Stock Valuation and Bond Issuance

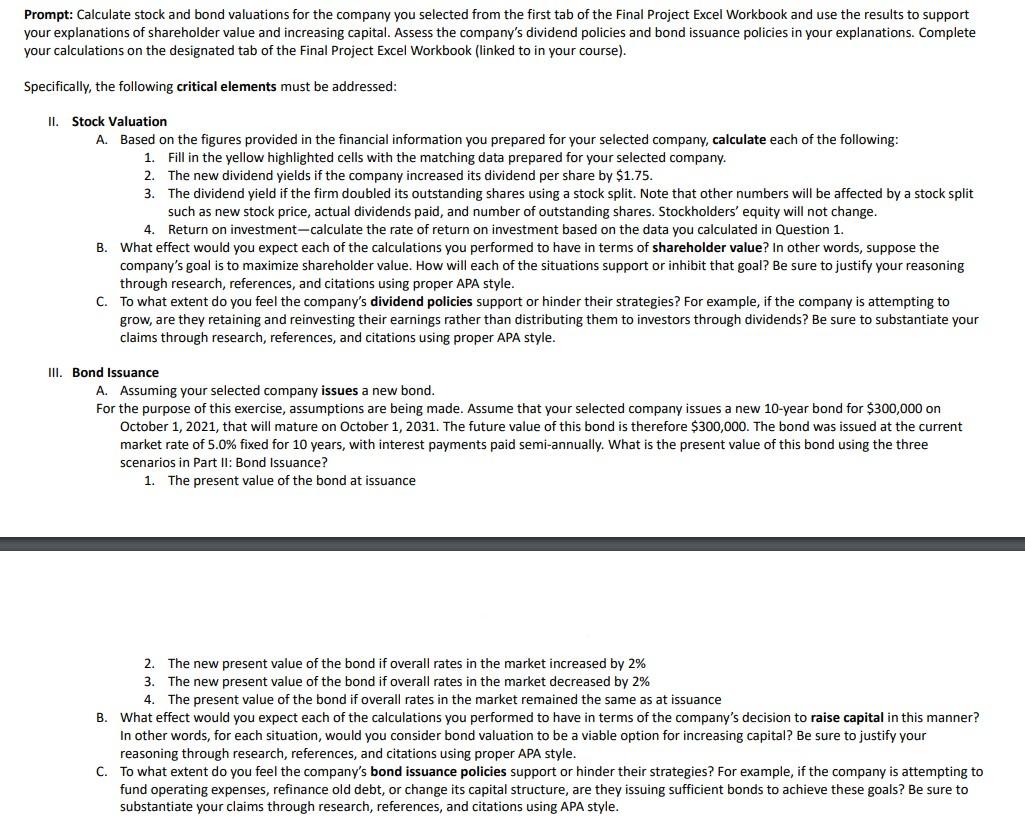

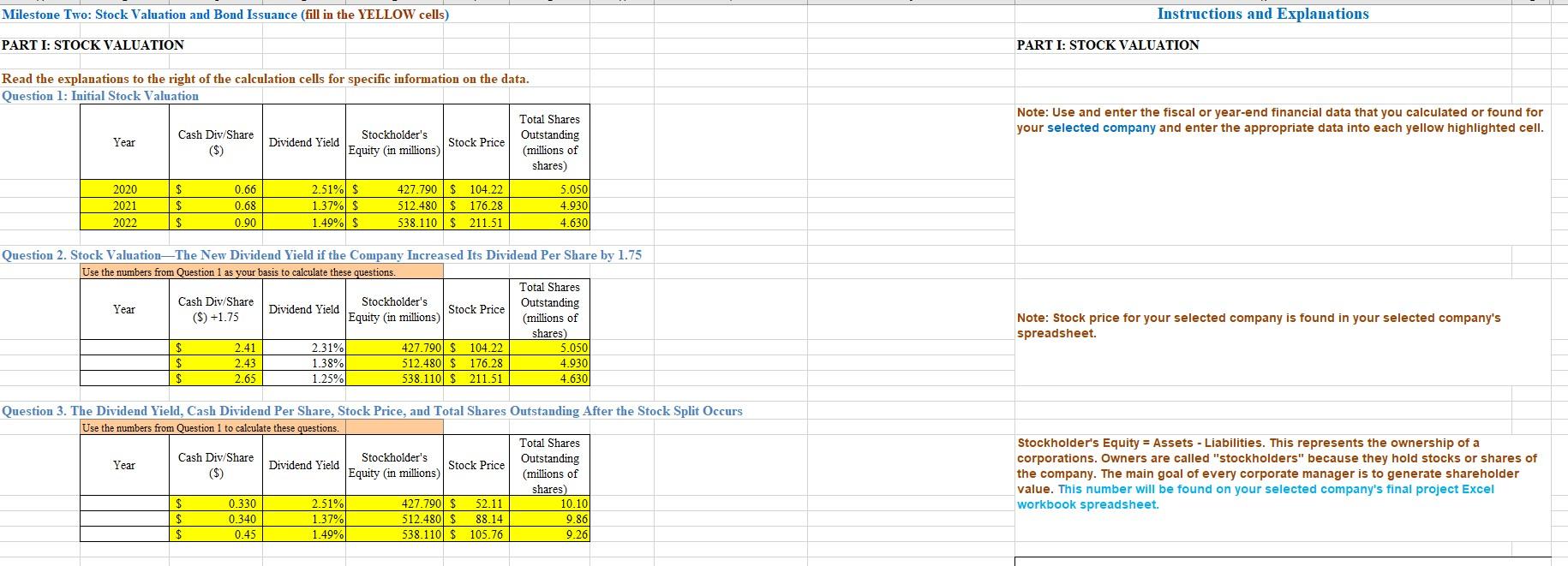

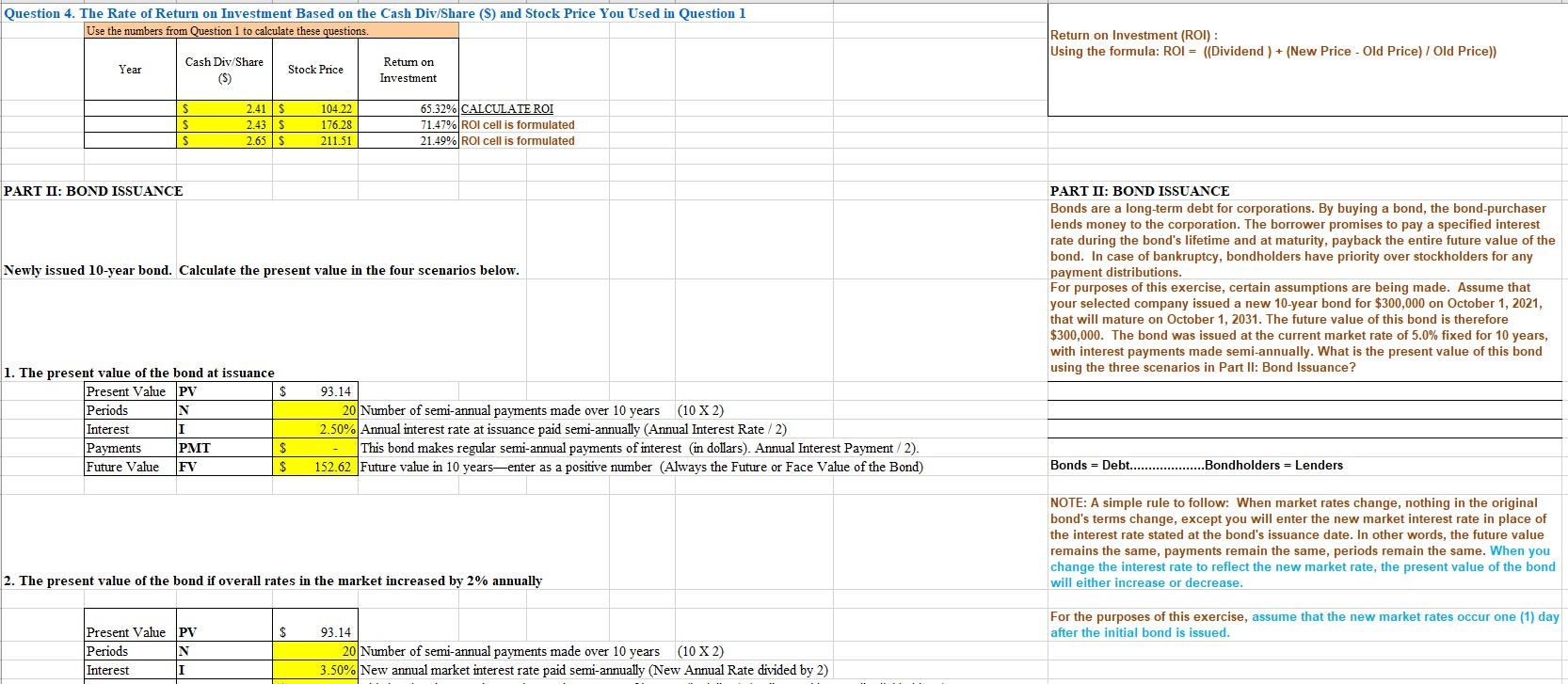

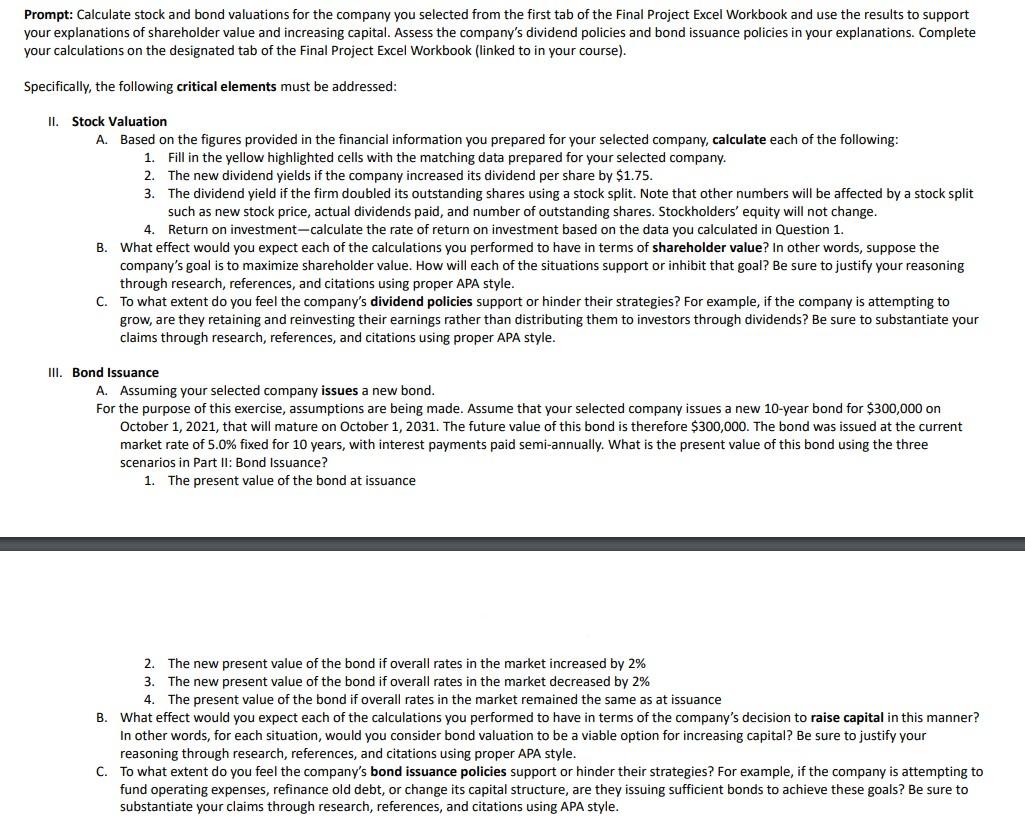

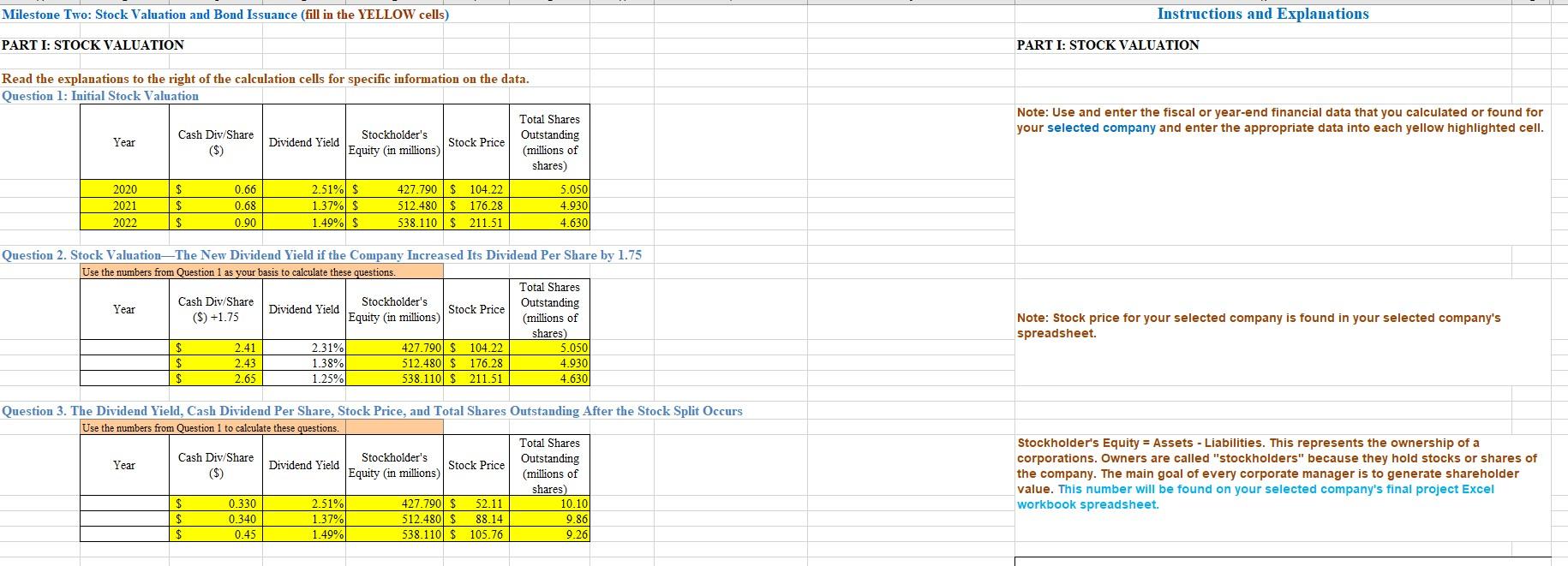

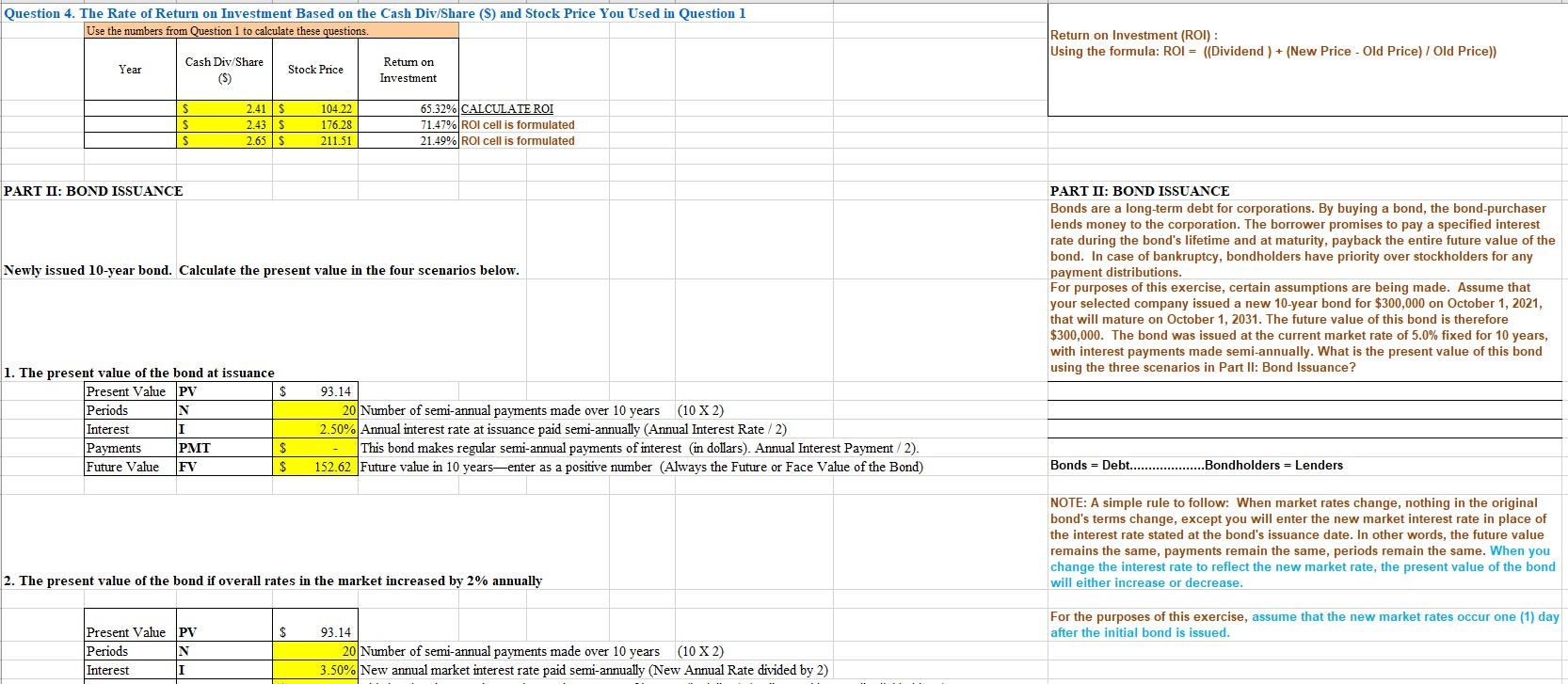

Prompt: Calculate stock and bond valuations for the company you selected from the first tab of the Final Project Excel Workbook and use the results to support your explanations of shareholder value and increasing capital. Assess the company's dividend policies and bond issuance policies in your explanations. Complete your calculations on the designated tab of the Final Project Excel Workbook (linked to in your course). Specifically, the following critical elements must be addressed: II. Stock Valuation A. Based on the figures provided in the financial information you prepared for your selected company, calculate each of the following: 1. Fill in the yellow highlighted cells with the matching data prepared for your selected company. 2. The new dividend yields if the company increased its dividend per share by $1.75. 3. The dividend yield if the firm doubled its outstanding shares using a stock split. Note that other numbers will be affected by a stock split such as new stock price, actual dividends paid, and number of outstanding shares. Stockholders' equity will not change. 4. Return on investment-calculate the rate of return on investment based on the data you calculated in Question 1 . B. What effect would you expect each of the calculations you performed to have in terms of shareholder value? In other words, suppose the company's goal is to maximize shareholder value. How will each of the situations support or inhibit that goal? Be sure to justify your reasoning through research, references, and citations using proper APA style. C. To what extent do you feel the company's dividend policies support or hinder their strategies? For example, if the company is attempting to grow, are they retaining and reinvesting their earnings rather than distributing them to investors through dividends? Be sure to substantiate your claims through research, references, and citations using proper APA style. III. Bond Issuance A. Assuming your selected company issues a new bond. For the purpose of this exercise, assumptions are being made. Assume that your selected company issues a new 10 -year bond for $300,000 on October 1,2021 , that will mature on October 1,2031 . The future value of this bond is therefore $300,000. The bond was issued at the current market rate of 5.0% fixed for 10 years, with interest payments paid semi-annually. What is the present value of this bond using the three scenarios in Part II: Bond Issuance? 1. The present value of the bond at issuance 2. The new present value of the bond if overall rates in the market increased by 2% 3. The new present value of the bond if overall rates in the market decreased by 2% 4. The present value of the bond if overall rates in the market remained the same as at issuance B. What effect would you expect each of the calculations you performed to have in terms of the company's decision to raise capital in this manner? In other words, for each situation, would you consider bond valuation to be a viable option for increasing capital? Be sure to justify your reasoning through research, references, and citations using proper APA style. C. To what extent do you feel the company's bond issuance policies support or hinder their strategies? For example, if the company is attempting to fund operating expenses, refinance old debt, or change its capital structure, are they issuing sufficient bonds to achieve these goals? Be sure to substantiate your claims through research, references, and citations using APA style. Mil PA] Re: I ] 2 Prompt: Calculate stock and bond valuations for the company you selected from the first tab of the Final Project Excel Workbook and use the results to support your explanations of shareholder value and increasing capital. Assess the company's dividend policies and bond issuance policies in your explanations. Complete your calculations on the designated tab of the Final Project Excel Workbook (linked to in your course). Specifically, the following critical elements must be addressed: II. Stock Valuation A. Based on the figures provided in the financial information you prepared for your selected company, calculate each of the following: 1. Fill in the yellow highlighted cells with the matching data prepared for your selected company. 2. The new dividend yields if the company increased its dividend per share by $1.75. 3. The dividend yield if the firm doubled its outstanding shares using a stock split. Note that other numbers will be affected by a stock split such as new stock price, actual dividends paid, and number of outstanding shares. Stockholders' equity will not change. 4. Return on investment-calculate the rate of return on investment based on the data you calculated in Question 1 . B. What effect would you expect each of the calculations you performed to have in terms of shareholder value? In other words, suppose the company's goal is to maximize shareholder value. How will each of the situations support or inhibit that goal? Be sure to justify your reasoning through research, references, and citations using proper APA style. C. To what extent do you feel the company's dividend policies support or hinder their strategies? For example, if the company is attempting to grow, are they retaining and reinvesting their earnings rather than distributing them to investors through dividends? Be sure to substantiate your claims through research, references, and citations using proper APA style. III. Bond Issuance A. Assuming your selected company issues a new bond. For the purpose of this exercise, assumptions are being made. Assume that your selected company issues a new 10 -year bond for $300,000 on October 1,2021 , that will mature on October 1,2031 . The future value of this bond is therefore $300,000. The bond was issued at the current market rate of 5.0% fixed for 10 years, with interest payments paid semi-annually. What is the present value of this bond using the three scenarios in Part II: Bond Issuance? 1. The present value of the bond at issuance 2. The new present value of the bond if overall rates in the market increased by 2% 3. The new present value of the bond if overall rates in the market decreased by 2% 4. The present value of the bond if overall rates in the market remained the same as at issuance B. What effect would you expect each of the calculations you performed to have in terms of the company's decision to raise capital in this manner? In other words, for each situation, would you consider bond valuation to be a viable option for increasing capital? Be sure to justify your reasoning through research, references, and citations using proper APA style. C. To what extent do you feel the company's bond issuance policies support or hinder their strategies? For example, if the company is attempting to fund operating expenses, refinance old debt, or change its capital structure, are they issuing sufficient bonds to achieve these goals? Be sure to substantiate your claims through research, references, and citations using APA style. Mil PA] Re: I ] 2