Question

Stockton Company Adjusted Trial Balance For the Year ended December 31, 2010 Cash $ 9,030 2,100 Accounts Receivable Prepaid Expenses Equipment Accumulated Depreciation 700

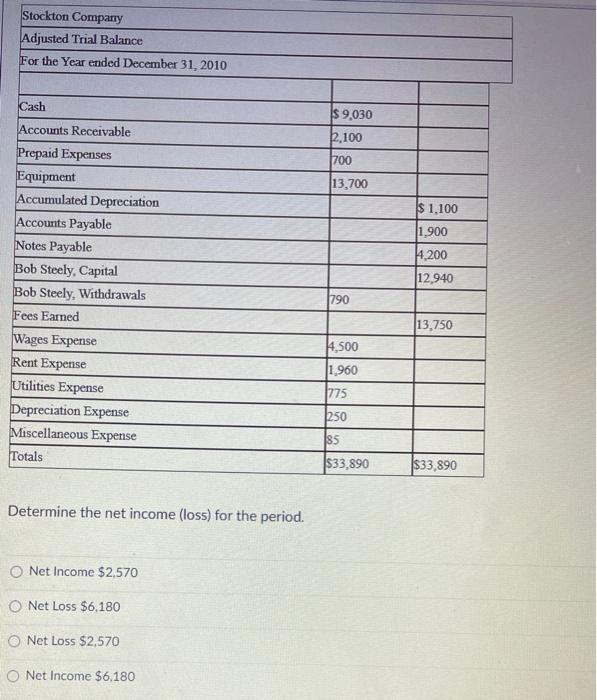

Stockton Company Adjusted Trial Balance For the Year ended December 31, 2010 Cash $ 9,030 2,100 Accounts Receivable Prepaid Expenses Equipment Accumulated Depreciation 700 13,700 $ 1,100 Accounts Payable Notes Payable Bob Steely, Capital Bob Steely, Withdrawals 1,900 4,200 12,940 790 Fees Earned 13,750 Wages Expense Rent Expense 4,500 1,960 Utilities Expense 775 Depreciation Expense Miscellaneous Expense 250 85 Totals $33,890 $33,890 Determine the net income (loss) for the period. O Net Income $2,570 O Net Loss $6,180 O Net Loss $2,570 O Net Income $6,180

Step by Step Solution

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer Net income 6180 Explanation Net income ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting: A Business Process Approach

Authors: Jane L. Reimers

3rd edition

978-013611539, 136115276, 013611539X, 978-0136115274

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App