Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In what follows (Bt), t 0 denotes the Brownian motion process started at zero. The terms option, claim and contract mean the same, and

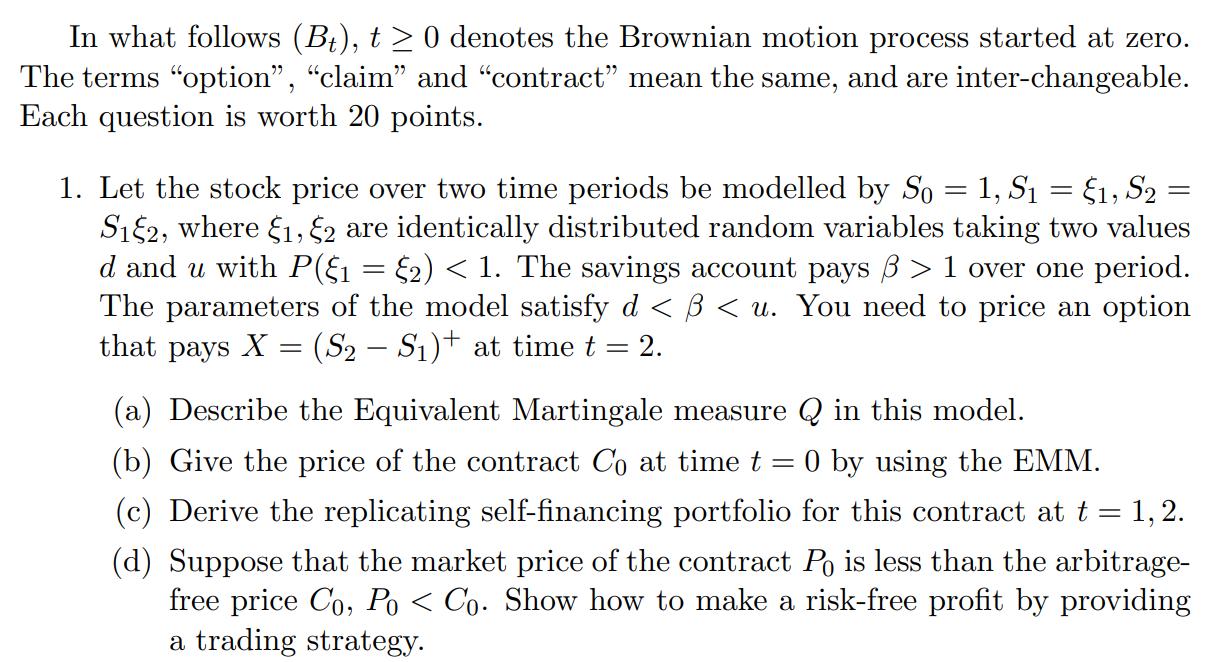

In what follows (Bt), t 0 denotes the Brownian motion process started at zero. The terms "option", "claim" and "contract" mean the same, and are inter-changeable. Each question is worth 20 points. 1. Let the stock price over two time periods be modelled by So = 1, S = $1, S = S12, where $1, 2 are identically distributed random variables taking two values d and u with P(1 = $2) < 1. The savings account pays 3 > 1 over one period. The parameters of the model satisfy d < < u. You need to price an option that pays X = (S2 S) at time t = = 2. (a) Describe the Equivalent Martingale measure Qin this model. (b) Give the price of the contract Co at time t = 0 by using the EMM. (c) Derive the replicating self-financing portfolio for this contract at t = 1, 2. (d) Suppose that the market price of the contract Po is less than the arbitrage- free price Co, Po < Co. Show how to make a risk-free profit by providing a trading strategy.

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

A a The equivalent martingale measure Q in this model is a measure which corresponds to the probabil...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started