Answered step by step

Verified Expert Solution

Question

1 Approved Answer

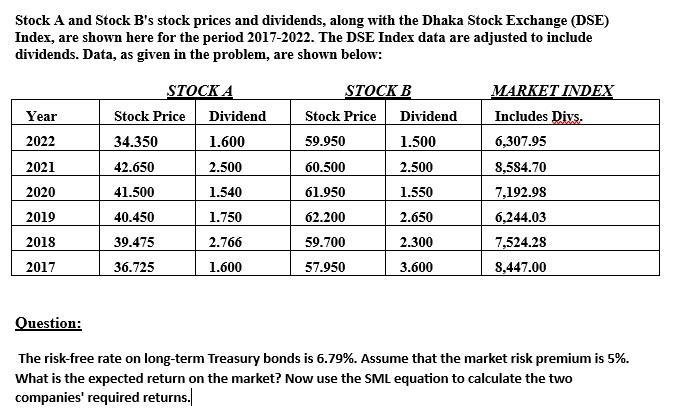

Stock A and Stock B's stock prices and dividends, along with the Dhaka Stock Exchange (DSE) Index, are shown here for the period 2017-2022.

|

Stock A and Stock B's stock prices and dividends, along with the Dhaka Stock Exchange (DSE) Index, are shown here for the period 2017-2022. The DSE Index data are adjusted to include dividends. Data, as given in the problem, are shown below: Year 2022 2021 2020 2019 2018 2017 STOCK A Stock Price Dividend 34.350 1.600 42.650 2.500 41.500 1.540 40.450 1.750 39.475 2.766 36.725 1.600 STOCK B Stock Price 59.950 60.500 61.950 62.200 59.700 57.950 Dividend 1.500 2.500 1.550 2.650 2.300 3.600 MARKET INDEX Includes Divs. 6,307.95 8,584.70 7,192.98 6,244.03 7,524.28 8,447.00 Question: The risk-free rate on long-term Treasury bonds is 6.79%. Assume that the market risk premium is 5%. What is the expected return on the market? Now use the SML equation to calculate the two companies' required returns.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution To calculate the expected return on the market we can use the Capital Asset Pricin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started