Answered step by step

Verified Expert Solution

Question

1 Approved Answer

STH pooled their resources and purchased an old abandoned warehouse on the outskirts of town. They saw the potential in transforming it into a

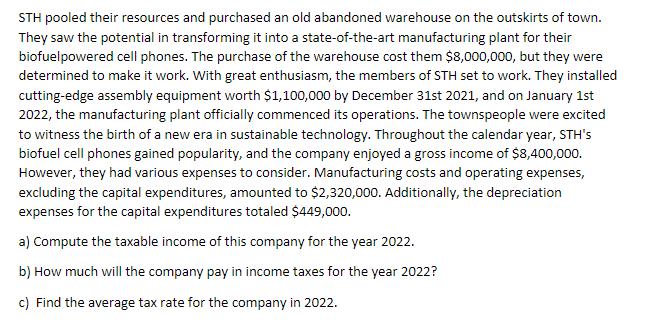

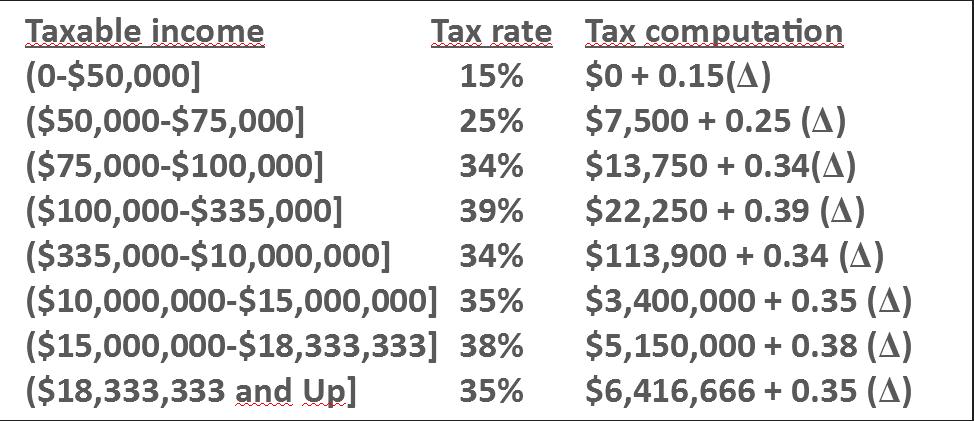

STH pooled their resources and purchased an old abandoned warehouse on the outskirts of town. They saw the potential in transforming it into a state-of-the-art manufacturing plant for their biofuelpowered cell phones. The purchase of the warehouse cost them $8,000,000, but they were determined to make it work. With great enthusiasm, the members of STH set to work. They installed cutting-edge assembly equipment worth $1,100,000 by December 31st 2021, and on January 1st 2022, the manufacturing plant officially commenced its operations. The townspeople were excited to witness the birth of a new era in sustainable technology. Throughout the calendar year, STH's biofuel cell phones gained popularity, and the company enjoyed a gross income of $8,400,000. However, they had various expenses to consider. Manufacturing costs and operating expenses, excluding the capital expenditures, amounted to $2,320,000. Additionally, the depreciation expenses for the capital expenditures totaled $449,000. a) Compute the taxable income of this company for the year 2022. b) How much will the company pay in income taxes for the year 2022? c) Find the average tax rate for the company in 2022.

Step by Step Solution

★★★★★

3.46 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started