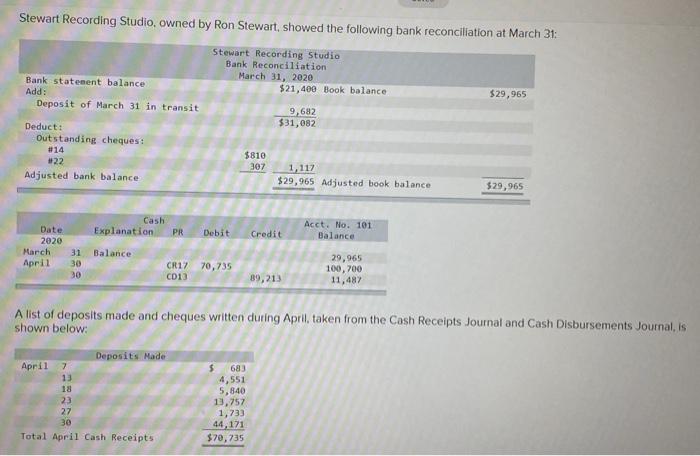

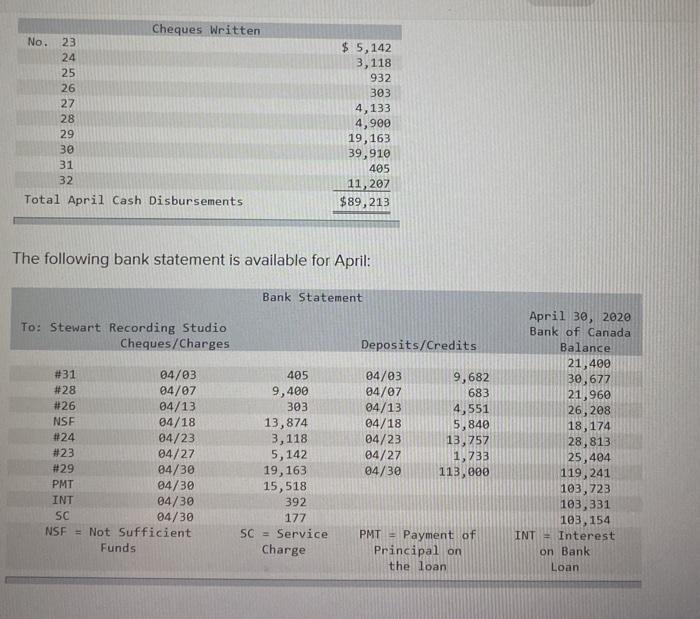

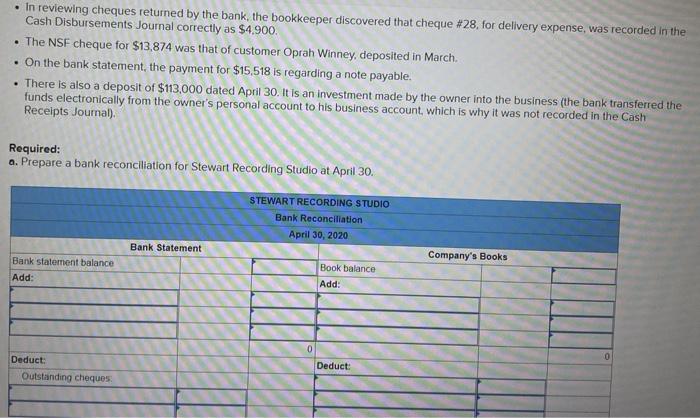

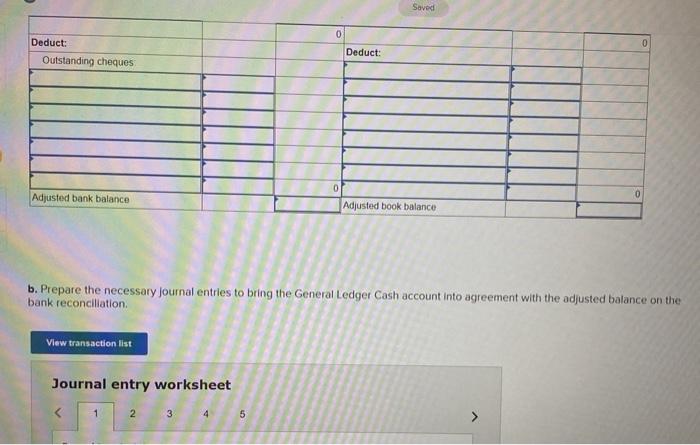

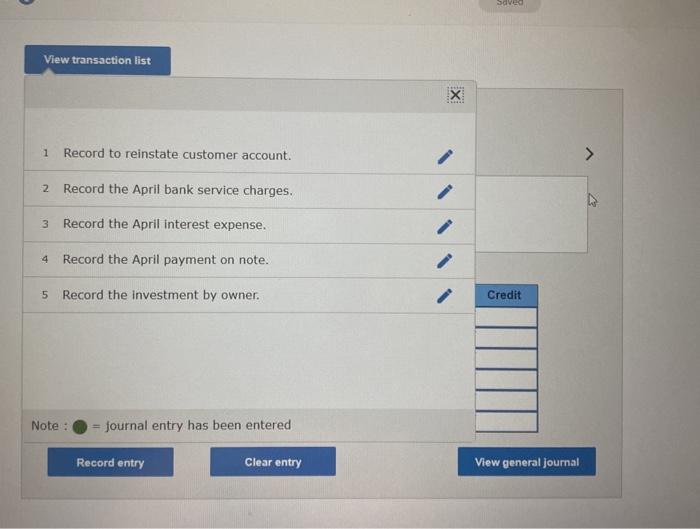

Stewart Recording Studio. owned by Ron Stewart, showed the following bank reconciliation at March 31: Stewart Recording Studio Bank Reconciliation March 31, 2020 $21,400 Book balance $29,965 9,682 $31,082 Bank statement balance Add: Deposit of March 31 in transit Deduct: Outstanding cheques : #14 #22 Adjusted bank balance $810 307 1,117 $29,965 Adjusted book balance $29,965 Date 2020 Cash Explanation PR Debit Credit Acct. No. 101 Balance March April Balance 31 30 30 CR17 70,735 CD13 29,965 100,700 11,487 89, 213 A list of deposits made and cheques written during April, taken from the Cash Receipts Journal and Cash Disbursements Journal, is shown below: Deposits Made April 7 13 18 23 27 30 Total April Cash Receipts $ 683 4,551 5,840 1,757 1,733 44,171 $70,735 Cheques Written No. 23 24 25 26 27 28 29 30 31 32 Total April Cash Disbursements $ 5,142 3,118 932 303 4,133 4,900 19,163 39,910 405 11,202 $89,213 The following bank statement is available for April: Bank Statement To: Stewart Recording Studio Cheques/Charges Deposits/Credits #31 04/03 #28 04/07 #26 04/13 NSF 04/18 #24 04/23 #23 04/27 #29 04/30 PMT 04/30 INT 04/30 04/30 NSF = Not Sufficient Funds 405 9,400 303 13,874 3,118 5, 142 19,163 15,518 392 177 SC = Service Charge 04/03 04/07 04/13 04/18 04/23 04/27 04/30 9,682 683 4,551 5,840 13,757 1,733 113,000 April 30, 2020 Bank of Canada Balance 21,400 30,677 21,960 26, 208 18,174 28,813 25,404 119,241 103,723 103,331 103, 154 INT Interest on Bank Loan SC PMT Payment of Principal on the loan In reviewing cheques returned by the bank, the bookkeeper discovered that cheque #28, for delivery expense, was recorded in the Cash Disbursements Journal correctly as $4.900. The NSF cheque for $13,874 was that of customer Oprah Winney, deposited in March. . On the bank statement, the payment for $15,518 is regarding a note payable. . There is also a deposit of $113,000 dated April 30. It is an investment made by the owner into the business (the bank transferred the funds electronically from the owner's personal account to his business account which is why it was not recorded in the Cash Receipts Joumal). Required: a. Prepare a bank reconciliation for Stewart Recording Studio at April 30. STEWART RECORDING STUDIO Bank Reconciliation April 30, 2020 Bank Statement Company's Books Bank statement balance Add: Book balance Add: 0 Deduct: Outstanding cheques Deduct: Saved 0 0 Deduct: Outstanding cheques Deduct: 0 Adjusted bank balance 0 Adjusted book balance b. Prepare the necessary Journal entries to bring the General Ledger Cash account into agreement with the adjusted balance on the bank reconciliation View transaction list Journal entry worksheet 1 2 3 4 5 Save View transaction list x 1 Record to reinstate customer account. N Record the April bank service charges. 3 Record the April interest expense. 4 Record the April payment on note. 5 5 Record the investment by owner. Credit Note: journal entry has been entered Record entry Clear entry View general Journal