Question

Stolton and Bright are partners in a business they started two years ago. The partnership agreement states that Stolton should receive a salary allowance

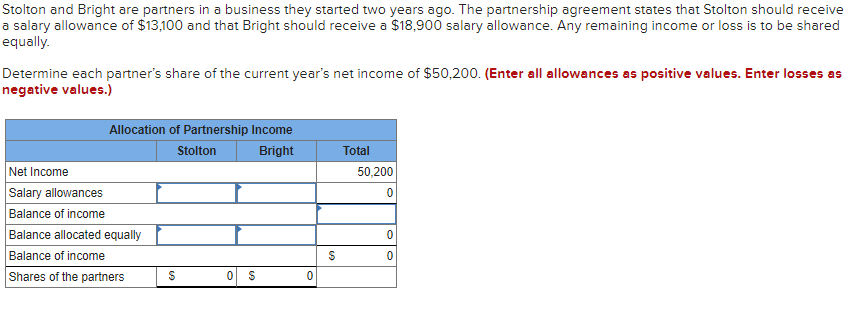

Stolton and Bright are partners in a business they started two years ago. The partnership agreement states that Stolton should receive a salary allowance of $13,100 and that Bright should receive a $18,900 salary allowance. Any remaining income or loss is to be shared equally. Determine each partner's share of the current year's net income of $50,200. (Enter all allowances as positive values. Enter losses as negative values.) Allocation of Partnership Income Stolton Bright Total Net Income Salary allowances Balance of income Balance allocated equally 50,200 Balance of income Shares of the partners %24

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution Correct Answer Stolton Bright To...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Accounting Principles

Authors: John J Wild, Ken Shaw

24th edition

1259916960, 978-1259916960

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App