Question

Stock in Bear's Big Bonanza has a beta of 1.15. The expected return on the market is 12 percent; and T-bills are currently yielding

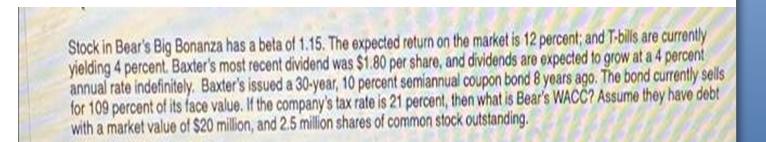

Stock in Bear's Big Bonanza has a beta of 1.15. The expected return on the market is 12 percent; and T-bills are currently yielding 4 percent. Baxter's most recent dividend was $1.80 per share, and dividends are expected to grow at a 4 percent annual rate indefinitely. Baxter's issued a 30-year, 10 percent semiannual coupon bond 8 years ago. The bond currently sells for 109 percent of its face value. If the company's tax rate is 21 percent, then what is Bear's WACC? Assume they have debt with a market value of $20 million, and 2.5 million shares of common stock outstanding.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

First we need to calculate the cost of equity using the CAPM Ke Rf Rm Rf Ke 004 115012 004 Ke 0112 N...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals Of Corporate Finance

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan

13th Edition

1265553602, 978-1265553609

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App