Question

Stocks A and B have the following historical returns: Year Stock A's Returns 2015 (24.25%) 2016 18.50 2017 38.67 2018 14.33 2019 39.13 Stock

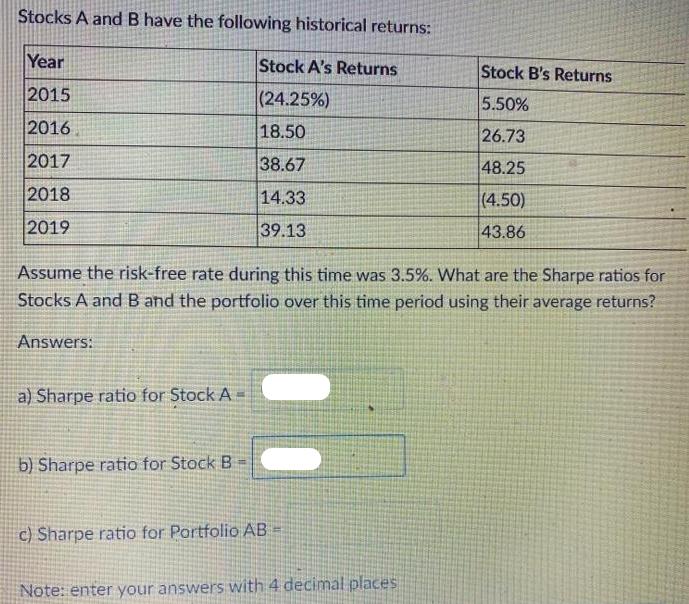

Stocks A and B have the following historical returns: Year Stock A's Returns 2015 (24.25%) 2016 18.50 2017 38.67 2018 14.33 2019 39.13 Stock B's Returns 5.50% 26.73 48.25 (4.50) 43.86 Assume the risk-free rate during this time was 3.5%. What are the Sharpe ratios for Stocks A and B and the portfolio over this time period using their average returns? Answers: a) Sharpe ratio for Stock A b) Sharpe ratio for Stock B c) Sharpe ratio for Portfolio AB = Note: enter your answers with 4 decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the Sharpe ratios we need the average returns and standard deviations of Stocks A and B ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals Of Financial Management

Authors: Eugene F. Brigham, Joel F. Houston

16th Edition

0357517571, 978-0357517574

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App