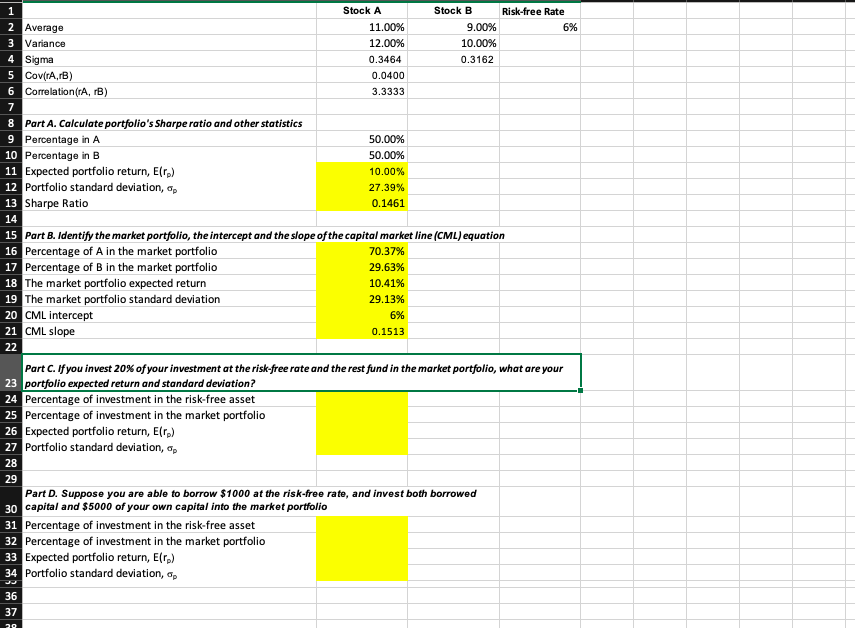

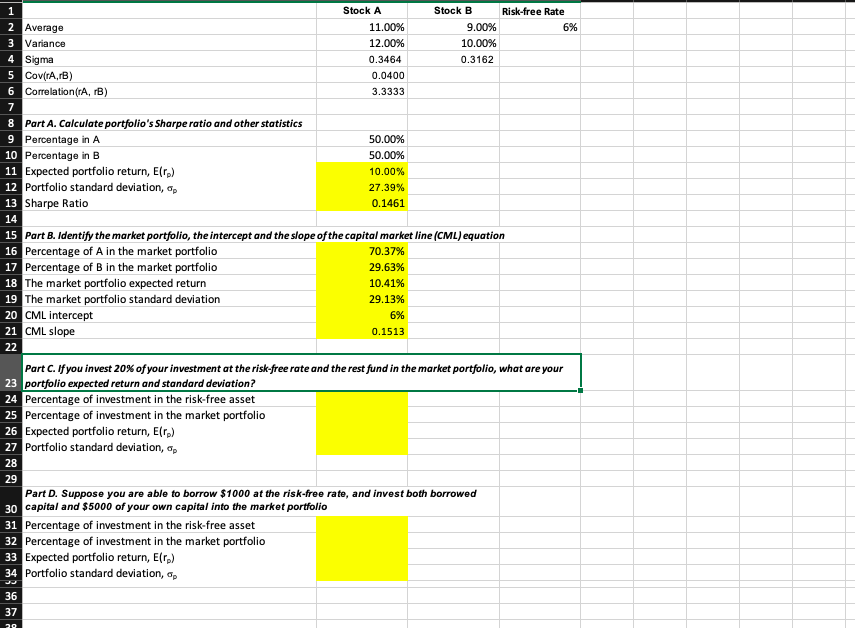

Stock A Stock B Risk-free Rate 1 2 Average 11.00% 9.00% 3 Variance 12.00% 10.00% 4 Sigma 0.3464 0.3162 5 Cov(rA,rB) 0.0400 6 Correlation (rA, rB) 3.3333 7 8 Part A. Calculate portfolio's Sharpe ratio and other statistics 9 Percentage in A 50.00% 10 Percentage in B 50.00% 11 Expected portfolio return, E(r.) 10.00% 12 Portfolio standard deviation, 27.39% 13 Sharpe Ratio 0.1461 14 15 Part B. Identify the market portfolio, the intercept and the slope of the capital market line (CML) equation 16 Percentage of A in the market portfolio 70.37% 17 Percentage of B in the market portfolio 29.63% 18 The market portfolio expected return 10.41% 19 The market portfolio standard deviation 29.13% 20 CML intercept 6% 21 CML slope 0.1513 22 Part C. If you invest 20% of your investment at the risk-free rate and the rest fund in the market portfolio, what are your 23 portfolio expected return and standard deviation? 24 Percentage of investment in the risk-free asset 25 Percentage of investment in the market portfolio 26 Expected portfolio return, E(r.) 27 Portfolio standard deviation, 28 29 Part D. Suppose you are able to borrow $1000 at the risk-free rate, and invest both borrowed 30 capital and $5000 of your own capital into the market portfolio 31 Percentage of investment in the risk-free asset 32 Percentage of investment in the market portfolio 33 Expected portfolio return, E(r) 34 Portfolio standard deviation, ap 36 37 20 6% Stock A Stock B Risk-free Rate 1 2 Average 11.00% 9.00% 3 Variance 12.00% 10.00% 4 Sigma 0.3464 0.3162 5 Cov(rA,rB) 0.0400 6 Correlation (rA, rB) 3.3333 7 8 Part A. Calculate portfolio's Sharpe ratio and other statistics 9 Percentage in A 50.00% 10 Percentage in B 50.00% 11 Expected portfolio return, E(r.) 10.00% 12 Portfolio standard deviation, 27.39% 13 Sharpe Ratio 0.1461 14 15 Part B. Identify the market portfolio, the intercept and the slope of the capital market line (CML) equation 16 Percentage of A in the market portfolio 70.37% 17 Percentage of B in the market portfolio 29.63% 18 The market portfolio expected return 10.41% 19 The market portfolio standard deviation 29.13% 20 CML intercept 6% 21 CML slope 0.1513 22 Part C. If you invest 20% of your investment at the risk-free rate and the rest fund in the market portfolio, what are your 23 portfolio expected return and standard deviation? 24 Percentage of investment in the risk-free asset 25 Percentage of investment in the market portfolio 26 Expected portfolio return, E(r.) 27 Portfolio standard deviation, 28 29 Part D. Suppose you are able to borrow $1000 at the risk-free rate, and invest both borrowed 30 capital and $5000 of your own capital into the market portfolio 31 Percentage of investment in the risk-free asset 32 Percentage of investment in the market portfolio 33 Expected portfolio return, E(r) 34 Portfolio standard deviation, ap 36 37 20 6%