Answered step by step

Verified Expert Solution

Question

1 Approved Answer

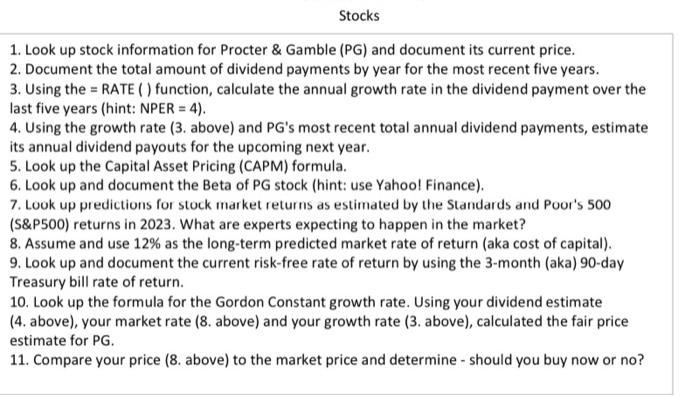

Stocks 1. Look up stock information for Procter & Gamble (PG) and document its current price. 2. Document the total amount of dividend payments by

Stocks 1. Look up stock information for Procter & Gamble (PG) and document its current price. 2. Document the total amount of dividend payments by year for the most recent five years. 3. Using the = RATE () function, calculate the annual growth rate in the dividend payment over the last five years (hint: NPER= 4). 4. Using the growth rate (3. above) and PG's most recent total annual dividend payments, estimate its annual dividend payouts for the upcoming next year. 5. Look up the Capital Asset Pricing (CAPM) formula. 6. Look up and document the Beta of PG stock (hint: use Yahoo! Finance). 7. Look up predictions for stock market returns as estimated by the Standards and Poor's 500 (S&P500) returns in 2023. What are experts expecting to happen in the market? 8. Assume and use 12% as the long-term predicted market rate of return (aka cost of capital). 9. Look up and document the current risk-free rate of return by using the 3-month (aka) 90-day Treasury bill rate of return. 10. Look up the formula for the Gordon Constant growth rate. Using your dividend estimate (4. above), your market rate (8. above) and your growth rate (3. above), calculated the fair price estimate for PG. 11. Compare your price (8. above) to the market price and determine - should you buy now or no?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started