Question

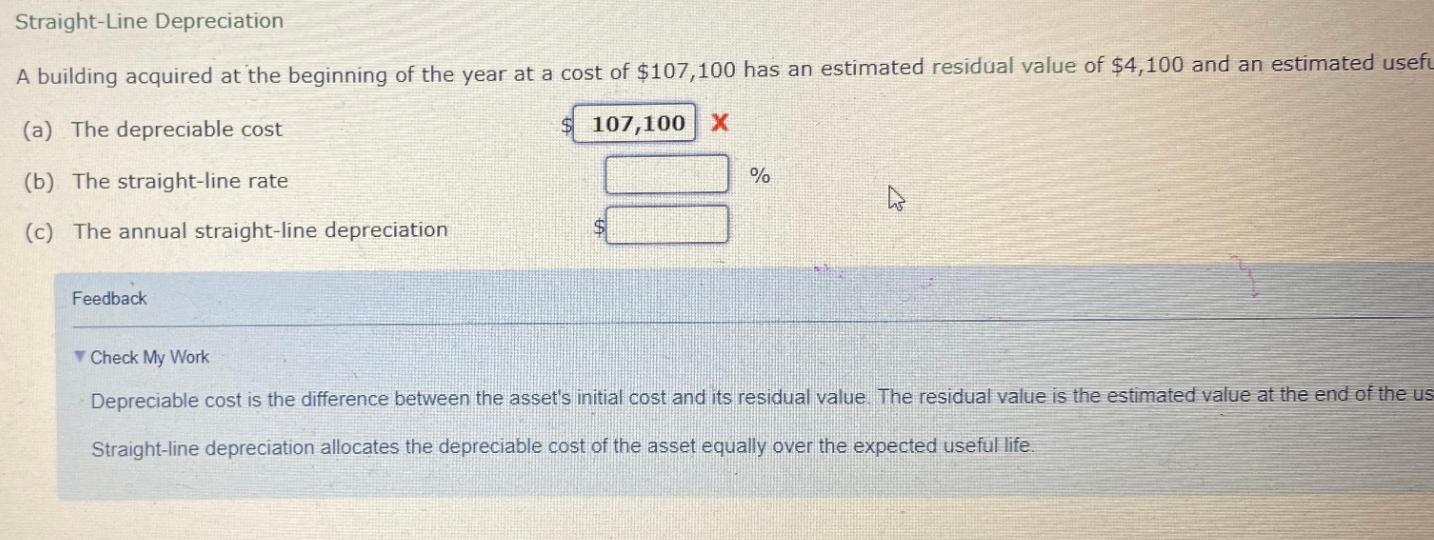

Straight-Line Depreciation A building acquired at the beginning of the year at a cost of $107,100 has an estimated residual value of $4,100 and

Straight-Line Depreciation A building acquired at the beginning of the year at a cost of $107,100 has an estimated residual value of $4,100 and an estimated usefu (a) The depreciable cost (b) The straight-line rate (c) The annual straight-line depreciation $ 107,100 X % $ Feedback Check My Work Depreciable cost is the difference between the asset's initial cost and its residual value. The residual value is the estimated value at the end of the us Straight-line depreciation allocates the depreciable cost of the asset equally over the expected useful life.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction To Java Programming And Data Structures Comprehensive Version

Authors: Y. Daniel Liang

12th Edition

0136520235, 978-0136520238

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App