Question

Strapped for cash, your neighbor makes you the following offer. He will pay you back the money he borrows today over the next 19

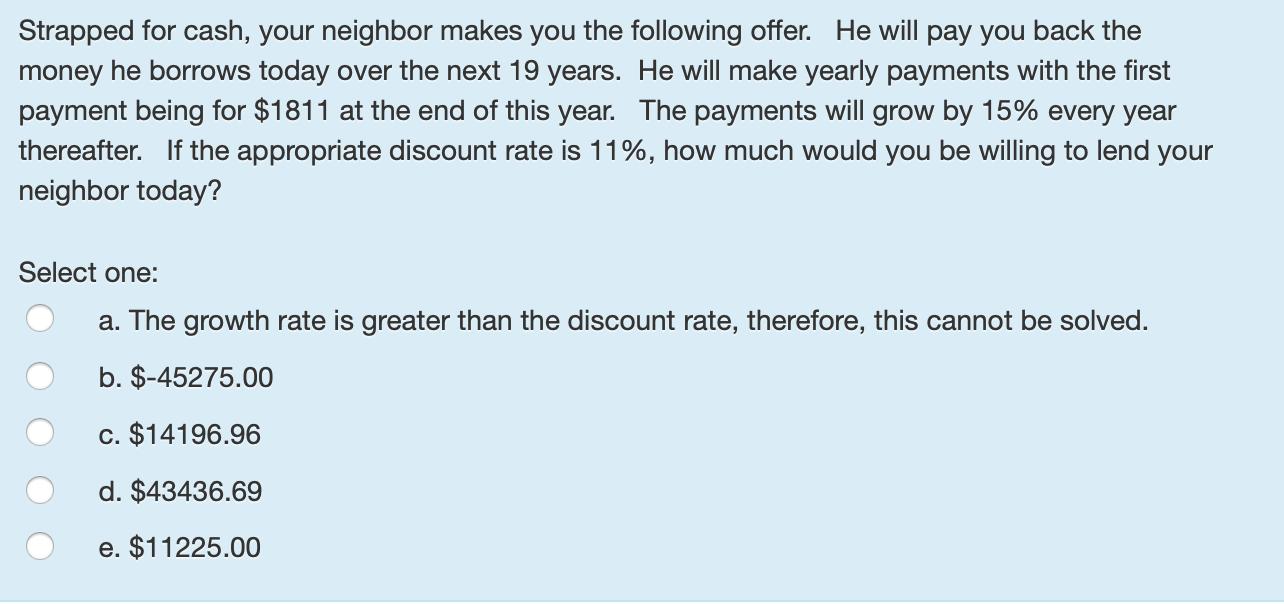

Strapped for cash, your neighbor makes you the following offer. He will pay you back the money he borrows today over the next 19 years. He will make yearly payments with the first payment being for $1811 at the end of this year. The payments will grow by 15% every year thereafter. If the appropriate discount rate is 11%, how much would you be willing to lend your neighbor today? Select one: a. The growth rate is greater than the discount rate, therefore, this cannot be solved. b. $-45275.00 c. $14196.96 d. $43436.69 e. $11225.00

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the present value of the future cash flows you can use the formula for the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Smith and Roberson Business Law

Authors: Richard A. Mann, Barry S. Roberts

15th Edition

1285141903, 1285141903, 9781285141909, 978-0538473637

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App