Answered step by step

Verified Expert Solution

Question

1 Approved Answer

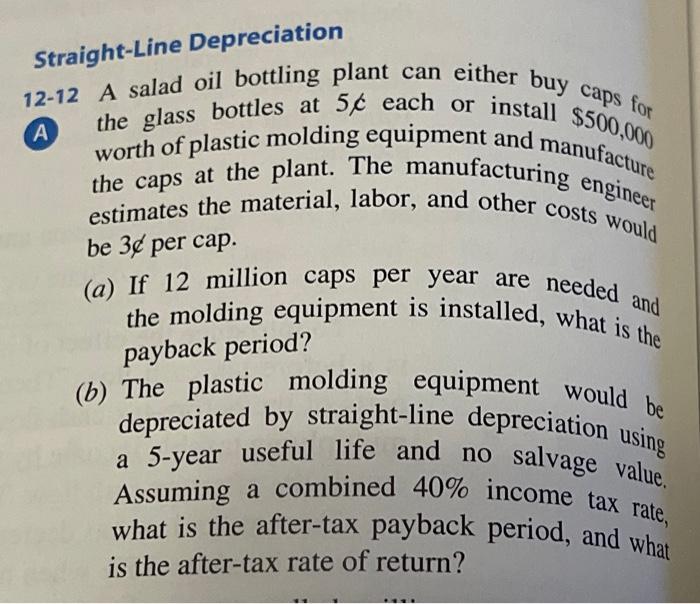

Straight-Line Depreciation A 12-12 A salad oil bottling plant can either buy caps for the glass bottles at 5 each or install $500,000 worth of

Straight-Line Depreciation A 12-12 A salad oil bottling plant can either buy caps for the glass bottles at 5 each or install $500,000 worth of plastic molding equipment and manufacture estimates the material, labor, and other costs would the caps at the plant. The manufacturing engineer be 3e per cap. (a) If 12 million caps per year are needed and the molding equipment is installed, what is the payback period? (b) The plastic molding equipment would be depreciated by straight-line depreciation using a 5-year useful life and no salvage value. Assuming a combined 40% income tax rate, what is the after-tax payback period, and what is the after-tax rate of return?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started