Answered step by step

Verified Expert Solution

Question

1 Approved Answer

stion list K Question 1 Question 2 Question 3 SR Toys started 2020 with no inventories. During the year, their expected and actual production

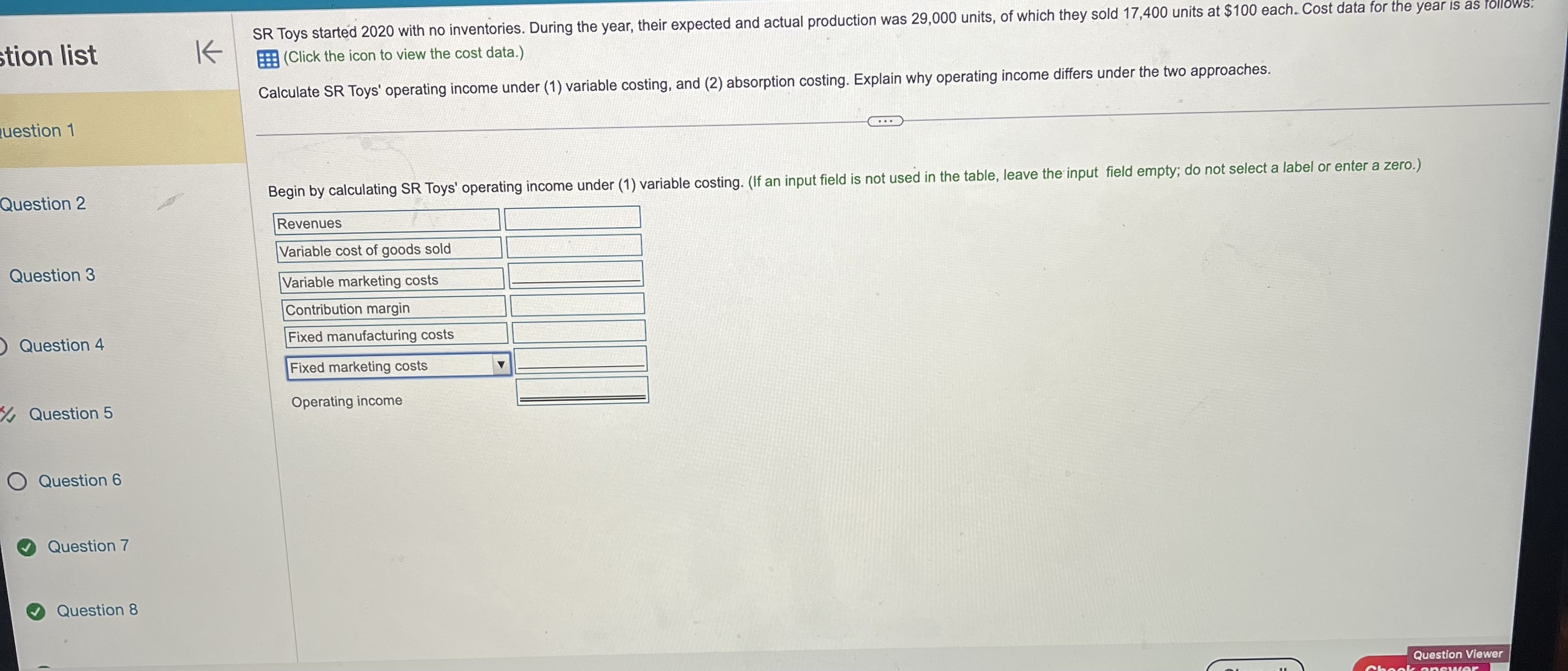

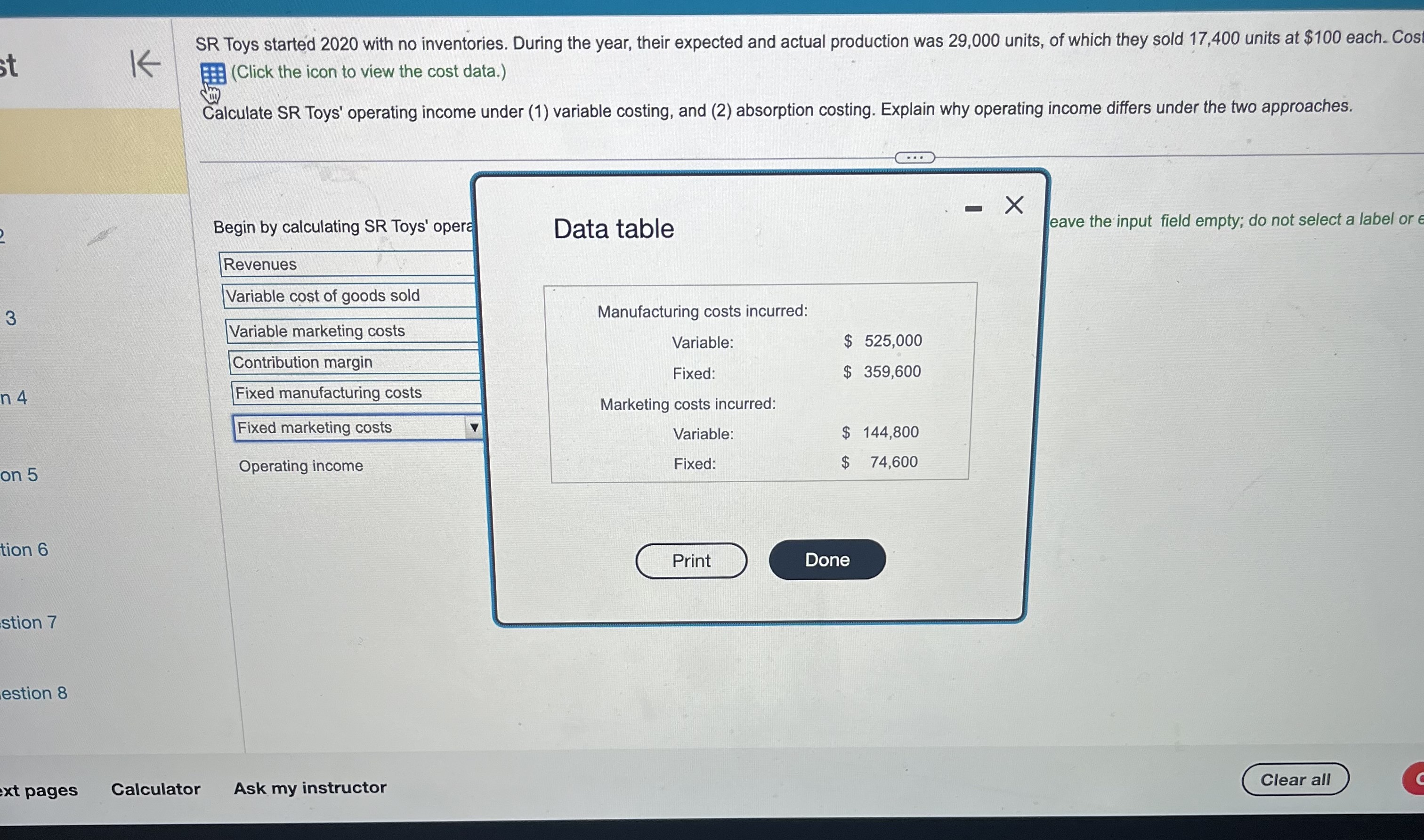

stion list K Question 1 Question 2 Question 3 SR Toys started 2020 with no inventories. During the year, their expected and actual production was 29,000 units, of which they sold 17,400 units at $100 each. Cost data for the year is as follows. (Click the icon to view the cost data.) Calculate SR Toys' operating income under (1) variable costing, and (2) absorption costing. Explain why operating income differs under the two approaches. Begin by calculating SR Toys' operating income under (1) variable costing. (If an input field is not used in the table, leave the input field empty; do not select a label or enter a zero.) Revenues Variable cost of goods sold Variable marketing costs Contribution margin Question 4 Question 5 Fixed manufacturing costs Fixed marketing costs Operating income Question 6 Question 7 Question 8 Question Viewer Whook answer st K SR Toys started 2020 with no inventories. During the year, their expected and actual production was 29,000 units, of which they sold 17,400 units at $100 each. Cost (Click the icon to view the cost data.) Calculate SR Toys' operating income under (1) variable costing, and (2) absorption costing. Explain why operating income differs under the two approaches. Begin by calculating SR Toys' opera Data table 2 3 n 4 on 5 Revenues Variable cost of goods sold Variable marketing costs Contribution margin Fixed manufacturing costs Fixed marketing costs Operating income tion 6 stion 7 estion 8 ext pages Calculator Ask my instructor Manufacturing costs incurred: Variable: $ 525,000 Fixed: $ 359,600 Marketing costs incurred: Variable: Fixed: $ 144,800 $ 74,600 Print Done - eave the input field empty; do not select a label or e Clear all

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started