Answered step by step

Verified Expert Solution

Question

1 Approved Answer

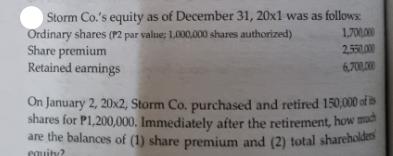

Storm Co.'s equity as of December 31, 20x1 was as follows Ordinary shares (12 par value: 1,000,000 shares authorized) Share premium Retained earnings 1,700,000

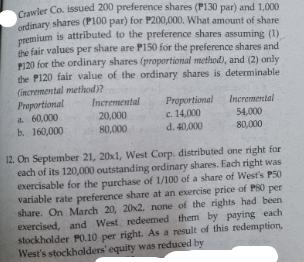

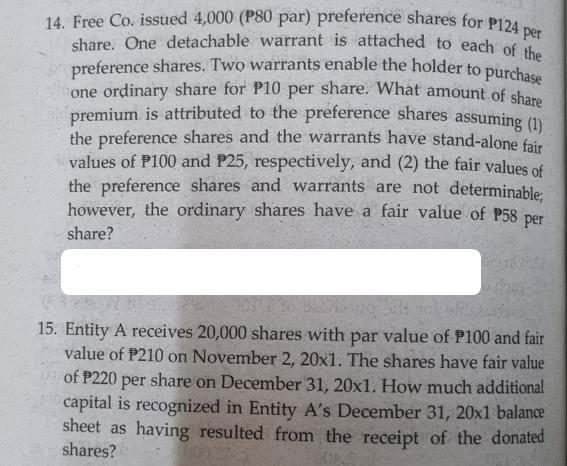

Storm Co.'s equity as of December 31, 20x1 was as follows Ordinary shares (12 par value: 1,000,000 shares authorized) Share premium Retained earnings 1,700,000 2.550.000 6,700,000 On January 2, 20x2, Storm Co. purchased and retired 150,000 of s shares for P1,200,000. Immediately after the retirement, how much are the balances of (1) share premium and (2) total shareholders equity? Crawler Co. issued 200 preference shares (P130 par) and 1,000 ordinary shares (P100 par) for P200,000. What amount of share premium is attributed to the preference shares assuming (1) the fair values per share are P150 for the preference shares and P120 for the ordinary shares (proportional method), and (2) only the P120 fair value of the ordinary shares is determinable fincremental method)? Proportional a 60,000 b. 160,000 Incremental 20,000 80,000 Proportional c. 14,000 d. 40,000 Incremental 54,000 80,000 12. On September 21, 20x1, West Corp, distributed one right for each of its 120,000 outstanding ordinary shares. Each right was exercisable for the purchase of 1/100 of a share of West's P50 variable rate preference share at an exercise price of P80 per share. On March 20, 2012. none of the rights had been exercised, and West redeemed them by paying each stockholder P0.10 per right. As a result of this redemption, West's stockholders' equity was reduced by 14. Free Co. issued 4,000 (P80 par) preference shares for P124 per share. One detachable warrant is attached to each of the preference shares. Two warrants enable the holder to purchase one ordinary share for P10 per share. What amount of share premium is attributed to the preference shares assuming (1) the preference shares and the warrants have stand-alone fair values of P100 and P25, respectively, and (2) the fair values of the preference shares and warrants are not determinable; however, the ordinary shares have a fair value of P58 share? per Foto 10310 30 berg als ncafeneatax 15. Entity A receives 20,000 shares with par value of P100 and fair value of P210 on November 2, 20x1. The shares have fair value of P220 per share on December 31, 20x1. How much additional capital is recognized in Entity A's December 31, 20x1 balance sheet as having resulted from the receipt of the donated shares?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

I see three different problems in the images youve shared involving share transactions and equity calculations Ill address the first problem as stated ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started