Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Streaky Bay plc incurred expenditure researching and developing a cure for SARS-CoV-2. At the end of 2020, its management determined that the research and

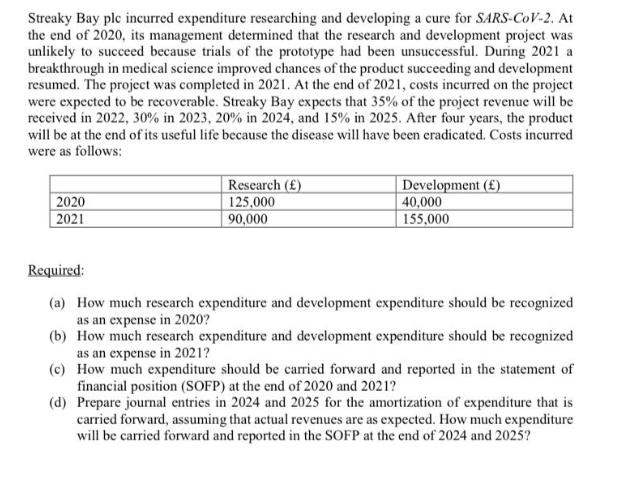

Streaky Bay plc incurred expenditure researching and developing a cure for SARS-CoV-2. At the end of 2020, its management determined that the research and development project was unlikely to succeed because trials of the prototype had been unsuccessful. During 2021 a breakthrough in medical science improved chances of the product succeeding and development resumed. The project was completed in 2021. At the end of 2021, costs incurred on the project were expected to be recoverable. Streaky Bay expects that 35% of the project revenue will be received in 2022, 30% in 2023, 20% in 2024, and 15% in 2025. After four years, the product will be at the end of its useful life because the disease will have been eradicated. Costs incurred were as follows: Research () 125,000 2020 Development () 40,000 155,000 2021 90,000 Required: (a) How much research expenditure and development expenditure should be recognized as an expense in 2020? (b) How much research expenditure and development expenditure should be recognized as an expense in 2021? (c) How much expenditure should be carried forward and reported in the statement of financial position (SOFP) at the end of 2020 and 2021? (d) Prepare journal entries in 2024 and 2025 for the amortization of expenditure that is carried forward, assuming that actual revenues are as expected. How much expenditure will be carried forward and reported in the SOFP at the end of 2024 and 2025?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

expenditure on research does not directly lead to future economic benefits and capitalising such cos...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started