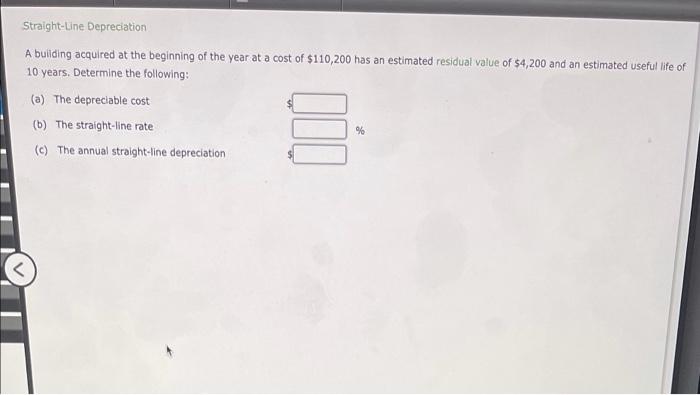

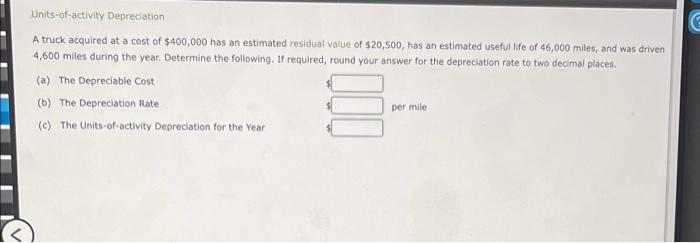

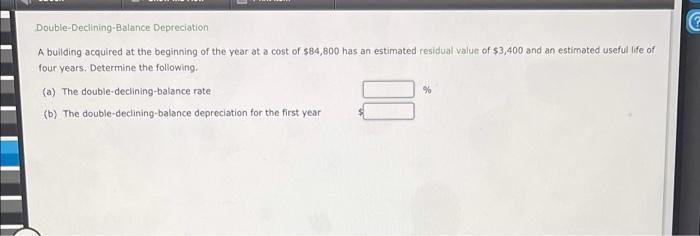

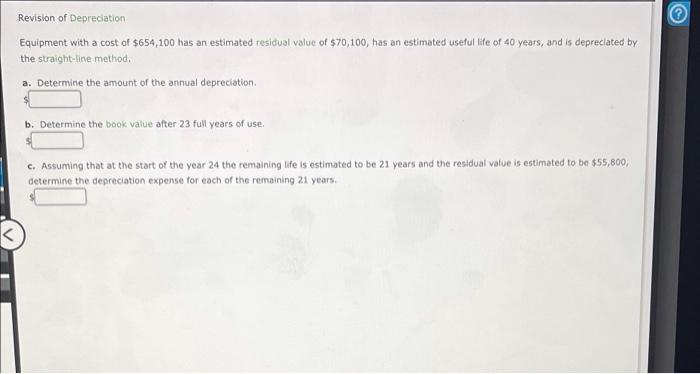

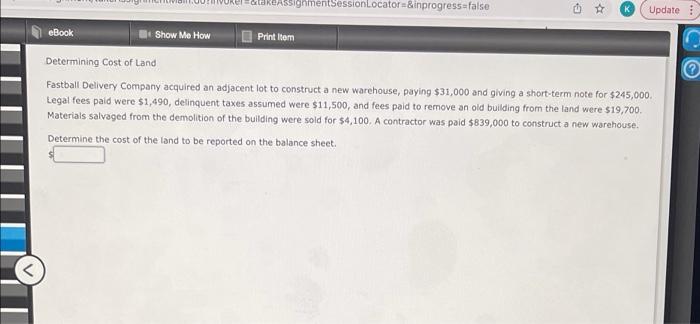

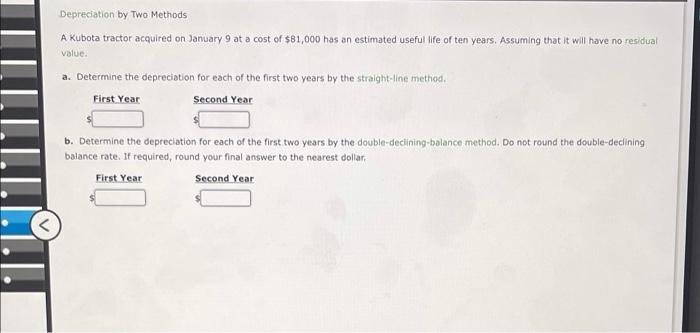

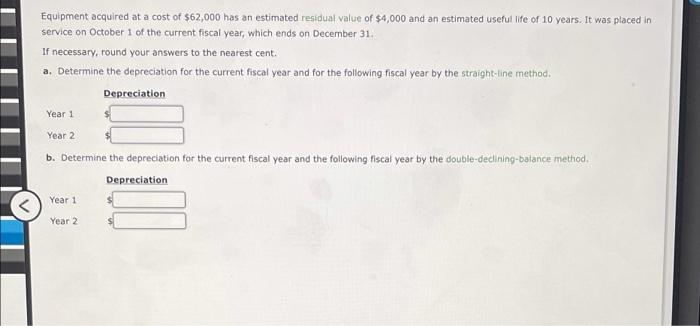

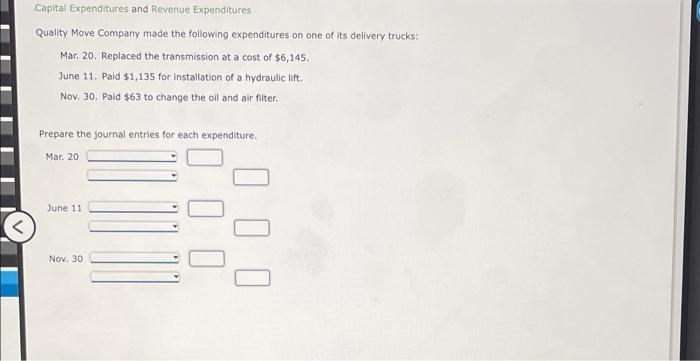

Straight-Line Depreciation A building acquired at the beginning of the year at a cost of $110,200 has an estimated residual value of $4,200 and an estimated useful life of 10 years. Determine the following: (a) The depreciable cost (b) The straight-line rate (c) The annual straight-line depreciation % Units-of-activity Depreciation A truck acquired at a cost of $400,000 has an estimated residual value of $20,500, has an estimated useful life of 46,000 miles, and was driven 4,600 miles during the year. Determine the following. If required, round your answer for the depreciation rate to two decimal places. (a) The Depreciable cost (b) The Depreciation Rate per mile (C) The Units-of-activity Depreciation for the Year @ Double-Declining-Balance Depreciation A building acquired at the beginning of the year at a cost of $84,800 has an estimated residual value of $3,400 and an estimated useful life of four years. Determine the following (a) The double-declining balance rate (b) The double-declining-balance depreciation for the first year % Revision of Depreciation Equipment with a cost of $654,100 has an estimated residual value of $70,100, has an estimated useful life of 40 years, and is depreciated by the straight-line method. a. Determine the amount of the annual depreciation b. Determine the book value after 23 full years of use, c. Assuming that at the start of the year 24 the remaining life is estimated to be 21 years and the residual value is estimated to be $55,800, determine the depreciation expense for each of the remaining 21 years, UnelteassignmentSession Locator &inprogress=false Update eBook Show Me How Print Item 2 Determining cost of Land Fastball Delivery Company acquired an adjacent lot to construct a new warehouse, paying $31,000 and giving a short-term note for $245,000. Legal fees paid were $1,490, delinquent taxes assumed were $11,500, and fees paid to remove an old building from the land were $19,700 Materials salvaged from the demolition of the building were sold for $4,100. A contractor was paid $839,000 to construct a new warehouse. Determine the cost of the land to be reported on the balance sheet. Depreciation by Two Methods A Kubota tractor acquired on January 9 at a cost of $81,000 has an estimated useful life of ten years. Assuming that it will have no residual value a. Determine the depreciation for each of the first two years by the straight line method. First Year Second Year b. Determine the depreciation for each of the first two years by the double-declining-balance method. Do not round the double-declining balance rate. If required, round your final answer to the nearest dollar First Year Second Year Equipment acquired at a cost of $62,000 has an estimated residual value of $4,000 and an estimated useful life of 10 years. It was placed in service on October 1 of the current fiscal year, which ends on December 31. If necessary, round your answers to the nearest cent. a. Determine the depreciation for the current fiscal year and for the following fiscal year by the straight-line method. Depreciation Year 1 Year 2 b. Determine the depreciation for the current fiscal year and the following fiscal year by the double-declining balance method Depreciation Year 1 Year 2 Capital Expenditures and Revenue Expenditures Quality Move Company made the following expenditures on one of its delivery trucks: Mar. 20. Replaced the transmission at a cost of $6,145. June 11. Paid $1,135 for installation of a hydraulic lift Nov. 30. Pald $63 to change the oil and air filter Prepare the journal entries for each expenditure Mar. 20 June 11