Question

Emily is employed as a finance manager and incurred the following expenses during the year 2020: (1) New laptop for office use $3,300 (2)

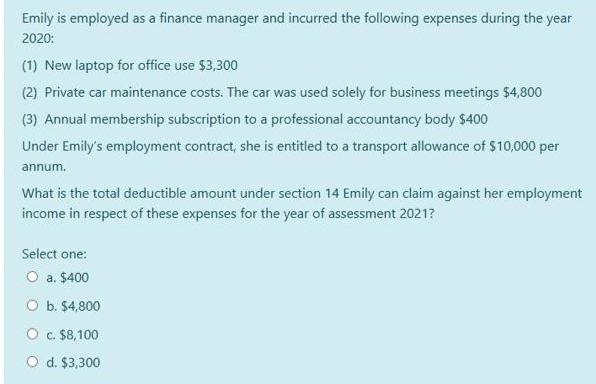

Emily is employed as a finance manager and incurred the following expenses during the year 2020: (1) New laptop for office use $3,300 (2) Private car maintenance costs. The car was used solely for business meetings $4,800 (3) Annual membership subscription to a professional accountancy body $400 Under Emily's employment contract, she is entitled to a transport allowance of $10,000 per annum. What is the total deductible amount under section 14 Emily can claim against her employment income in respect of these expenses for the year of assessment 2021? Select one: O a. $400 O b. $4.800 O c. $8,100 O d. $3,300

Step by Step Solution

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Answer c8100 33004800 These two relates to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

South Western Federal Taxation 2015

Authors: William H. Hoffman, William A. Raabe, David M. Maloney, James C. Young

38th Edition

978-1305310810, 1305310810, 978-1285439631

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App