of money Stephen wi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started