Answered step by step

Verified Expert Solution

Question

1 Approved Answer

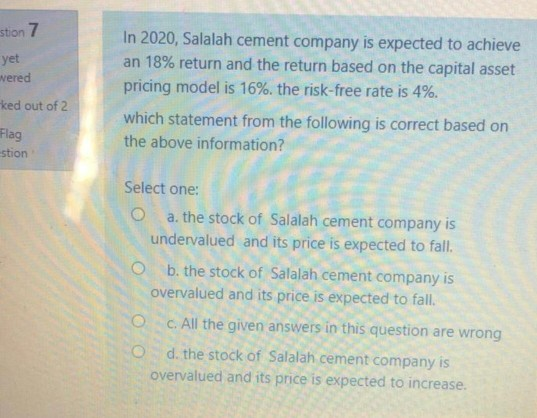

stion 7 yet wered In 2020, Salalah cement company is expected to achieve an 18% return and the return based on the capital asset pricing

stion 7 yet wered In 2020, Salalah cement company is expected to achieve an 18% return and the return based on the capital asset pricing model is 16%. the risk-free rate is 4%. which statement from the following is correct based on the above information? ked out of 2 Flag -stion Select one: a. the stock of Salalah cement company is undervalued and its price is expected to fall. b. the stock of Salalah cement company is overvalued and its price is expected to fall. c. All the given answers in this question are wrong d. the stock of Salalah cement company is overvalued and its price is expected to increase

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started