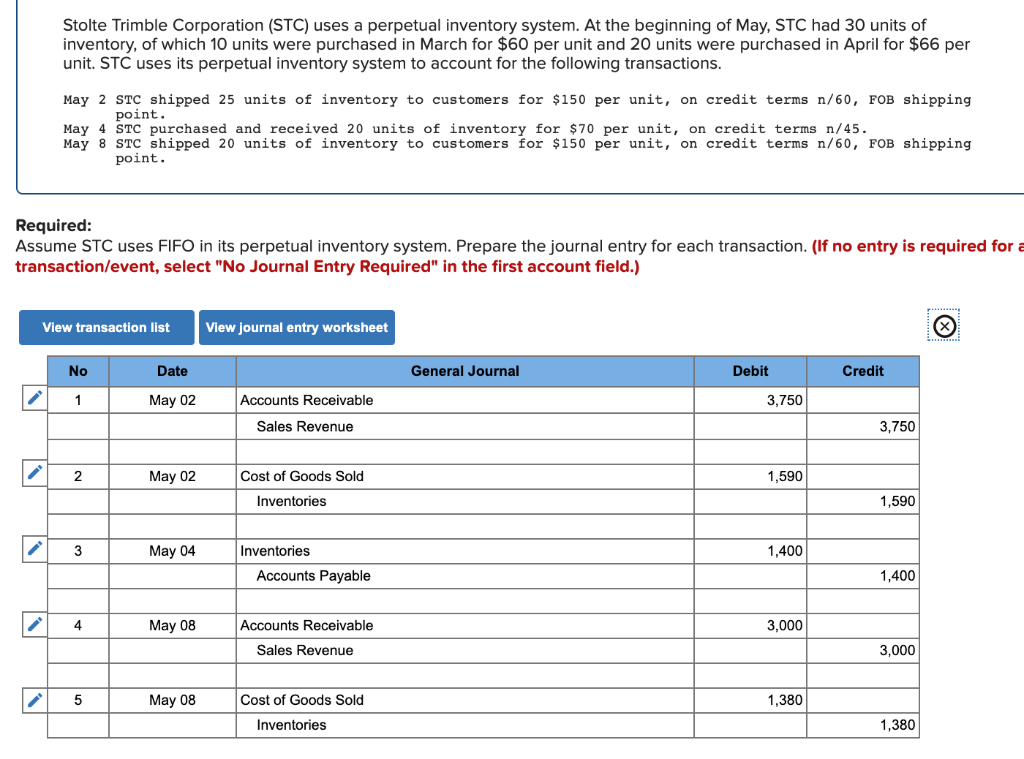

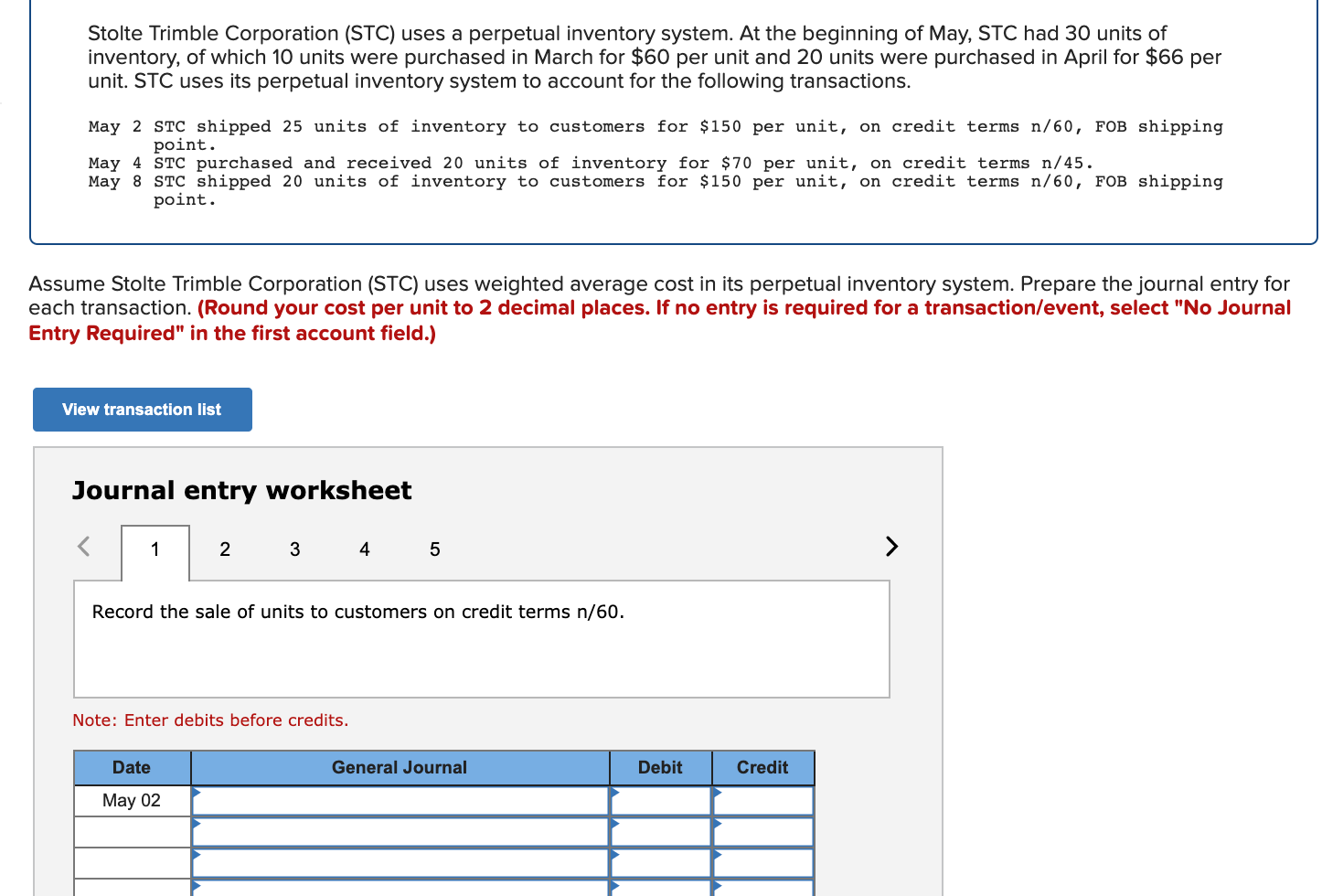

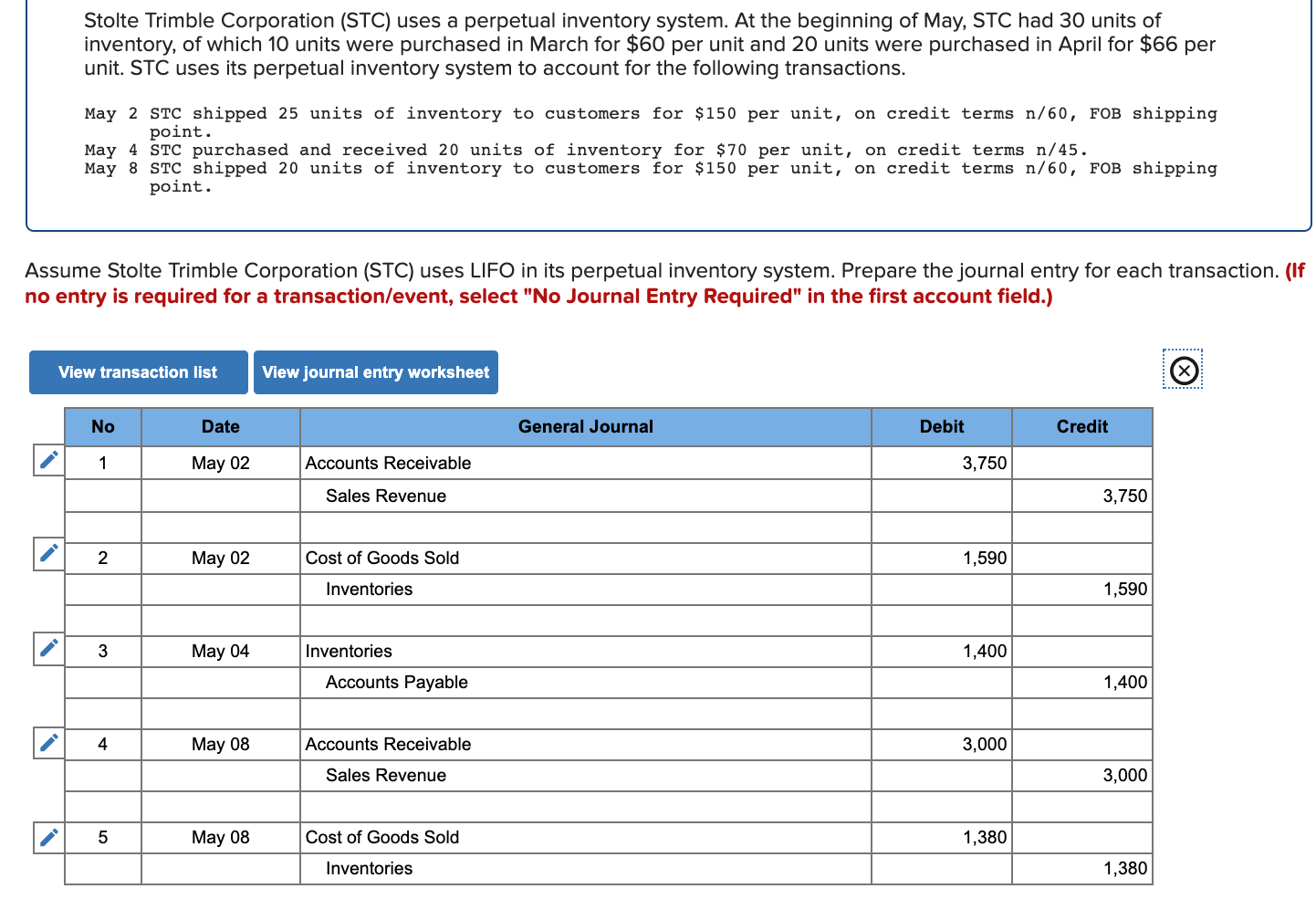

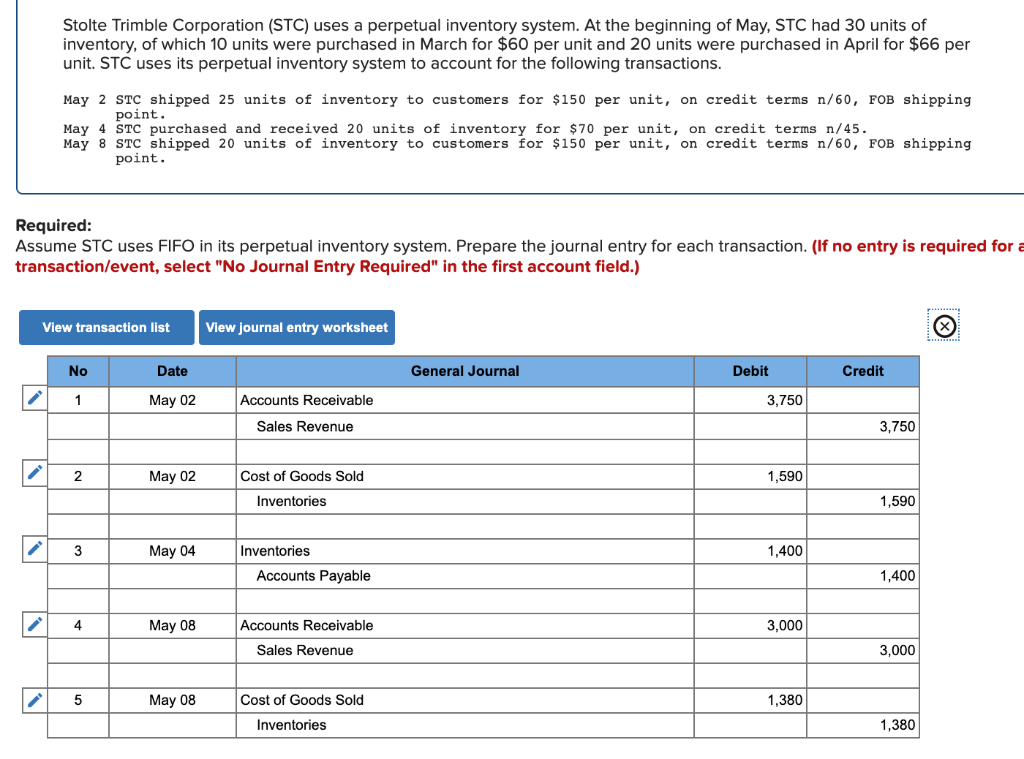

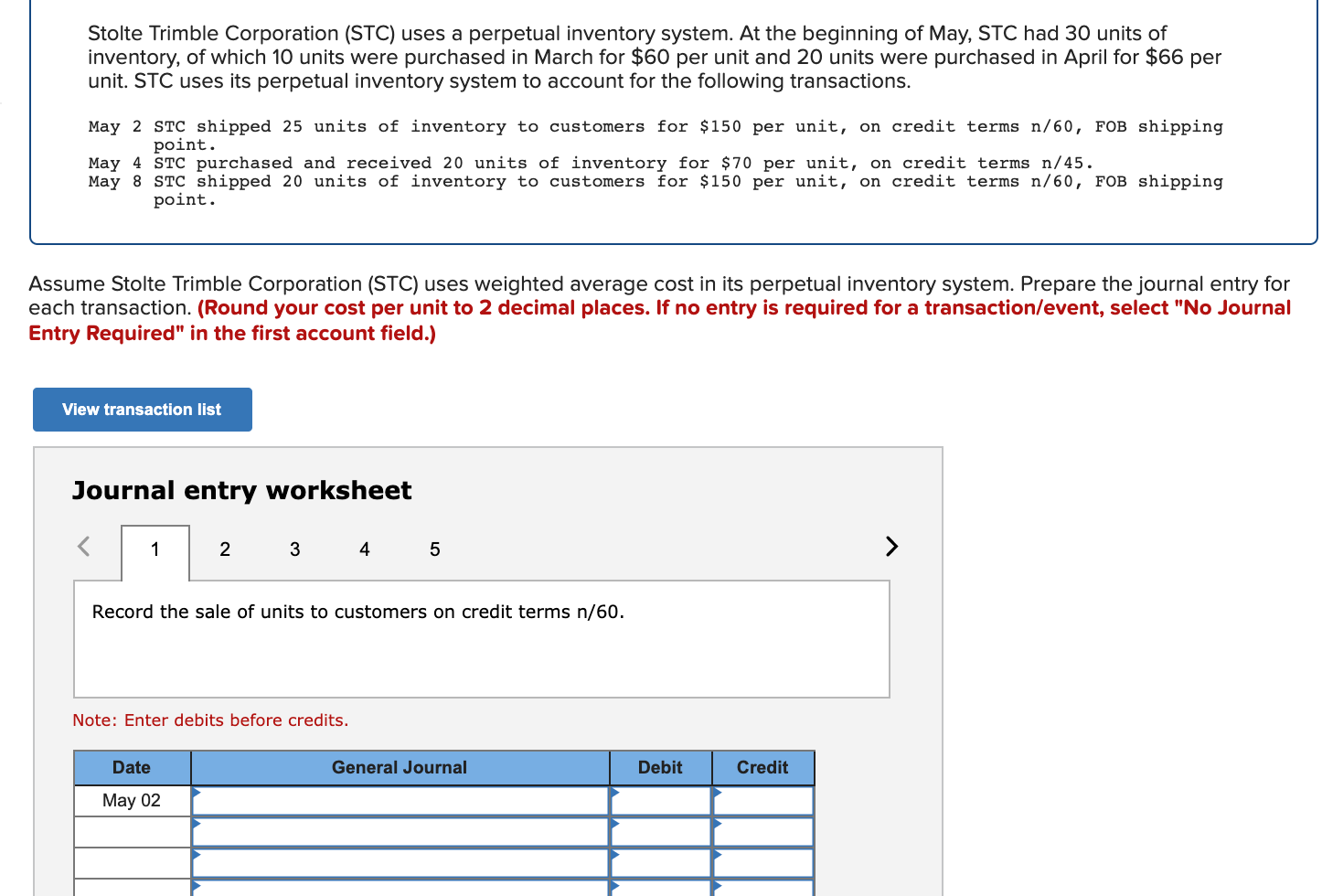

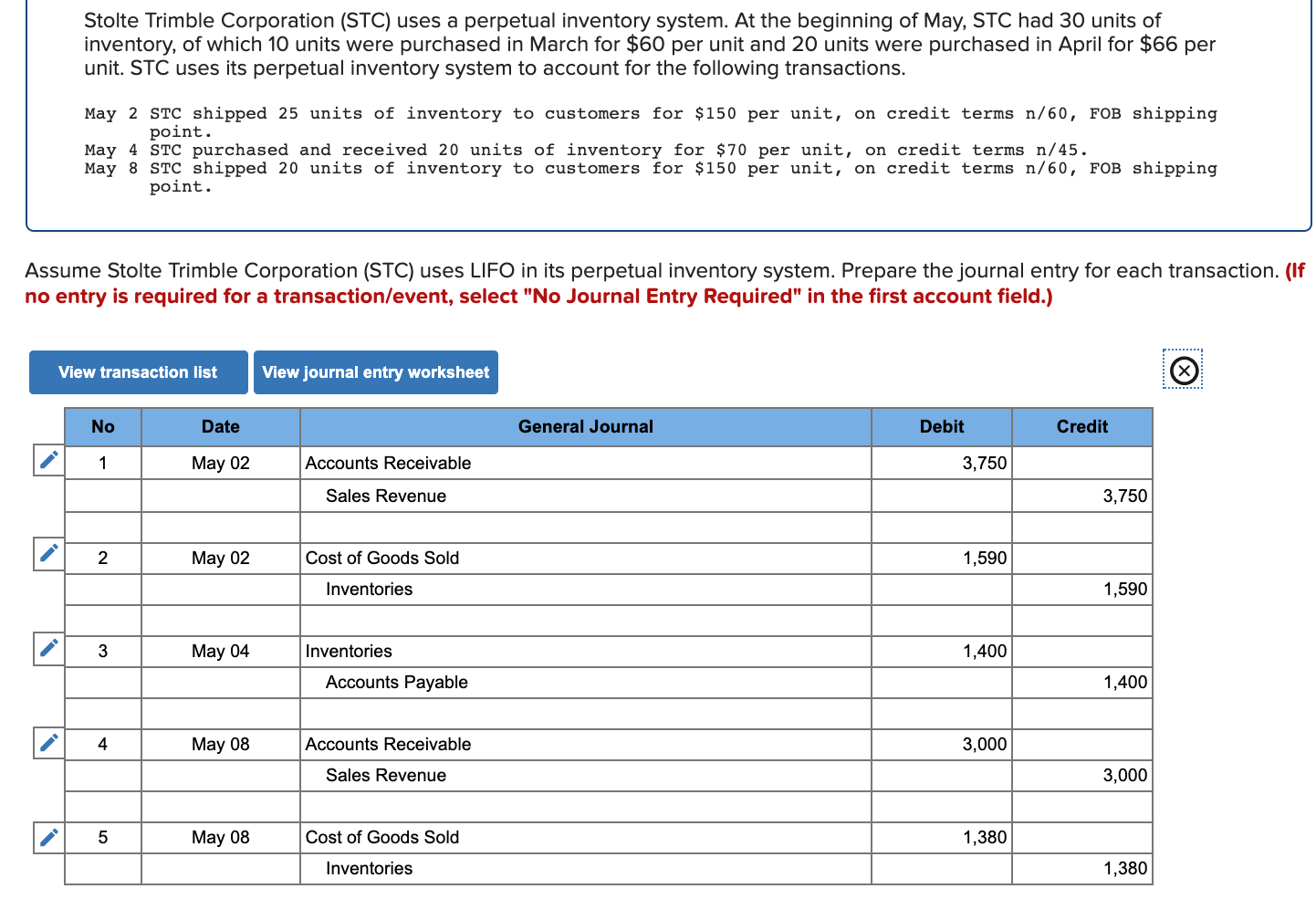

Stolte Trimble Corporation (STC) uses a perpetual inventory system. At the beginning of May, STC had 30 units of inventory, of which 10 units were purchased in March for $60 per unit and 20 units were purchased in April for $66 per unit. STC uses its perpetual inventory system to account for the following transactions. May 2 STC shipped 25 units of inventory to customers for $150 per unit, on credit terms n/60, FOB shipping point. May 4 STC purchased and received 20 units of inventory for $70 per unit, on credit terms n/45. May 8 STC shipped 20 units of inventory to customers for $150 per unit, on credit terms n/60, FOB shipping point. Required: Assume STC uses FIFO in its perpetual inventory system. Prepare the journal entry for each transaction. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list View journal entry worksheet No Date General Journal Debit Credit 1 May 02 3,750 Accounts Receivable Sales Revenue 3,750 2 May 02 Cost of Goods Sold 1,590 Inventories 1,590 May 04 Inventories 1,400 Accounts Payable 1,400 4 May 08 Accounts Receivable 3,000 Sales Revenue 3,000 5 May 08 1,380 Cost of Goods Sold Inventories 1,380 Stolte Trimble Corporation (STC) uses a perpetual inventory system. At the beginning of May, STC had 30 units of inventory, of which 10 units were purchased in March for $60 per unit and 20 units were purchased in April for $66 per unit. STC uses its perpetual inventory system to account for the following transactions. May 2 STC shipped 25 units of inventory to customers for $150 per unit, on credit terms n/60, FOB shipping point. May 4 STC purchased and received 20 units of inventory for $70 per unit, on credit terms n/45. May 8 STC shipped 20 units of inventory to customers for $150 per unit, on credit terms n/60, FOB shipping point. Assume Stolte Trimble Corporation (STC) uses weighted average cost in its perpetual inventory system. Prepare the journal entry for each transaction. (Round your cost per unit to 2 decimal places. If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the sale of units to customers on credit terms n/60. Note: Enter debits before credits. Date General Journal Debit Credit May 02 Stolte Trimble Corporation (STC) uses a perpetual inventory system. At the beginning of May, STC had 30 units of inventory, of which 10 units were purchased in March for $60 per unit and 20 units were purchased in April for $66 per unit. STC uses its perpetual inventory system to account for the following transactions. May 2 STC shipped 25 units of inventory to customers for $150 per unit, on credit terms n/60, FOB shipping point. May 4 STC purchased and received 20 units of inventory for $70 per unit, on credit terms n/45. May 8 STC shipped 20 units of inventory to customers for $150 per unit, on credit terms n/60, FOB shipping point. Assume Stolte Trimble Corporation (STC) uses LIFO in its perpetual inventory system. Prepare the journal entry for each transaction. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list View journal entry worksheet No Date General Journal Debit Credit 1 May 02 Accounts Receivable 3,750 Sales Revenue 3,750 2 May 02 Cost of Goods Sold 1,590 Inventories 1,590 3 May 04 Inventories 1,400 Accounts Payable 1,400 4 May 08 3,000 Accounts Receivable Sales Revenue 3,000 5 May 08 Cost of Goods Sold 1,380 Inventories 1,380