Answered step by step

Verified Expert Solution

Question

1 Approved Answer

straight-line depreciation method for all of its plant and equipment. Partial-year depreciation is calculated based on the number of months the asset is in

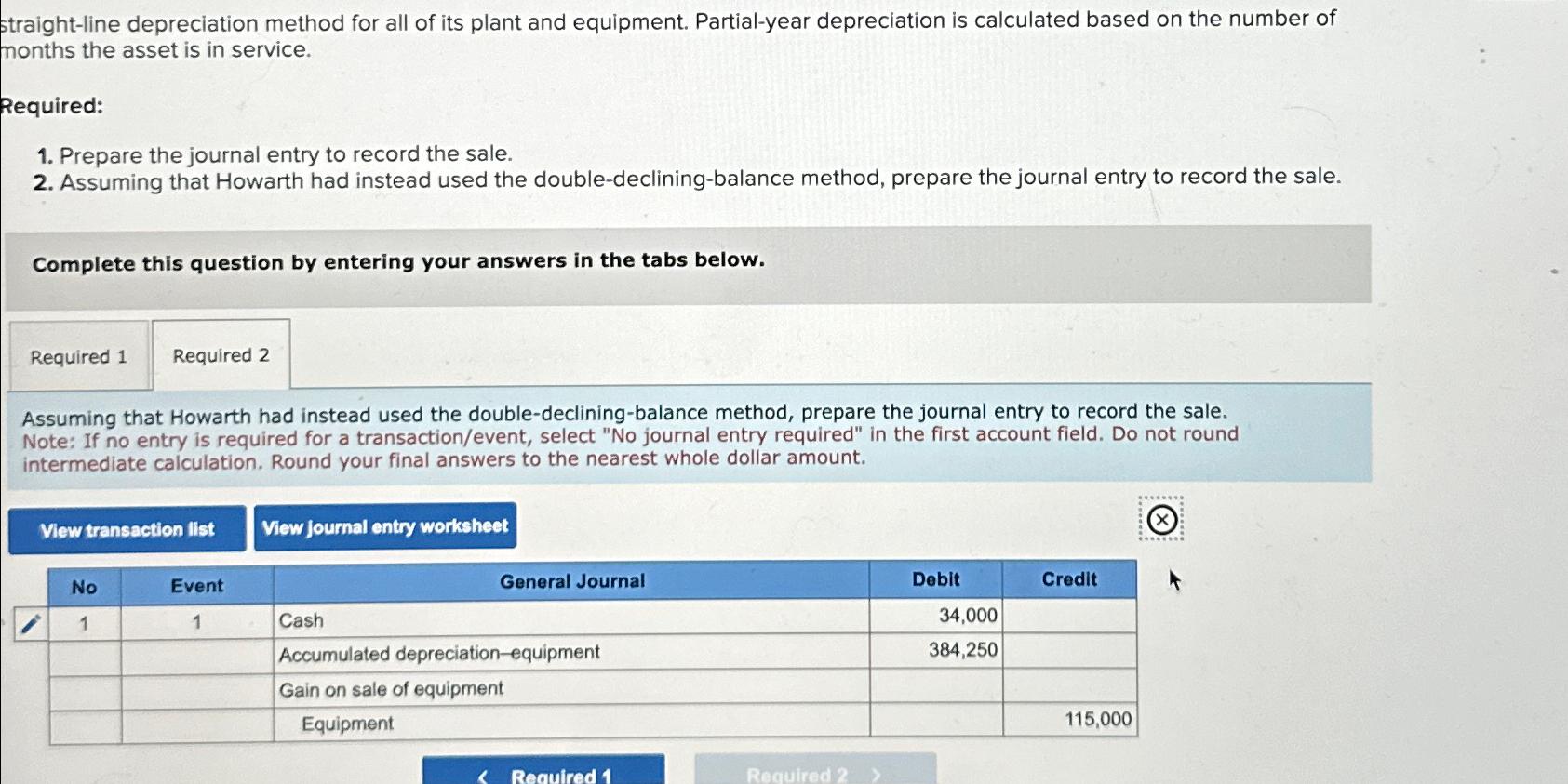

straight-line depreciation method for all of its plant and equipment. Partial-year depreciation is calculated based on the number of months the asset is in service. Required: 1. Prepare the journal entry to record the sale. 2. Assuming that Howarth had instead used the double-declining-balance method, prepare the journal entry to record the sale. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assuming that Howarth had instead used the double-declining-balance method, prepare the journal entry to record the sale. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculation. Round your final answers to the nearest whole dollar amount. View transaction list View journal entry worksheet No Event 1 1 Cash General Journal Accumulated depreciation-equipment Gain on sale of equipment Equipment Debit Credit 34,000 384,250 115,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started