Answered step by step

Verified Expert Solution

Question

1 Approved Answer

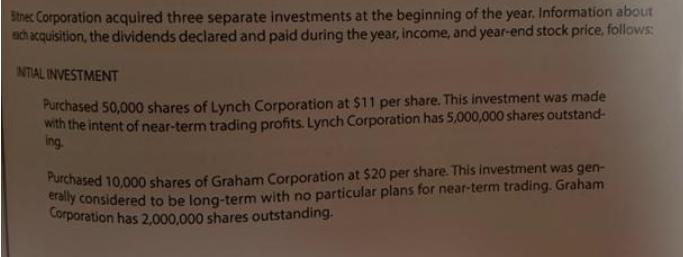

Strec Corporation acquired three separate investments at the beginning of the year. Information about each acquisition, the dividends declared and paid during the year,

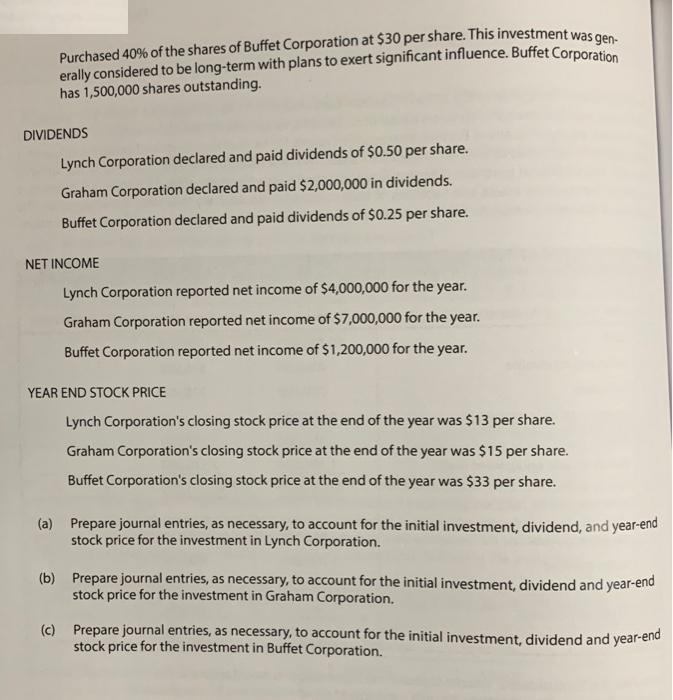

Strec Corporation acquired three separate investments at the beginning of the year. Information about each acquisition, the dividends declared and paid during the year, income, and year-end stock price, follows: INITIAL INVESTMENT Purchased 50,000 shares of Lynch Corporation at $11 per share. This investment was made with the intent of near-term trading profits. Lynch Corporation has 5,000,000 shares outstand- ing. Purchased 10,000 shares of Graham Corporation at $20 per share. This investment was gen- erally considered to be long-term with no particular plans for near-term trading. Graham Corporation has 2,000,000 shares outstanding. Purchased 40% of the shares of Buffet Corporation at $30 per share. This investment was gen- erally considered to be long-term with plans to exert significant influence. Buffet Corporation has 1,500,000 shares outstanding. DIVIDENDS Lynch Corporation declared and paid dividends of $0.50 per share. Graham Corporation declared and paid $2,000,000 in dividends. Buffet Corporation declared and paid dividends of $0.25 per share. NET INCOME Lynch Corporation reported net income of $4,000,000 for the year. Graham Corporation reported net income of $7,000,000 for the year. Buffet Corporation reported net income of $1,200,000 for the year. YEAR END STOCK PRICE Lynch Corporation's closing stock price at the end of the year was $13 per share. Graham Corporation's closing stock price at the end of the year was $15 per share. Buffet Corporation's closing stock price at the end of the year was $33 per share. (a) Prepare journal entries, as necessary, to account for the initial investment, dividend, and year-end stock price for the investment in Lynch Corporation. (b) Prepare journal entries, as necessary, to account for the initial investment, dividend and year-end stock price for the investment in Graham Corporation. (c) Prepare journal entries, as necessary, to account for the initial investment, dividend and year-end stock price for the investment in Buffet Corporation.

Step by Step Solution

★★★★★

3.44 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

aInvestment in Lynch Corporation Date Account Titles and Explanation Debit Credit Jan 1 Investment in Lynch Corporation 550000 Common Stock 50000 shar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started