Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Stock markets fluctuate every day. Some stocks increase in value, some decrease, and portfolios increase and decrease in value based on the owner's investments.

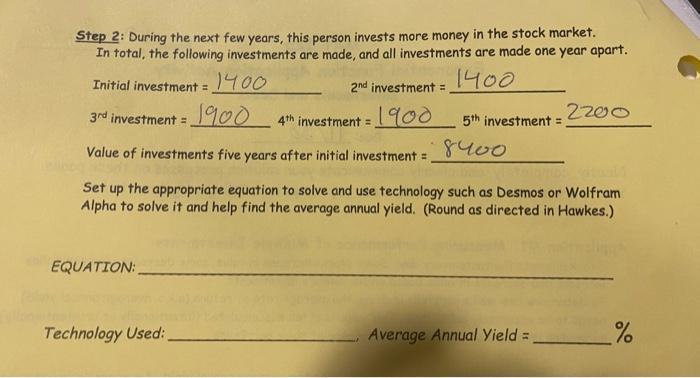

Stock markets fluctuate every day. Some stocks increase in value, some decrease, and portfolios increase and decrease in value based on the owner's investments. To determine how well a portfolio is doing, the average rate of return (a.k.a. average annual yield) needs to be accurately calculated. This value is often miscalculated (intentionally or unintentionally), misleading investors of the actual performance of their portfolios. In this problem, you will be accurately calculating the average annual yield of a person's investments. Step 1: A person made the following investments in the stock market, and wants to know the true average annual yield of these investments. The two investments were made exactly one year apart. 2nd investment 1400 $2604 Initial investment = 14 00 Value of investments two years after initial investment = Use algebra to set up and solve the appropriate equation to find the average annual yield of these investments. (Round as directed in Hawkes.) Step 2: During the next few years, this person invests more money in the stock market. In total, the following investments are made, and all investments are made one year apart. 1400 2nd investment = 1400 Initial investment = 1900 1900 2z00 3rd investment = 4th investment = 5th investment = Value of investments five years after initial investment = 8400 Set up the appropriate equation to solve and use technology such as Desmos or Wolfram Alpha to solve it and help find the average annual yield. (Round as directed in Hawkes.) EQUATION: Technology Used: Average Annual Yield =

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 The average yield on an investment or a portfolio is the sum of all interest divide...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started