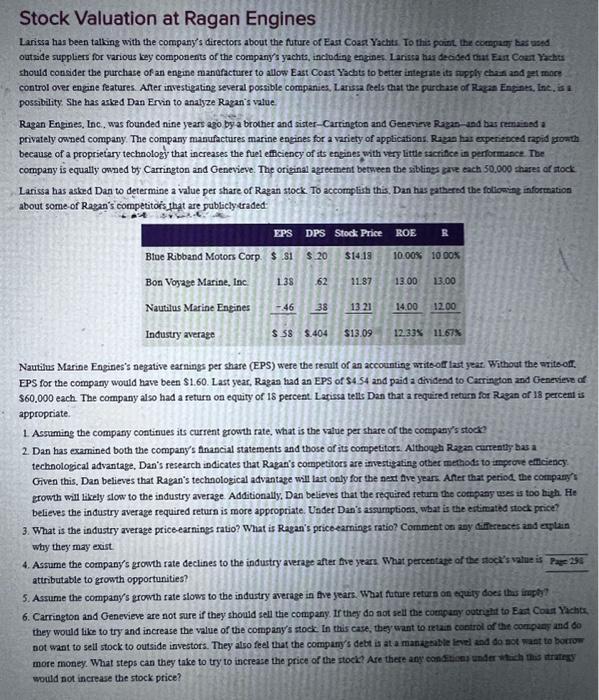

Stock Valuation at Ragan Engines Larissa has been talking with the company's directors about the futare of Eart Coast Yachts. To this point, the compant bar used outside suppliers for various bey components of the company's yachts, incioding engines. Lansca has deaised cut East Coant Yackts should consider the purchase of an enpine manafacturer to allow East Coast Yachts to better integrate ita rupghy chazn and get ronce control over engine features. After investigating several possible companies, Larissa feels that the purchate of Rasas Engints, Int, is 1 . possibility. She has arked Dan Ervin to analyze Ragan's value. Ragan Engines, Inc., was founded nine years ago by a brother and sister-Carringtod and Generieve Ragan-and bas remained a privately owned company. The company manufactures marine engines for a variety of applications, Ragan has experiebced rapid gibath because of a proprietary technology that increases the fuel efficiency of its engines with very little aacriffce in performance. Toe company is equally omned by Carrington and Genevieve. The original agreement between the siblings grve each 50.000 thares of tock: Lanissa has asked Dan to determine a value per share of Ragan stock. To accomplist this, Dan has pathered the following information about some of Ragan's competitors that are publicly traded: Nautihs Marine Engines's negative earnings per share (EPS) were the result of an accounting write-off last yeat Without the write-off. EPS for the company would have been \$1.60. Last year, Ragan had an EPS of \$4.54 and paid a dividend to Carrington and Generieve of $60.000 each. The company also had a return on equity of 18 percent. Larissa tells Dan that a reguired return for Ragan of 18 percent is appropriate. 1. Acsuming the company continues its current growth rate, what is the value per share of the conapany's stocke 2. Dan has examined both the company's flnancial statements and those of its competitors. Althouah Ragan curtent? bas a technological advantage, Dan's research indicates that Ragan's competitors are invertigating othet methods to inpeove eftciency: Given this, Dan believes that Ragan's technological advantage will last only for the nat dve years. Anter that petiod. the conpaer's growth will likely slow to the industry average. Additionally, Dan believes that the required return the company ues is too high. He believes the industry average required return is more appropriate. Under Dan's assumptions, what is the eitimated stock price? 3. What is the industry average price-earnings ratio? What is Ragan's priceeamings ratio? Cornment on any differences and eytain why they may exist. 4. Assume the company's growth rate declines to the industry average after fve years. What percentage of the rtock's vahie is Par 295 attributable to growth opportunities? 5. Assume the company's growth rate slows to the industry average in flve jears. What fature returs on equity does thas irvphi? 6. Carrington and Genevieve are not sure if they should sell the conpany. If they do not sell the coengany ootriaht to Eact Coust Yachts. they would like to try and increase the value of the company/s stock. In tais case, they want to retais coctrol of the compary and 6o not want to sell stock to outside investors. They atso feel that the company's debt is at a managbibie invel and do aot hast to botror more money. What steps can they take to try to increase the price of the stock? Are there any constives waler whach thas thatrsy woutd not increase the stock price? Stock Valuation at Ragan Engines Larissa has been talking with the company's directors about the futare of Eart Coast Yachts. To this point, the compant bar used outside suppliers for various bey components of the company's yachts, incioding engines. Lansca has deaised cut East Coant Yackts should consider the purchase of an enpine manafacturer to allow East Coast Yachts to better integrate ita rupghy chazn and get ronce control over engine features. After investigating several possible companies, Larissa feels that the purchate of Rasas Engints, Int, is 1 . possibility. She has arked Dan Ervin to analyze Ragan's value. Ragan Engines, Inc., was founded nine years ago by a brother and sister-Carringtod and Generieve Ragan-and bas remained a privately owned company. The company manufactures marine engines for a variety of applications, Ragan has experiebced rapid gibath because of a proprietary technology that increases the fuel efficiency of its engines with very little aacriffce in performance. Toe company is equally omned by Carrington and Genevieve. The original agreement between the siblings grve each 50.000 thares of tock: Lanissa has asked Dan to determine a value per share of Ragan stock. To accomplist this, Dan has pathered the following information about some of Ragan's competitors that are publicly traded: Nautihs Marine Engines's negative earnings per share (EPS) were the result of an accounting write-off last yeat Without the write-off. EPS for the company would have been \$1.60. Last year, Ragan had an EPS of \$4.54 and paid a dividend to Carrington and Generieve of $60.000 each. The company also had a return on equity of 18 percent. Larissa tells Dan that a reguired return for Ragan of 18 percent is appropriate. 1. Acsuming the company continues its current growth rate, what is the value per share of the conapany's stocke 2. Dan has examined both the company's flnancial statements and those of its competitors. Althouah Ragan curtent? bas a technological advantage, Dan's research indicates that Ragan's competitors are invertigating othet methods to inpeove eftciency: Given this, Dan believes that Ragan's technological advantage will last only for the nat dve years. Anter that petiod. the conpaer's growth will likely slow to the industry average. Additionally, Dan believes that the required return the company ues is too high. He believes the industry average required return is more appropriate. Under Dan's assumptions, what is the eitimated stock price? 3. What is the industry average price-earnings ratio? What is Ragan's priceeamings ratio? Cornment on any differences and eytain why they may exist. 4. Assume the company's growth rate declines to the industry average after fve years. What percentage of the rtock's vahie is Par 295 attributable to growth opportunities? 5. Assume the company's growth rate slows to the industry average in flve jears. What fature returs on equity does thas irvphi? 6. Carrington and Genevieve are not sure if they should sell the conpany. If they do not sell the coengany ootriaht to Eact Coust Yachts. they would like to try and increase the value of the company/s stock. In tais case, they want to retais coctrol of the compary and 6o not want to sell stock to outside investors. They atso feel that the company's debt is at a managbibie invel and do aot hast to botror more money. What steps can they take to try to increase the price of the stock? Are there any constives waler whach thas thatrsy woutd not increase the stock price