Answered step by step

Verified Expert Solution

Question

1 Approved Answer

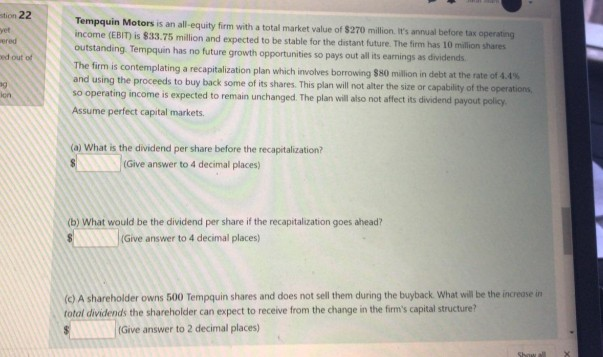

stion 22 wered bed out of Tempquin Motors is an all-equity firm with a total market value of $270 million. It's annual before tax operating

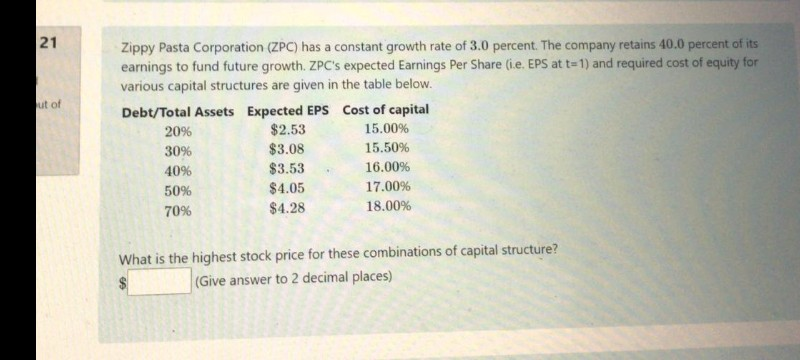

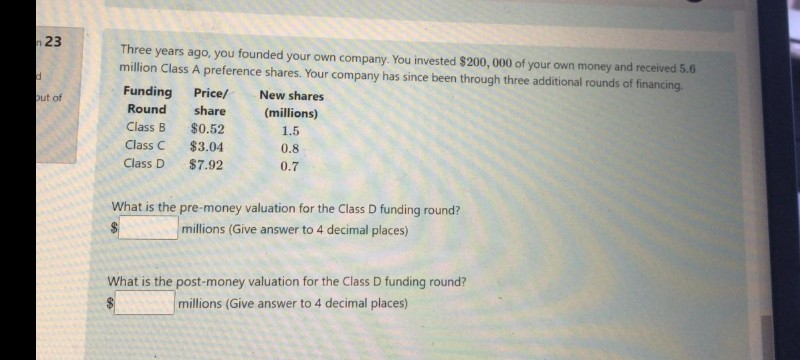

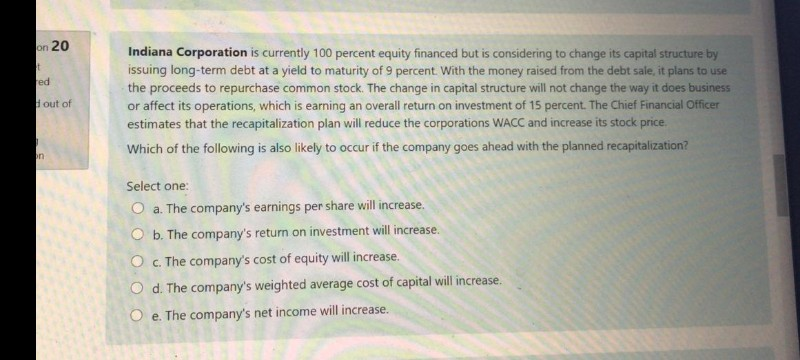

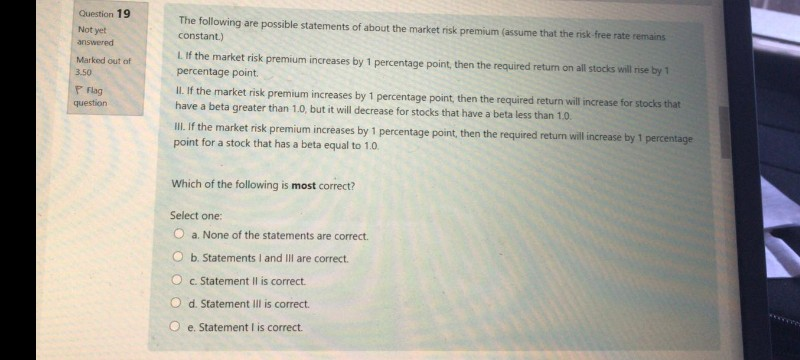

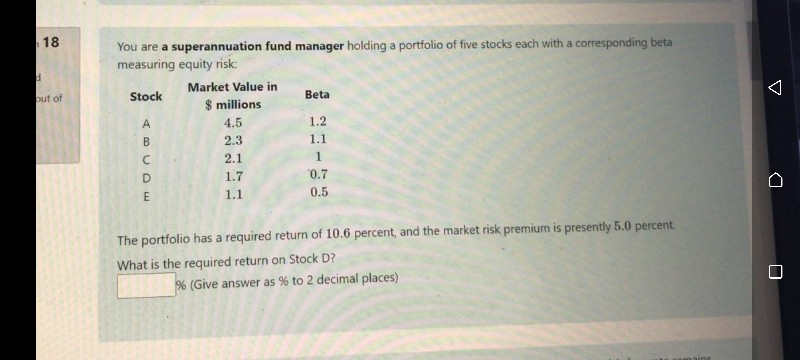

stion 22 wered bed out of Tempquin Motors is an all-equity firm with a total market value of $270 million. It's annual before tax operating income (EBIT) is $33.75 million and expected to be stable for the distant future. The firm has 10 million shares outstanding Tempquin has no future growth opportunities so pays out all its earnings as dividends The firm is contemplating a recapitalization plan which involves borrowing 880 million in debt at the rate of 4.4% and using the proceeds to buy back some of its shares. This plan will not alter the size or capability of the operations so operating income is expected to remain unchanged. The plan will also not affect its dividend payout policy Assume perfect capital markets, ag lon (a) What is the dividend per share before the recapitalization? (Give answer to 4 decimal places) (b) What would be the dividend per share if the recapitalization goes ahead? (Give answer to 4 decimal places) (0) A shareholder owns 500 Tempquin shares and does not sell them during the buyback. What will be the increase in total dividends the shareholder can expect to receive from the change in the firm's capital structure? (Give answer to 2 decimal places) Sh 21 ut of Zippy Pasta Corporation (ZPC) has a constant growth rate of 3.0 percent. The company retains 40.0 percent of its earnings to fund future growth. ZPC's expected Earnings Per Share (i.e. EPS at t=1) and required cost of equity for various capital structures are given in the table below. Debt/Total Assets Expected EPS Cost of capital 20% $2.53 15.00% 30% $3.08 15.50% 40% $3.53 16.00% 50% $4.05 17.00% 70% $4.28 18.00% What is the highest stock price for these combinations of capital structure? (Give answer to 2 decimal places) 23 but of Three years ago, you founded your own company. You invested $200,000 of your own money and received 5.6 million Class A preference shares. Your company has since been through three additional rounds of financing. Funding Price/ New shares Round share (millions) Class B $0.52 1.5 Class C $3.04 0.8 Class D $7.92 0.7 What is the pre-money valuation for the Class D funding round? millions (Give answer to 4 decimal places) What is the post-money valuation for the Class D funding round? millions (Give answer to 4 decimal places) on 20 red Hout of Indiana Corporation is currently 100 percent equity financed but is considering to change its capital structure by issuing long-term debt at a yield to maturity of 9 percent. With the money raised from the debt sale, it plans to use the proceeds to repurchase common stock. The change in capital structure will not change the way it does business or affect its operations, which is earning an overall return on investment of 15 percent. The Chief Financial Officer estimates that the recapitalization plan will reduce the corporations WACC and increase its stock price. Which of the following is also likely to occur if the company goes ahead with the planned recapitalization? on Select one: O a. The company's earnings per share will increase. O b. The company's return on investment will increase. O c The company's cost of equity will increase. O d. The company's weighted average cost of capital will increase. O e. The company's net income will increase. Question 19 Not yet answered Marked out of 3.50 Flag question The following are possible statements of about the market risk premium (assume that the risk-free rate remains constant.) L. If the market risk premium increases by 1 percentage point, then the required return on all stocks will rise by 1 percentage point IL. If the market risk premium increases by 1 percentage point, then the required return will increase for stocks that have a beta greater than 1.0, but it will decrease for stocks that have a beta less than 1.0. Ill. If the market risk premium increases by 1 percentage point, then the required return will increase by 1 percentage point for a stock that has a beta equal to 10. Which of the following is most correct? Select one: a. None of the statements are correct. O b. Statements I and Ill are correct. O c Statement il is correct d. Statement Ill is correct. e. Statement is correct. 18 but of You are a superannuation fund manager holding a portfolio of five stocks each with a corresponding beta measuring equity risk Market Value in Stock Beta $ millions A 4.5 1.2 B 2.3 1.1 C 2.1 D 1.7 0.7 E 1.1 0.5 1 The portfolio has a required return of 10.6 percent, and the market risk premium is presently 5.0 percent What is the required return on Stock D? % (Give answer as % to 2 decimal places) ]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started