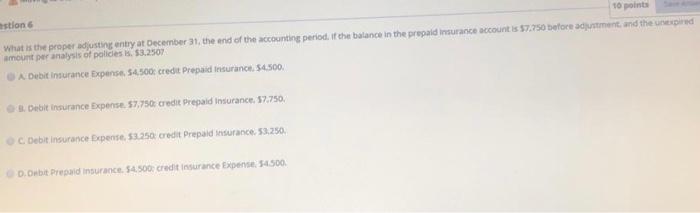

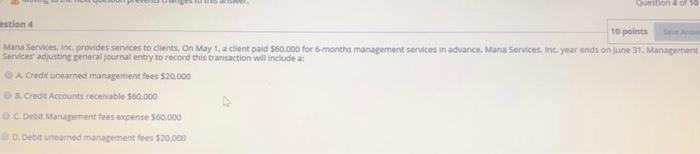

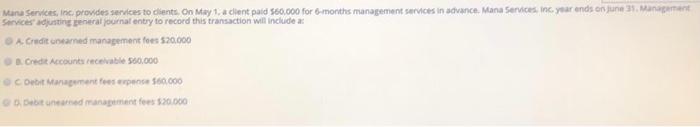

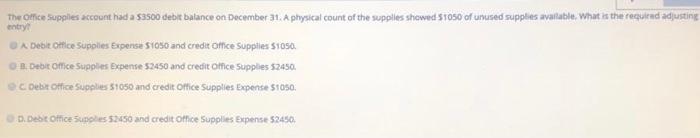

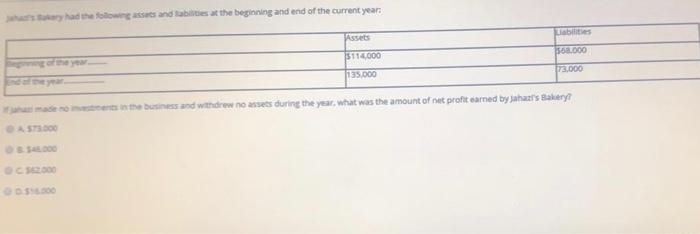

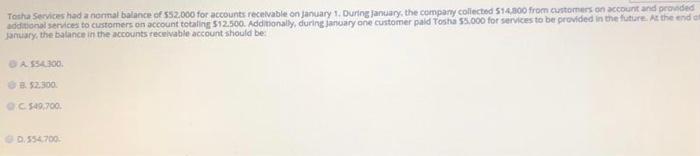

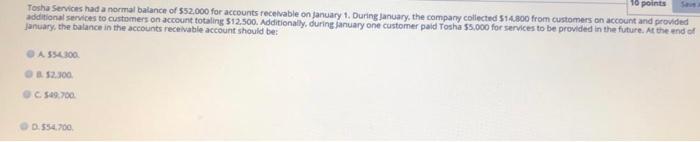

stion 10 points What is the proper adjusting entry at December 31. the end of the accounting period. If the balance in the prepaid insurance account is 57.750 before ment, and the need amount per analysis of policesi. 53.2507 A Debit Insurance Expense, 54,500 credit Prepaid Insurance $4.500 8. Debit insurance Expense. 57,750 credit Prepaid Imurance. 57.750, C Debit insurance Expense, 53250: credit Prepaid Insurance 53.250 Debit Prepaid insurance. 54.500: credit insurance Expense. 54500 wiono 10 stion 4 10 points Mars Services, Inc. provides services to clients. On May 1. client pald $60.000 for 6 months management services in advance, Mana Services, Inc year ends on jone 31. Management Services adjusting beneral journal entry to record this transaction will include: A Credit earned management fees $20,000 et Accounts receivable 560.000 Debit Management fees expense 560.000 3. Debit unearned management fees $20.000 Mana Services, Inc provides services to clients. On May 14 dient paid 360.000 for 6 months management services in advance. Mana Services, Inc. year ends on june 3 Management Services adjusting general Journal entry to record this transaction will include: Credit neamed management foes 520.000 Credit Accounts receivable 500.000 Debit Management fee 560.000 Debt und management fees 20.000 entry The Office Supplies account had a 3500 debit balance on December 31. A physical count of the supplies showed 51050 of unused supplies available. What is the required adjusting A Deble Office Supplies Expense S1050 and credit Office Supplies S1050 on Debit Office Supplies Expense 52450 and credit Office Supplies 52450. C. Debit Office Supplies 51050 and credit Office Supplies Expense 51050 D. Debt Office Supplies 52450 and credit Office Supplies Expense 52450. had the assets and tables at the beginning and end of the current year Assets Tbs BOOOO 311400O 13.000 135.000 made in the business and withdrew no assets during the year, what was the amount of net profit earned by ahal's Bay! 500 Toth Services had a normal balance of 552.000 for accounts receivable on January 1. During January, the company collected 514.800 from customers on account and prouded additional services to customers on account totaling $12.500. Additionally during January one customer paid fosha 55.000 for services to be provided in the future. At the end of January, the balance in the accounts receivable account should be LA 554300 B. $2,300 6.549,700 0.554 700 10 points Tosha Services had a normal balance of $52.000 for accounts receivable on january 1. During January, the company collected 514.800 from customers on account and provided additional services to customers on account totaling 512,500. Additionally, during January one customer paid Tosha 55.000 for services to be provided in the future. At the end of January, the balance in the accounts receivable account should be: DA 5540300 52.300 549.700 2.554.00