Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Storm, Inc. purchased 100% of the outstanding common stock of Front, Inc. on 1/1/2X for $500,000 in cash and stock. Storm, Inc. accounts for

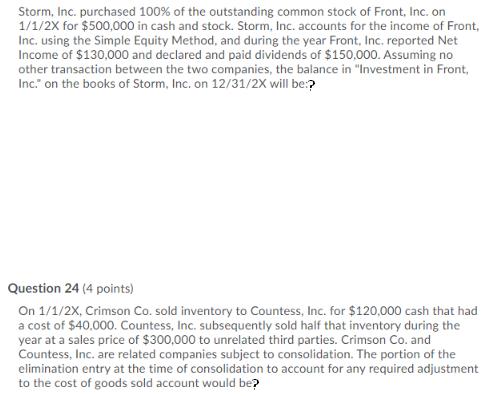

Storm, Inc. purchased 100% of the outstanding common stock of Front, Inc. on 1/1/2X for $500,000 in cash and stock. Storm, Inc. accounts for the income of Front, Inc. using the Simple Equity Method, and during the year Front, Inc. reported Net Income of $130,000 and declared and paid dividends of $150,000. Assuming no other transaction between the two companies, the balance in "Investment in Front, Inc." on the books of Storm, Inc. on 12/31/2X will be? Question 24 (4 points) On 1/1/2X, Crimson Co. sold inventory to Countess, Inc. for $120,000 cash that had a cost of $40,000. Countess, Inc. subsequently sold half that inventory during the year at a sales price of $300,000 to unrelated third parties. Crimson Co. and Countess, Inc. are related companies subject to consolidation. The portion of the elimination entry at the time of consolidation to account for any required adjustment to the cost of goods sold account would be?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Question 23 Investment in Front Inc When using the Simple Equity Method the investor company records ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started