Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Steve Kires operates the Coolidge Pen Shop (CPS), a business in which he purchases and sells all sorts of pens from various branded manufacturers

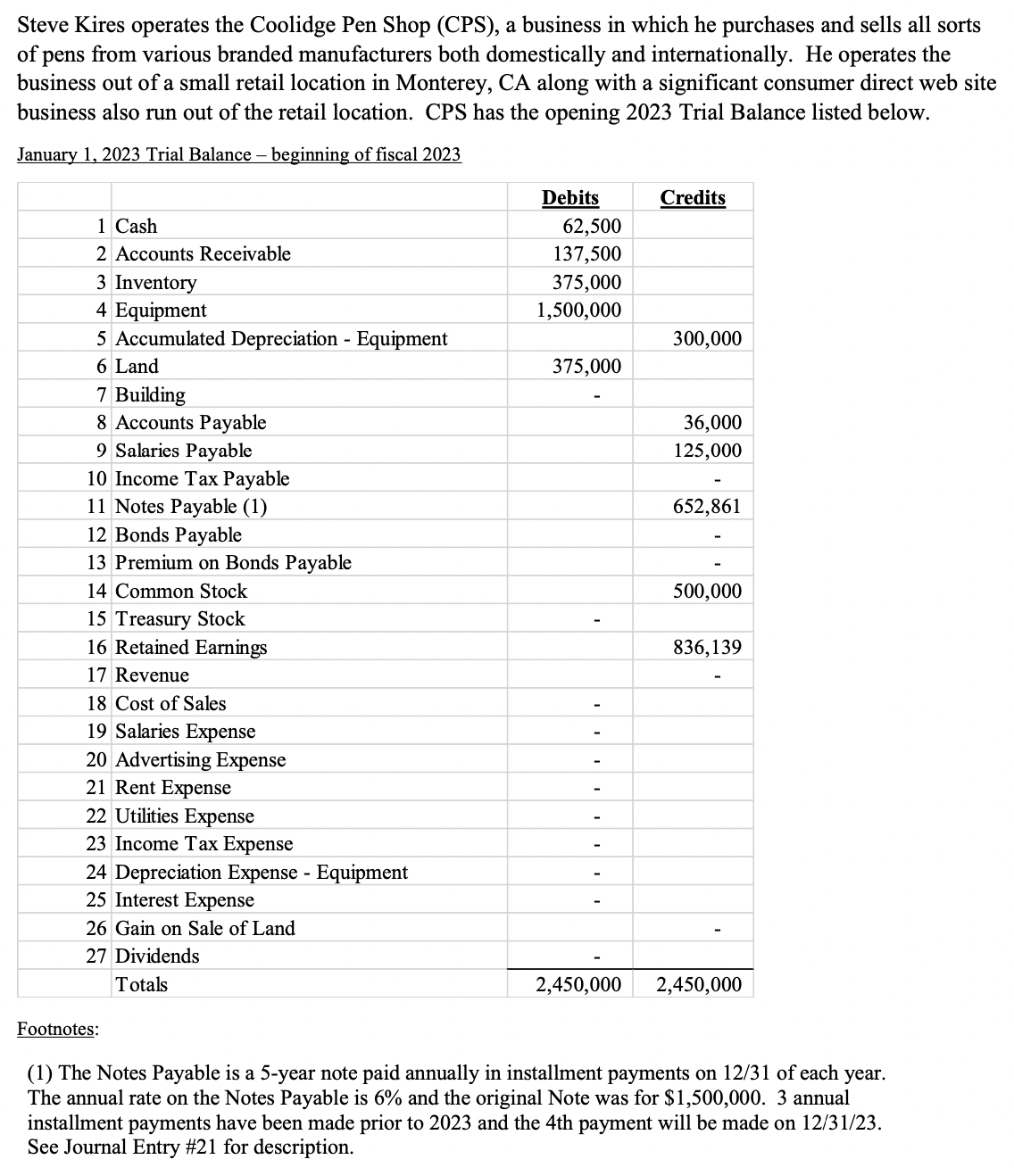

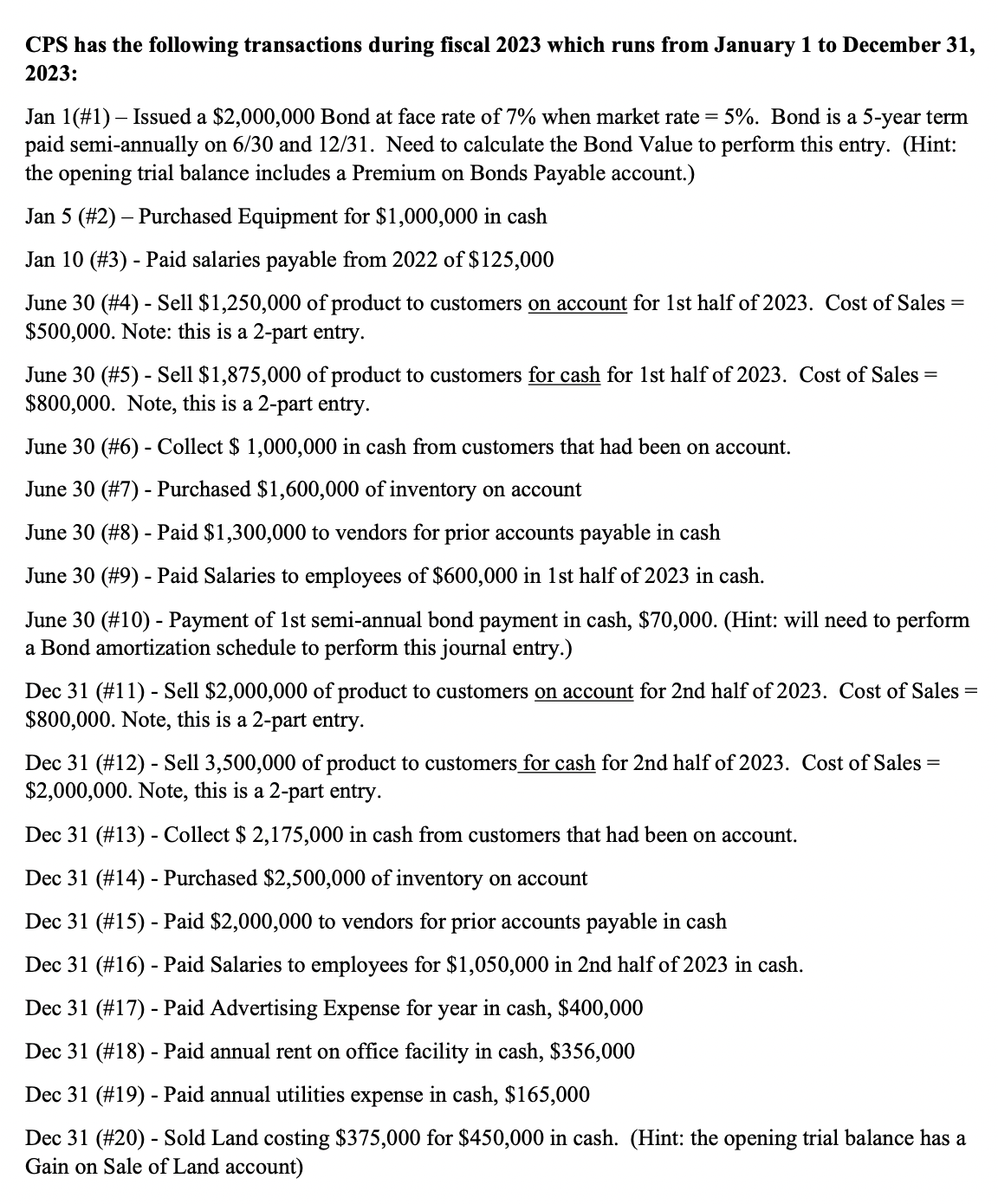

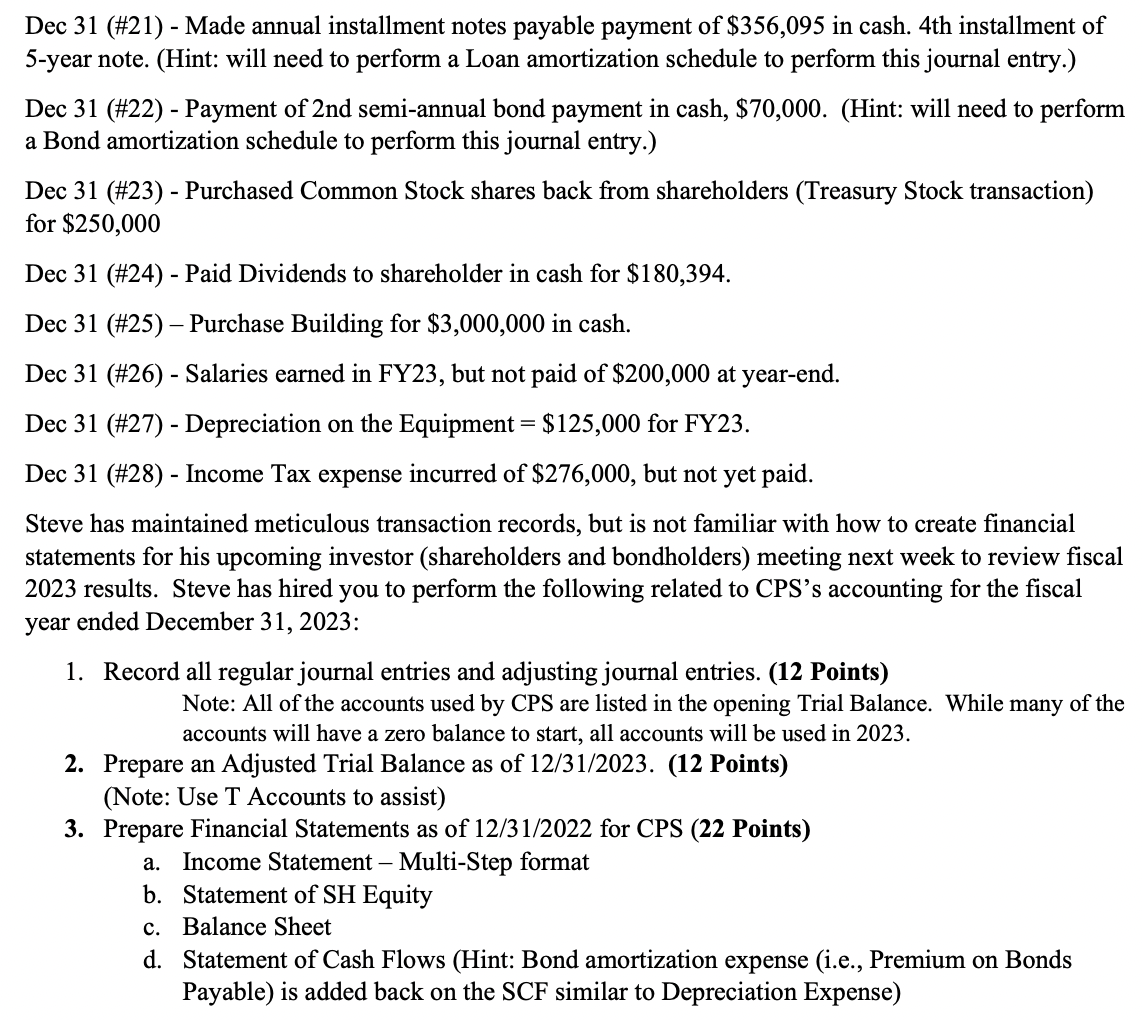

Steve Kires operates the Coolidge Pen Shop (CPS), a business in which he purchases and sells all sorts of pens from various branded manufacturers both domestically and internationally. He operates the business out of a small retail location in Monterey, CA along with a significant consumer direct web site business also run out of the retail location. CPS has the opening 2023 Trial Balance listed below. January 1, 2023 Trial Balance - beginning of fiscal 2023 Debits Credits 1 Cash 62,500 2 Accounts Receivable 137,500 3 Inventory 375,000 4 Equipment 1,500,000 5 Accumulated Depreciation - Equipment 300,000 6 Land 375,000 7 Building 8 Accounts Payable 36,000 9 Salaries Payable 125,000 10 Income Tax Payable 11 Notes Payable (1) 652,861 12 Bonds Payable 13 Premium on Bonds Payable 14 Common Stock 500,000 836,139 15 Treasury Stock 16 Retained Earnings 17 Revenue 18 Cost of Sales 19 Salaries Expense 20 Advertising Expense 21 Rent Expense 22 Utilities Expense 23 Income Tax Expense 24 Depreciation Expense - Equipment 25 Interest Expense 26 Gain on Sale of Land 27 Dividends Totals - - - 2,450,000 2,450,000 Footnotes: (1) The Notes Payable is a 5-year note paid annually in installment payments on 12/31 of each year. The annual rate on the Notes Payable is 6% and the original Note was for $1,500,000. 3 annual installment payments have been made prior to 2023 and the 4th payment will be made on 12/31/23. See Journal Entry #21 for description. CPS has the following transactions during fiscal 2023 which runs from January 1 to December 31, 2023: Jan 1(#1) - Issued a $2,000,000 Bond at face rate of 7% when market rate = 5%. Bond is a 5-year term paid semi-annually on 6/30 and 12/31. Need to calculate the Bond Value to perform this entry. (Hint: the opening trial balance includes a Premium on Bonds Payable account.) Jan 5 (#2) - Purchased Equipment for $1,000,000 in cash Jan 10 (#3) - Paid salaries payable from 2022 of $125,000 June 30 (#4) - Sell $1,250,000 of product to customers on account for 1st half of 2023. Cost of Sales = $500,000. Note: this is a 2-part entry. June 30 (#5) - Sell $1,875,000 of product to customers for cash for 1st half of 2023. Cost of Sales = $800,000. Note, this is a 2-part entry. June 30 (#6) Collect $ 1,000,000 in cash from customers that had been on account. - June 30 (#7) - Purchased $1,600,000 of inventory on account - June 30 (#8) Paid $1,300,000 to vendors for prior accounts payable in cash June 30 (#9) Paid Salaries to employees of $600,000 in 1st half of 2023 in cash. June 30 (#10) - Payment of 1st semi-annual bond payment in cash, $70,000. (Hint: will need to perform a Bond amortization schedule to perform this journal entry.) Dec 31 (#11) Sell $2,000,000 of product to customers on account for 2nd half of 2023. Cost of Sales = $800,000. Note, this is a 2-part entry. Dec 31 (#12) Sell 3,500,000 of product to customers for cash for 2nd half of 2023. Cost of Sales = $2,000,000. Note, this is a 2-part entry. Dec 31 (#13) Collect $ 2,175,000 in cash from customers that had been on account. - Dec 31 (#14) - Purchased $2,500,000 of inventory on account Dec 31 (#15) - Paid $2,000,000 to vendors for prior accounts payable in cash - Dec 31 (#16) Paid Salaries to employees for $1,050,000 in 2nd half of 2023 in cash. Dec 31 (#17) - Paid Advertising Expense for year in cash, $400,000 Dec 31 (#18) - Paid annual rent on office facility in cash, $356,000 - Dec 31 (#19) Paid annual utilities expense in cash, $165,000 - Dec 31 (#20) Sold Land costing $375,000 for $450,000 in cash. (Hint: the opening trial balance has a Gain on Sale of Land account) - Dec 31 (#21) Made annual installment notes payable payment of $356,095 in cash. 4th installment of 5-year note. (Hint: will need to perform a Loan amortization schedule to perform this journal entry.) Dec 31 (#22) Payment of 2nd semi-annual bond payment in cash, $70,000. (Hint: will need to perform a Bond amortization schedule to perform this journal entry.) Dec 31 (#23) - Purchased Common Stock shares back from shareholders (Treasury Stock transaction) for $250,000 Dec 31 (#24) Paid Dividends to shareholder in cash for $180,394. - - Dec 31 (#25) Purchase Building for $3,000,000 in cash. Dec 31 (#26) - Salaries earned in FY23, but not paid of $200,000 at year-end. Dec 31 (#27) Depreciation on the Equipment = $125,000 for FY23. - Dec 31 (#28) Income Tax expense incurred of $276,000, but not yet paid. Steve has maintained meticulous transaction records, but is not familiar with how to create financial statements for his upcoming investor (shareholders and bondholders) meeting next week to review fiscal 2023 results. Steve has hired you to perform the following related to CPS's accounting for the fiscal year ended December 31, 2023: 1. Record all regular journal entries and adjusting journal entries. (12 Points) Note: All of the accounts used by CPS are listed in the opening Trial Balance. While many of the accounts will have a zero balance to start, all accounts will be used in 2023. 2. Prepare an Adjusted Trial Balance as of 12/31/2023. (12 Points) (Note: Use T Accounts to assist) 3. Prepare Financial Statements as of 12/31/2022 for CPS (22 Points) a. Income Statement - Multi-Step format b. Statement of SH Equity c. Balance Sheet d. Statement of Cash Flows (Hint: Bond amortization expense (i.e., Premium on Bonds Payable) is added back on the SCF similar to Depreciation Expense)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To help you with your task I will provide the regular journal entries and adjusting journal entries for the transactions mentioned as well as assist i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started