Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Strong has loan of $1 million due at the end of the year. With the current strategy, the market value of its assets will

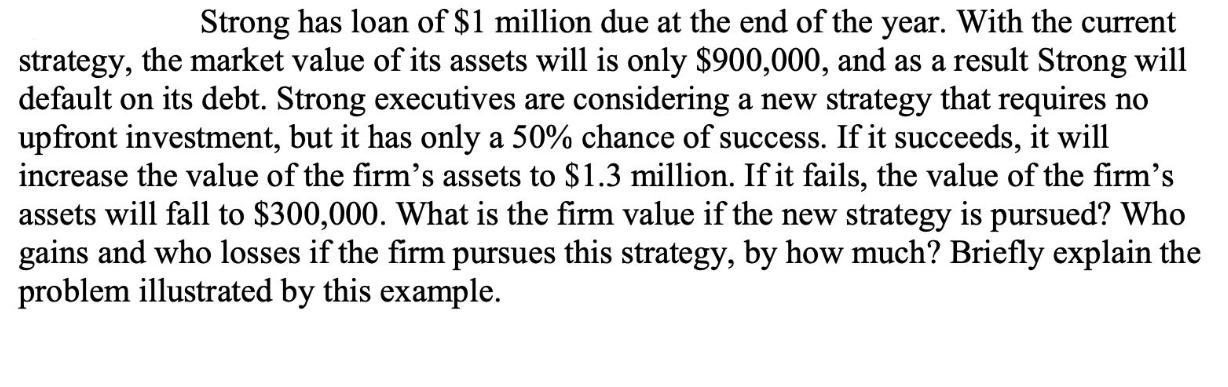

Strong has loan of $1 million due at the end of the year. With the current strategy, the market value of its assets will is only $900,000, and as a result Strong will default on its debt. Strong executives are considering a new strategy that requires no upfront investment, but it has only a 50% chance of success. If it succeeds, it will increase the value of the firm's assets to $1.3 million. If it fails, the value of the firm's assets will fall to $300,000. What is the firm value if the new strategy is pursued? Who gains and who losses if the firm pursues this strategy, by how much? Briefly explain the problem illustrated by this example.

Step by Step Solution

★★★★★

3.63 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

The firm value if the new strategy is pursued is 900000 current asset value x 13 success scenari...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started