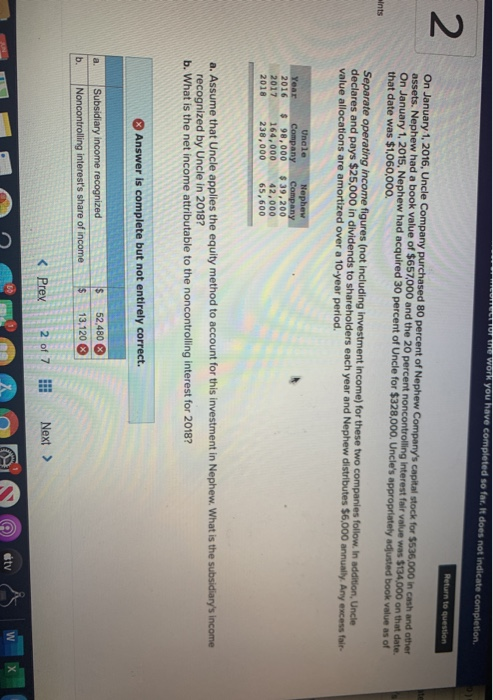

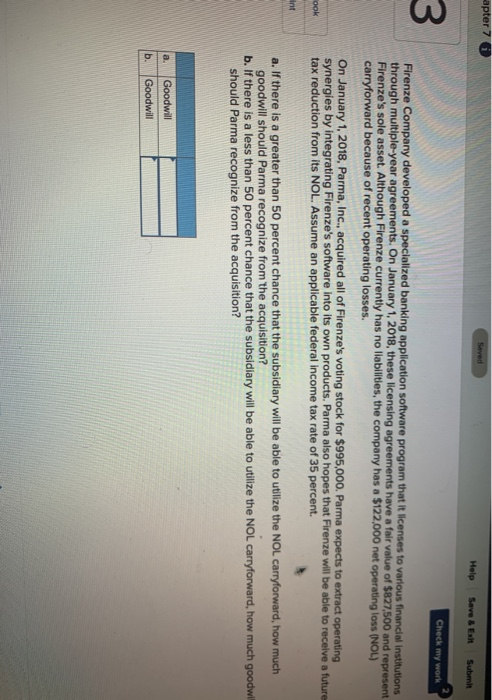

STOF Wonk you have completed so far. It does not indicate completion 2. Return to question aints On January 1, 2016. Uncle Company purchased 80 percent of Nephew Company's capital stock for $536,000 in cash and other assets. Nephew had a book value of $657,000 and the 20 percent noncontrolling interest fair value was $134,000 on that date. On January 1, 2015, Nephew had acquired 30 percent of Uncle for $328,000. Uncle's appropriately adjusted book value as of that date was $1,060,000. Separate operating income figures (not including investment income) for these two companies follow. In addition, Uncle declares and pays $25,000 in dividends to shareholders each year and Nephew distributes $6,000 annually. Any excess fale value allocations are amortized over a 10-year period. Year 2016 2017 2018 Unele Company $ 98,000 164,000 238,000 Nephew Company $ 39,200 42,000 65,600 a. Assume that Uncle applies the equity method to account for this investment in Nephew. What is the subsidiary's income recognized by Uncle in 2018? b. What is the net income attributable to the noncontrolling interest for 2018? Answer is complete but not entirely correct. a. $ Subsidiary income recognized Noncontrolling interest's share of income 52,480 13,120 b. $ ctv apter 7 Help Save & Exit Submit Check my work 3 Firenze Company developed a specialized banking application software program that it licenses to various financial institutions through multiple-year agreements. On January 1, 2018, these licensing agreements have a fair value of $827,500 and represent Firenze's sole asset. Although Firenze currently has no liabilities, the company has a $122,000 net operating loss (NOL) carryforward because of recent operating losses. On January 1, 2018, Parma, Inc., acquired all of Firenze's voting stock for $995,000. Parma expects to extract operating synergies by integrating Firenze's software into its own products. Parma also hopes that Firenze will be able to receive a future tax reduction from its NOL. Assume an applicable federal income tax rate of 35 percent. ook int a. If there is a greater than 50 percent chance that the subsidiary will be able to utilize the NOL carryforward, how much goodwill should Parma recognize from the acquisition? b. If there is a less than 50 percent chance that the subsidiary will be able to utilize the NOL carryforward, how much goodwill should Parma recognize from the acquisition? a. Goodwill Goodwill b