Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Steve and Charlene have an HO-3 policy (replacement value and open perils endorsement) with a $250 deductible, a dwelling value of $500,000, an 80%

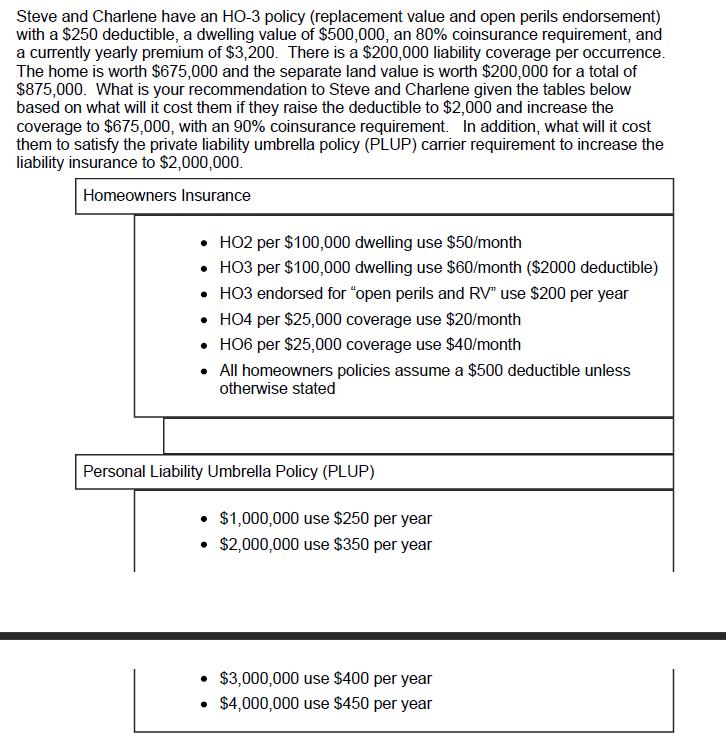

Steve and Charlene have an HO-3 policy (replacement value and open perils endorsement) with a $250 deductible, a dwelling value of $500,000, an 80% coinsurance requirement, and a currently yearly premium of $3,200. There is a $200,000 liability coverage per occurrence. The home is worth $675,000 and the separate land value is worth $200,000 for a total of $875,000. What is your recommendation to Steve and Charlene given the tables below based on what will it cost them if they raise the deductible to $2,000 and increase the coverage to $675,000, with an 90% coinsurance requirement. In addition, what will it cost them to satisfy the private liability umbrella policy (PLUP) carrier requirement to increase the liability insurance to $2,000,000. Homeowners Insurance HO2 per $100,000 dwelling use $50/month HO3 per $100,000 dwelling use $60/month ($2000 deductible) HO3 endorsed for "open perils and RV" use $200 per year HO4 per $25,000 coverage use $20/month HO6 per $25,000 coverage use $40/month All homeowners policies assume a $500 deductible unless otherwise stated Personal Liability Umbrella Policy (PLUP) $1,000,000 use $250 per year $2,000,000 use $350 per year $3,000,000 use $400 per year $4,000,000 use $450 per year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To answer the questions we will use the following calculations 1 Cost of in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started