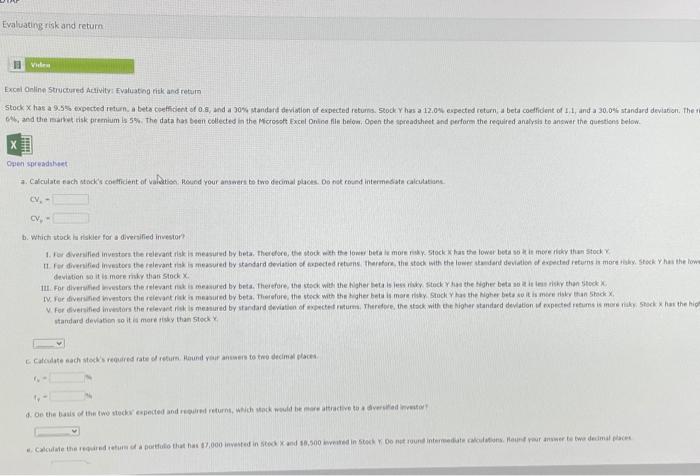

Stockhus 9.55 pctereum, betont of and 30 standard deviation of expected returns, Stockhu 12.04pected return, but coeffident of t.. ada 300 standard deviation. The 0 tematisk premium is the data has been collected in the roof of below. On the pathest and perform the required and tenswer the questions below Open the a. Calculeschtes coefficient atatlan Round your res to we decimales Dentro Internet dation cv, - Wider for adhereinvestor For de Investors and that there is the lower but more Stock as it is more than stock it or diversified investors relevant risk ismered by standard deviation of the therefore, the stack with the standardevono espected memory Stock has the des more than stock trovare into the levant red by the the which besok has the higher battery Stock IV. For de Investors there there the tow with the mostech a height Vi forventer the related and deviation therefore the stock with the detected more that the werden so it is more than testovalotum. Runtur two T- on the body expected return, which would be more attractive to a diversiteit Calculate the return of the $7.00 Stock X 18.500 vedeti te bo netroud intermediate calcul duranter to two decimal of the market minced to which of the two stocksaw there was required return Evaluating risk and return View Excel Online Structured Activity: Evaluating risk and return Stock has a 9.5 expected return a bets coefficient of os, and a 30% standard deviation of expected returns. Stock Y has a 12.0% expected return a beta coefficient of and a 30.05 standard deviation. The 6 and the mattisk belum ls 5% The data has been collected in the Microsoft Excel Online fin brion, Open the spreadsheet and perform the required analysis to answer the questions below. Open spread 2. Calculate each stock content of valtion Round your answers to two decimal places. Do not found intermediate calculation CV- CV- b. Which stock skier for a diversified investor 1. For diversified investors the relevant risk is measured by beta therefore, wock with the low betale more Stock at the lower bota sot more ricky than stock IL for diversified investors the relevant is measured by standard deviation of expected returns therefore the stock with the lower standard deviation of expected returns is more Shock has the low deviation so it is more my thats Stock II. For diverted intors the relevant risk is measured by bets. Therefore, the stock with the herselsky stocks the highet betaso its the stock IV. For diversified westors the relevant ek is measured by beta, Therefore, the stock with the higher but is more by Stock has the higher to suit is misky a todex For diversified Investors the relevant mamured by standard deviation of certum Thre, the stock with the higher standard deviation of expected retums ismeriky Stock has the hig standard deviation to it is more than Stock Cateodate nach stereoted rate returned your store decimal places . On the basis of the two stock expected and return, ich stack would be more attractive to advert calculate the returned about that has 67.000 ed into and 18,500 wted into one round intermediate action and were we decimal aces