Question

Strobe Inc. is a large trendy warehouse nightclub in Melbourne?s inner Eastern suburbs. Here, patrons can enjoy a dance floor where DJs play loud electronic

Strobe Inc. is a large trendy warehouse nightclub in Melbourne?s inner Eastern suburbs. Here, patrons can enjoy a dance floor where DJs play loud electronic music and bars with a variety of non-alcoholic and alcoholic beverages.

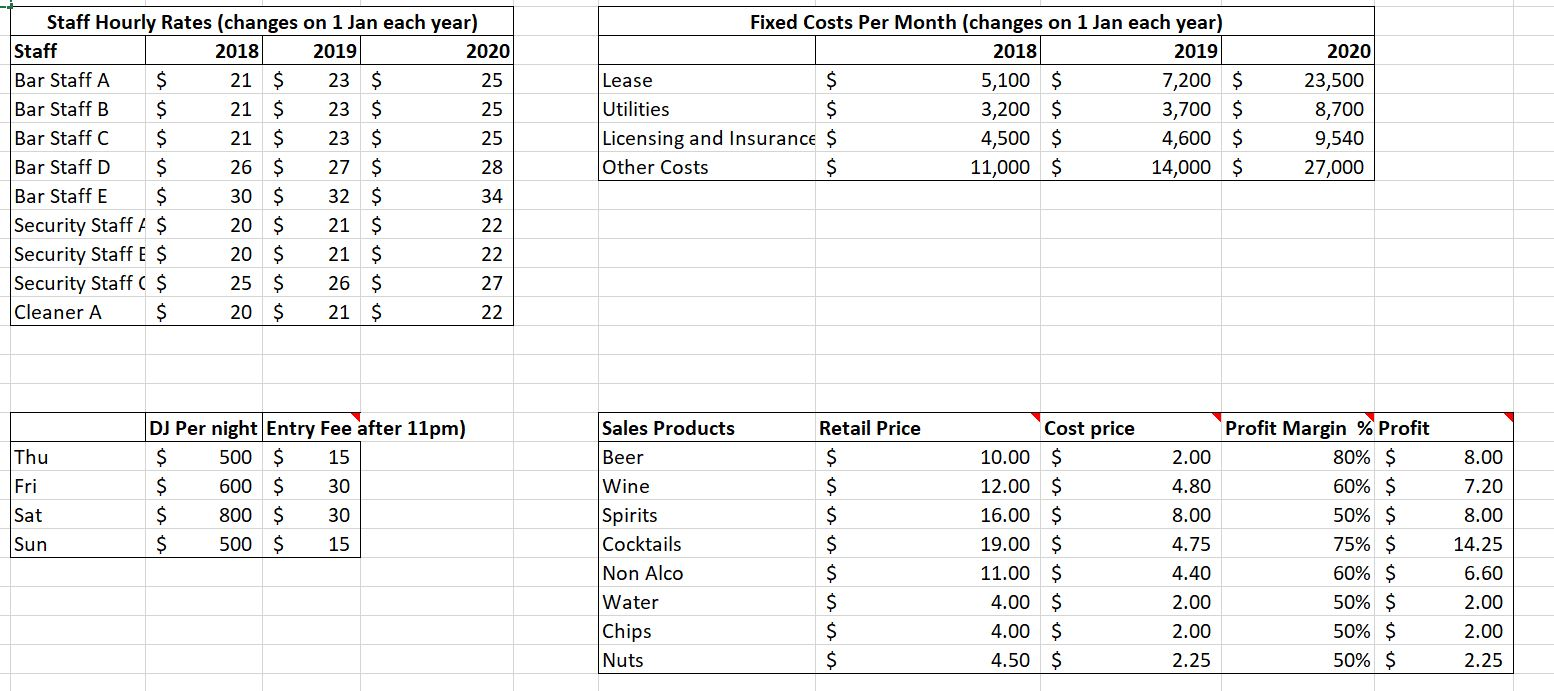

The business is jointly owned by friends, Jose and Ellie, who met in an information systems workshop during their undergrad at RMIT. Jose takes care of the accounts/finances whilst Ellie manages Strobe Inc.?s nightly operations. They employ 3 security guards, 5 bar staff and 1 cleaner who are paid by the hour. Security and bar staff finish work depending on how busy the venue is so their hours can vary a little. Staff receive pay rises which apply from the 1st Jan each year. The DJ is paid a flat fee depending on the nights worked e.g. it varies from $500 on Thursday up to $800 Saturday. Jose and Ellie pay themselves out of the profit of the business.

Since opening in 2018 business has been booming, with upwards of 300 patrons on most nights. Strobe Inc. is open from 7:00pm to 7:00am nightly, Thursday evening to Monday morning. They charge an entry fee after 11:00pm which depends on the night- Friday and Saturday $30 and Thursday, Sunday $15. Currently they serve packaged snacks (eg chips and nuts) but no cooked or fresh food, mainly because they don?t have proper kitchen facilities. They keep their pricing simple with a profit percentage on all drinks and snacks.

Recently (since Jan 2020), leasing and other costs have increased significantly and Jose and Ellie are concerned this will put the business at risk of shutting down. Additionally, with construction completed on an apartment block next door, they have been receiving noise complaints from their new neighbours. They have not kept detailed financial records of the business- just nightly takings of drinks, snacks and entry fees. They pay their staff cash at the end of each night based on hours worked and have recorded the hours and pay for each staff member.

They have a spare, noise insulated band practice room that is currently used for storage. They have considered opening up the band practice room as another music option for earlier in the evening or on the quieter nights to increase business. The band room can accommodate roughly 100 audience members. Jose and Ellie have not done a thorough analysis yet but they think they would need at least 1 more junior security staff to manage the band room and at least 1 more junior bar staff. Of course they would have to pay for bands (usually about $1000 per night) so an entry fee to the band room might be required to cover the costs or perhaps they just pay for the bands out of current profits. They?ve also estimated a setup cost of $350,000 to get it ready e.g. renovations, a small bar, furnishings, etc, which they would fund from their own savings.

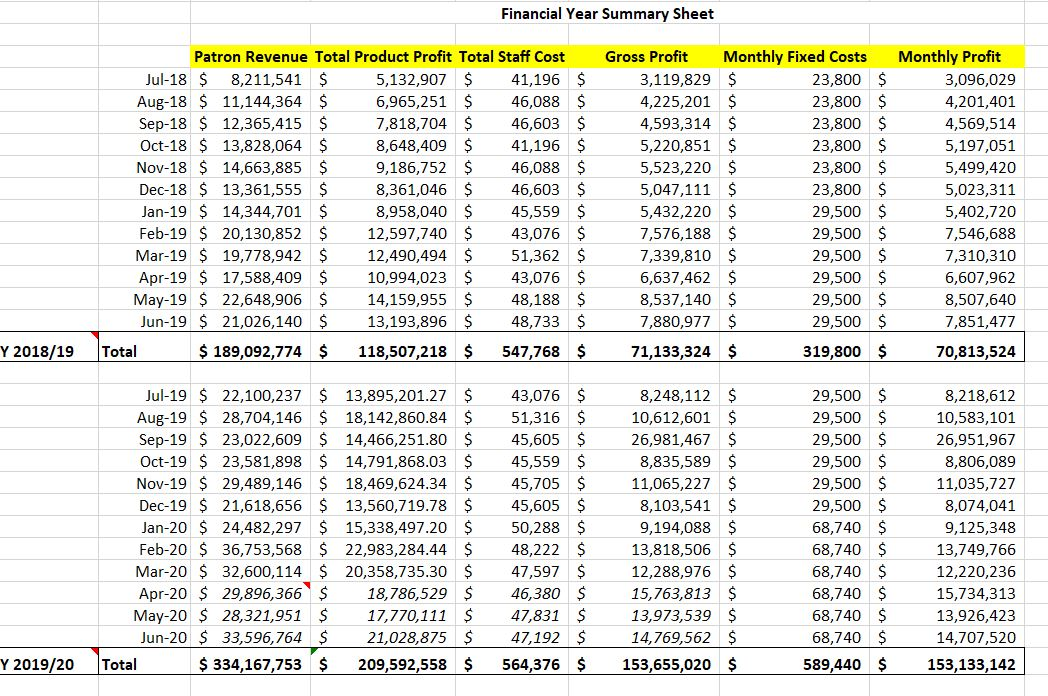

Jose and Ellie love what they do and want to remain open. To do this, they seek your consultation. They not sure how been profitable they?ve been so far, for the current and the past financial year and they?re not sure if they?re going to be profitable in the last financial quarter of 2020 given the increasing staff costs and lease expenses. Perhaps the band practice room is a good idea ? if it makes them more profitable however they don?t know the analysis to conduct to ensure it is sensible. They?d have to work out to charge customers to make sure that they earn their $350000 back within 5 years. Are they charging enough for their current product sales? Are there problems with the staffing?

A spreadsheet has been provided containing data for the business. A ?financial year? usually runs from 1st July until 30th June the following year. Josie and Ellie have recorded data from July 2018 until March 2020.

They have also provided some cost information and point out that some of their costs change on the 1st January each calendar year rather than the 1st July financial year.

As a business they haven?t really kept track of how many units of drinks are sold (This can be hard to know how many pints from a keg, or how many glasses from a bottle of wine) but they keep track of sales figures in $ amounts for each category and they have given the profit% for each category.

Some of the data and calculations have been completed for you and you are guided to some of the other calculations and tools.

You will need to calculate Patron Revenue and Product Profits on the Nightly Takings worksheet. There are three additional columns at the end of the Calculations worksheet you will also need to complete, plus any additional calculations you may think the business needs. A summary sheet has been started for you. You may continue to use these or you may make your calculations using any Excel methods/tools you are comfortable with.

Report Requirements

You are expected to undertake descriptive, predictive and prescriptive analysis of the data that Jose has provided and use Excel to analyze the data. The results of the analysis are then required to be presented in a professionally organized report that analyses and discusses both profitability so far and the various options available to help increase future profitability. Some specific expectations are as follows:

- Analyze the past two financial year?s sales figures - has the business been profitable? Identify the key variables/features (eg products, costs, customer revenues, time, etc.) which have lead to this outcome.

- Predict the likely profits for the final quarter of the financial year of 2020 (April ? June) and for the following financial year July 2020 ? June 2021 (predictive analysis)

- Discuss (briefly) options for improving profitability based on your analysis in the first bullet.

- Identify at least one business issue you have identified from your analysis that the business should further explore. Clearly explain your reasoning using data to support your discussion

- Advise them on their expansion plans ? Is it feasible to repay the $350000 costs within 5 years from the profits of the band room expansion given current interest rates? What should they charge? Justify your answer with calculations.

- Make two specific recommendations with regard to improving profitability which are based on your previous analysis. Briefly justify these recommendations (i.e. prescribe what should be done and why this would be helpful, drawing on your previous predictive and descriptive analysis). (These are in addition to the expansion plans)

Staff Hourly Rates (changes on 1 Jan each year) 2019 Staff Bar Staff A Bar Staff B Bar Staff C Bar Staff D Bar Staff E $ Security Staff A $ Security Staff E $ Security Staff ( $ Cleaner A $ Thu Fri Sat Sun $ $ $ $ es 2018 21 $ 21 $ 21 $ 26 $ 30 $ 20 $ 20 $ 25 $ 20 $ 23 $ 23 $ 23 $ 27 $ 32 $ 21 $ 21 $ 26 $ 21 $ 2020 25 25 25 28 34 22 22 27 22 DJ Per night Entry Fee after 11pm) $ 500 $ 15 $ 600 $ 30 30 $ 800 $ $ 500 $ 15 Lease $ Utilities $ Licensing and Insurance $ Other Costs $ Sales Products Beer Wine Spirits Cocktails Fixed Costs Per Month (changes on 1 Jan each year) 2019 2018 5,100 $ 3,200 $ 4,500 $ 11,000 $ Non Alco Water Chips Nuts Retail Price $ $ $ $ $ $ $ $ Cost price 10.00 $ 12.00 $ 16.00 $ 19.00 $ 11.00 $ 4.00 $ 4.00 $ 4.50 $ 7,200 $ 3,700 $ 4,600 $ 14,000 $ 2.00 4.80 8.00 4.75 4.40 2.00 2.00 2.25 2020 23,500 8,700 9,540 27,000 Profit Margin % Profit 80% $ 60% $ 50% $ 75% $ 60% $ 50% $ 50% $ 50% $ 8.00 7.20 8.00 14.25 6.60 2.00 2.00 2.25

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Financial Analysis Introduction Strobe Inc a large and trendy warehouse nightclub in the inner Easte...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started