Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Stock XXX is currently trading at So= 100 and the price is widely expected to fall. The put option prices therefore start to build

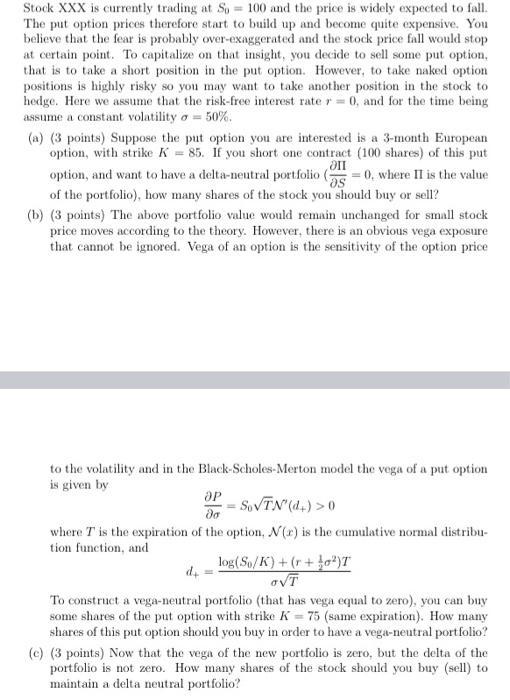

Stock XXX is currently trading at So= 100 and the price is widely expected to fall. The put option prices therefore start to build up and become quite expensive. You believe that the fear is probably over-exaggerated and the stock price fall would stop at certain point. To capitalize on that insight, you decide to sell some put option, that is to take a short position in the put option. However, to take naked option positions is highly risky so you may want to take another position in the stock to hedge. Here we assume that the risk-free interest rate r = 0, and for the time being assume a constant volatility = 50%. (a) (3 points) Suppose the put option you are interested is a 3-month European option, with strike K = 85. If you short one contract (100 shares) of this put option, and want to have a delta-neutral portfolio (1 0, where II is the value s of the portfolio), how many shares of the stock you should buy or sell? (b) (3 points) The above portfolio value would remain unchanged for small stock price moves according to the theory. However, there is an obvious vega exposure that cannot be ignored. Vega of an option is the sensitivity of the option price to the volatility and in the Black-Scholes-Merton model the vega of a put option is given by - SoVTN' (d.) > 0 da where T is the expiration of the option, N(r) is the cumulative normal distribu- tion function, and d4 log(So/K) + (r+)T OVT To construct a vega-neutral portfolio (that has vega equal to zero), you can buy some shares of the put option with strike K= 75 (same expiration). How many shares of this put option should you buy in order to have a vega-neutral portfolio? (c) (3 points) Now that the vega of the new portfolio is zero, but the delta of the portfolio is not zero. How many shares of the stock should you buy (sell) to maintain a delta neutral portfolio?

Step by Step Solution

★★★★★

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

As only part b is asked kindly note Nd1 is written as N d1 1 2 e First we need to calculate the vega ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started