straight line, units of production, double declining

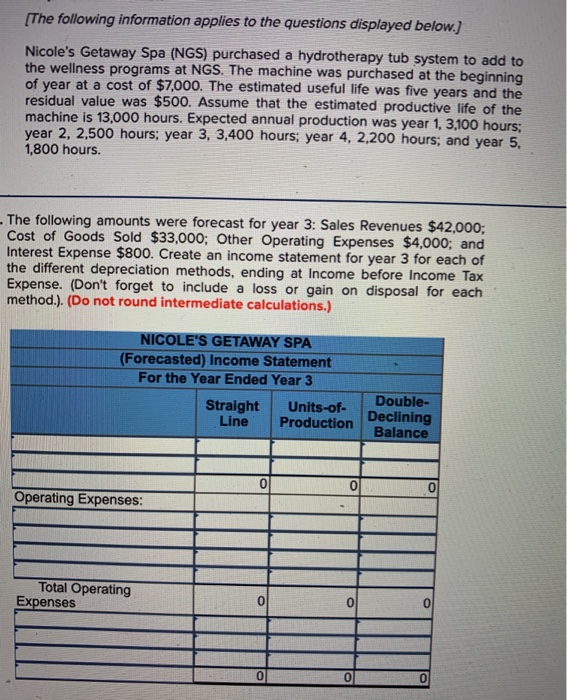

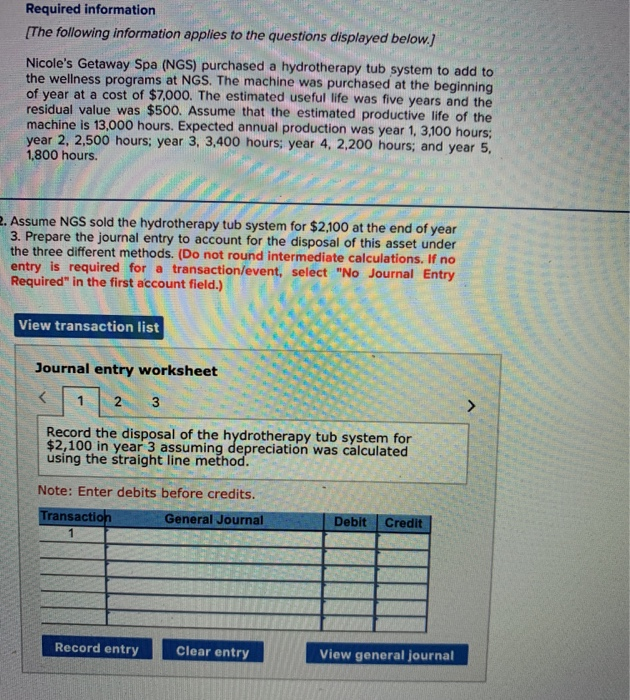

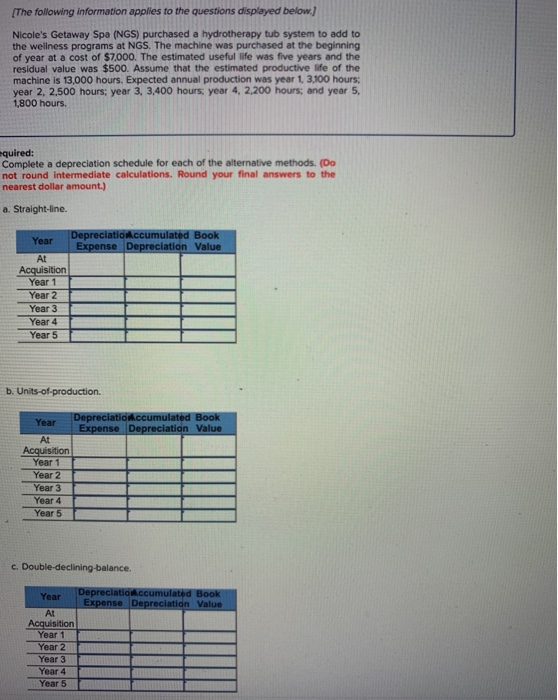

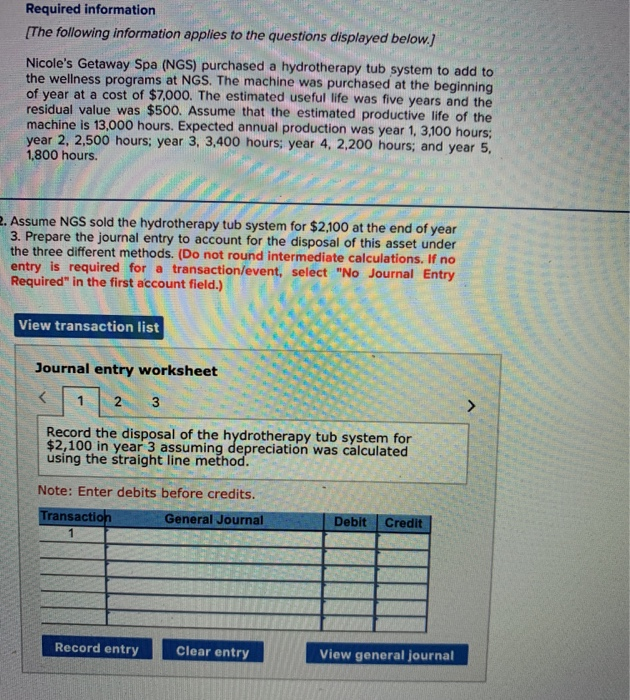

{The following information applies to the questions displayed below.) Nicole's Getaway Spa (NGS) purchased a hydrotherapy tub system to add to the wellness programs at NGS. The machine was purchased at the beginning of year at a cost of $7,000. The estimated useful life was five years and the residual value was $500. Assume that the estimated productive life of the machine is 13,000 hours. Expected annual production was year 1, 3,100 hours: year 2, 2.500 hours: year 3, 3,400 hours: year 4, 2,200 hours; and year 5, 1,800 hours. quired: Complete a depreciation schedule for each of the alternative methods. (Do not round intermediate calculations. Round your final answers to the nearest dollar amount.) a. Straight-line. Depreciationccumulated Book Year Expense Depreciation Value At Acquisition Year 1 Year 2 Year 3 Year 4 b. Units-of-production. Year Depreciationccumulated Book Expense Depreciation Value Acquisition Year 1 Year 2 Year 3D Year 4 Year 5 c. Double-declining-balance. Year Depreciationccumulated Book Expense Depreciation Value Acquisition Year 1 Year 2 Year 3 Year 4 Year 5 Required information [The following information applies to the questions displayed below.] Nicole's Getaway Spa (NGS) purchased a hydrotherapy tub system to add to the wellness programs at NGS. The machine was purchased at the beginning of year at a cost of $7,000. The estimated useful life was five years and the residual value was $500. Assume that the estimated productive life of the machine is 13,000 hours. Expected annual production was year 1, 3,100 hours: year 2, 2,500 hours: year 3, 3,400 hours: year 4, 2,200 hours; and year 5, 1,800 hours. Assume NGS sold the hydrotherapy tub system for $2,100 at the end of year 3. Prepare the journal entry to account for the disposal of this asset under the three different methods. (Do not round Intermediate calculations. If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the disposal of the hydrotherapy tub system for $2,100 in year 3 assuming depreciation was calculated using the straight line method. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal (The following information applies to the questions displayed below.) Nicole's Getaway Spa (NGS) purchased a hydrotherapy tub system to add to the wellness programs at NGS. The machine was purchased at the beginning of year at a cost of $7,000. The estimated useful life was five years and the residual value was $500. Assume that the estimated productive life of the machine is 13,000 hours. Expected annual production was year 1, 3,100 hours; year 2, 2,500 hours: year 3, 3,400 hours, year 4, 2,200 hours; and year 5. 1,800 hours. The following amounts were forecast for year 3: Sales Revenues $42,000: Cost of Goods Sold $33,000; Other Operating Expenses $4,000; and Interest Expense $800. Create an income statement for year 3 for each of the different depreciation methods, ending at Income before Income Tax Expense. (Don't forget to include a loss or gain on disposal for each method.). (Do not round intermediate calculations.) NICOLE'S GETAWAY SPA (Forecasted) Income Statement For the Year Ended Year 3 Straight Units-of- Line Production Double- Declining Balance Operating Expenses: 1 Total Operating Expenses 00 000

straight line, units of production, double declining

straight line, units of production, double declining