Answered step by step

Verified Expert Solution

Question

1 Approved Answer

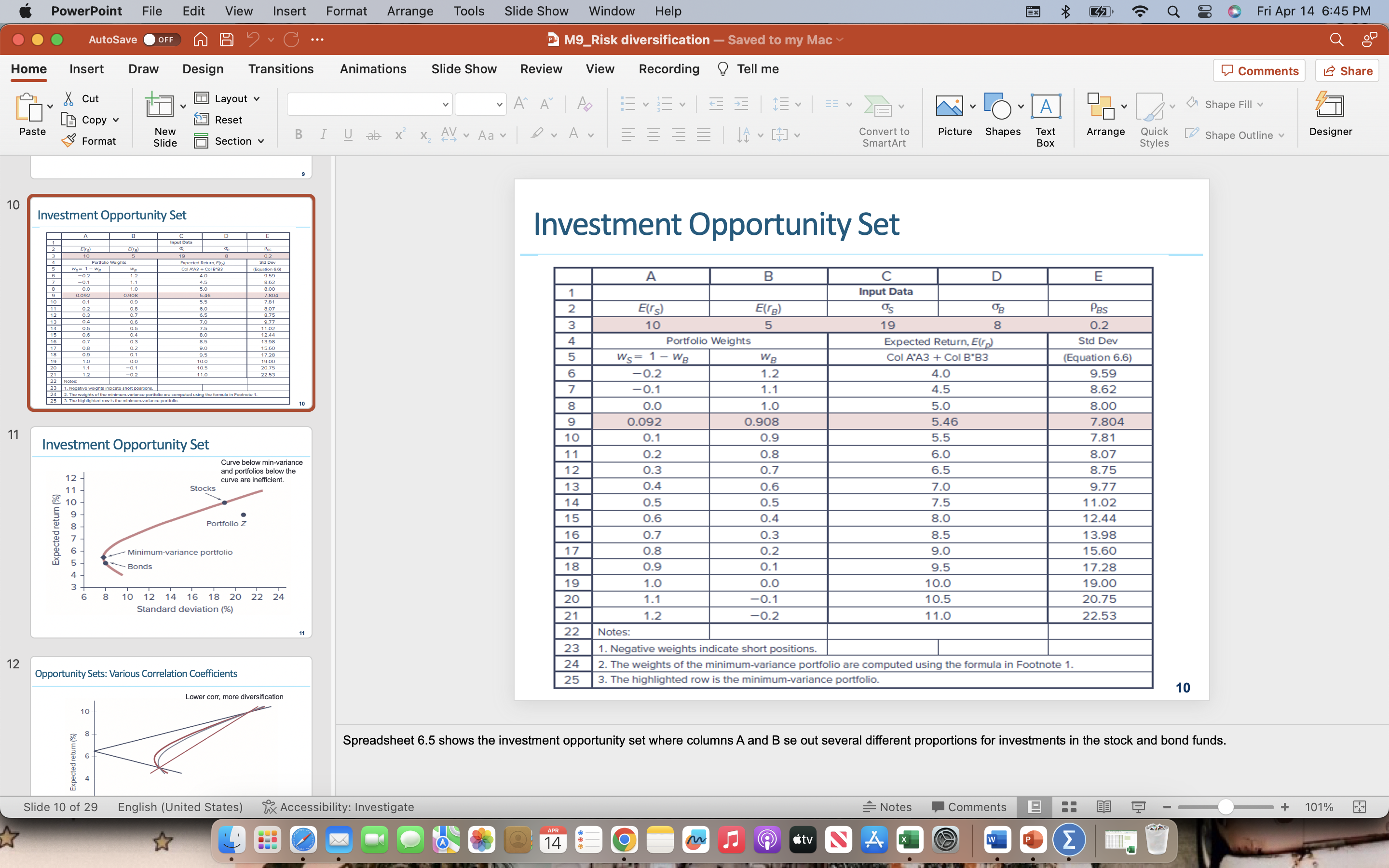

Stock A has expected return of 10%, a standard deviation of 19%, Stock B has expected return of 5%, a standard deviation of 8%. They

Stock A has expected return of 10%, a standard deviation of 19%, Stock B has expected return of 5%, a standard deviation of 8%. They have a correlation of -0.5. Following page 10 in M9 lecture notes, plot the efficient frontier formed by the two stocks. You must report the process, e.g., expected returns and risk of the portfolio for each weight set.

help me answer this question

Investment Opportunity Set Investment Opportunitv Set Opportunity Sets: Various Correlation Coefficients 10 Spreadsheet 6.5 shows the investment opportunity set where columns A and B se out several different proportions for investments in the stock and bond funds

Investment Opportunity Set Investment Opportunitv Set Opportunity Sets: Various Correlation Coefficients 10 Spreadsheet 6.5 shows the investment opportunity set where columns A and B se out several different proportions for investments in the stock and bond funds Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started