Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Stochastic methods in applied finance Bosco has an investment portfolio comprised of shares in three companies: Abacus, Baracus and Cerberus. (A, B and C for

Stochastic methods in applied finance

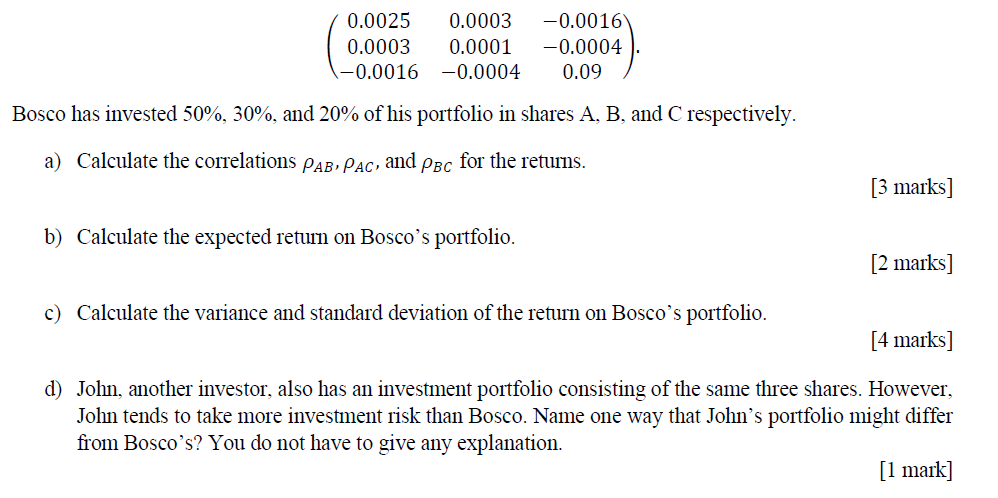

Bosco has an investment portfolio comprised of shares in three companies: Abacus, Baracus and Cerberus. (A, B and C for short). The returns for shares A, B, and C have expected values 5%, 4% and 8% respectively. The covariance matrix for these returns is:

0.0025 0.0003 -0.0016 0.0003 0.0001 -0.0004 -0.0016 -0.0004 0.09 Bosco has invested 50%, 30%, and 20% of his portfolio in shares A, B, and respectively. a) Calculate the correlations PAB, PAC, and Plc for the returns. [3 marks] b) Calculate the expected return on Bosco's portfolio. [2 marks] c) Calculate the variance and standard deviation of the return on Bosco's portfolio. [4 marks] d) John, another investor, also has an investment portfolio consisting of the same three shares. However, John tends to take more investment risk than Bosco. Name one way that John's portfolio might differ from Bosco's? You do not have to give any explanation. [1 mark] 0.0025 0.0003 -0.0016 0.0003 0.0001 -0.0004 -0.0016 -0.0004 0.09 Bosco has invested 50%, 30%, and 20% of his portfolio in shares A, B, and respectively. a) Calculate the correlations PAB, PAC, and Plc for the returns. [3 marks] b) Calculate the expected return on Bosco's portfolio. [2 marks] c) Calculate the variance and standard deviation of the return on Bosco's portfolio. [4 marks] d) John, another investor, also has an investment portfolio consisting of the same three shares. However, John tends to take more investment risk than Bosco. Name one way that John's portfolio might differ from Bosco's? You do not have to give any explanation. [1 mark]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started