Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Stowe has 80 shares outstanding in 2015. The price per share is $45. What are the P/E ratio and the M/B ratio? Use the following

Stowe has 80 shares outstanding in 2015. The price per share is $45. What are the P/E ratio and the M/B ratio?

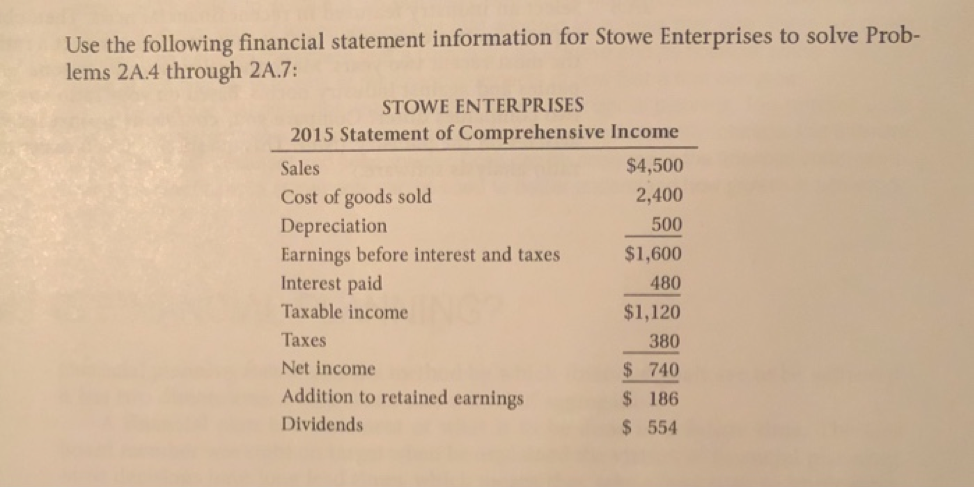

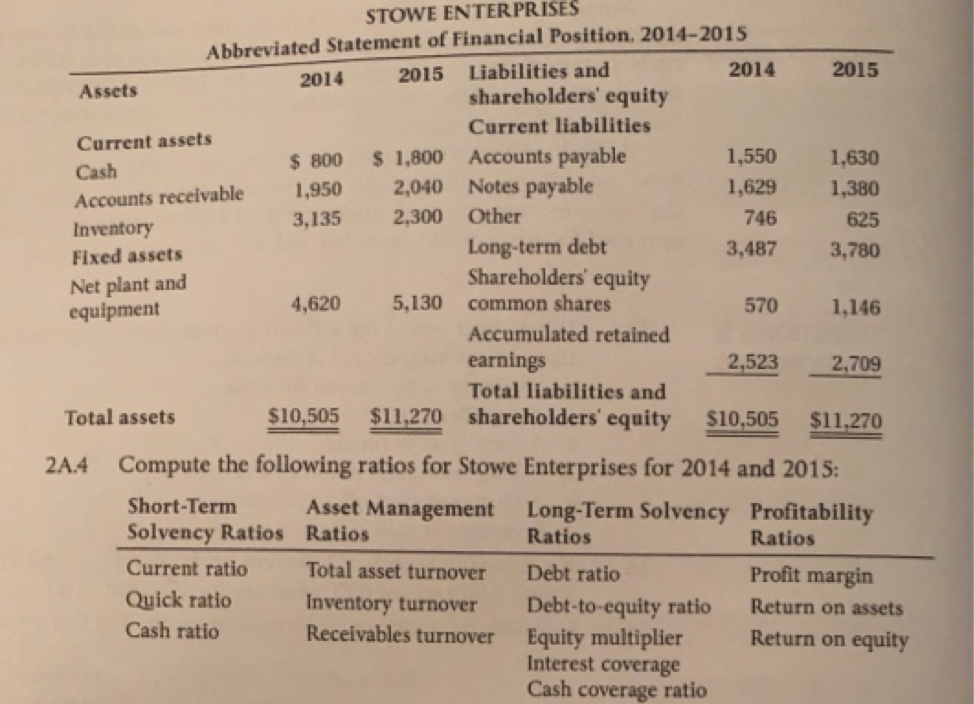

Use the following financial statement information for Stowe Enterprises to solve Prob- lems 2A4 through 2A.7 STOWE ENTERPRISES 2015 Statement of Comprehensive Income $4,500 Sales Cost of goods sold Depreciation 2,400 500 Earnings before interest and taxes $%1,600 480 $1,120 380 S 740 S 186 $ 554 Interest paid Taxable income Taxes Net income Addition to retained earnings Dividends STOWE ENTERPRISES Abbreviated Statement of Financial Position. 2014-2015 2014 2015 2014 2015 Liabilities and Assets shareholders' equity Current liabilities Current assets Cash Accounts receivable ,9502,040 Notes payable Inventory Fixed assets Net plant and equipment s 800 $1,800 Accounts payable 1,550 1,630 1,629 1,380 625 3,487 3,780 3,135 2,300 Other 746 Long-term debt Shareholders' equity 4,620 5,130 common shares 570 1,146 2,523 2.709 $10,505 $11,270 shareholders' equity$10,505 $11,270 Accumulated retained earnings Total liabilities and Total assets 2A4 Compute the following ratios for Stowe Enterprises for 2014 and 2015 Short-Term Solvency Ratios Current ratio Quick ratio Cash ratio Asset Management Long-Term Solvency Ratios Total asset turnover Debt ratio Inventory turnoverDebt-to-equity ratio Receivables turnover Profitability Ratios Profit margin Return on assets Return on equity Ratios Equity multiplier Interest coverage Cash coverage ratioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started